Every Monday, I put out my trade of the week. It’s based on research and chart scans from the previous week’s trading and over the weekend. This week my favorite trade setup was ANET (insert link)

Arista Networks (ANET) had a great chart, and all the things I look for in a trade setup. It was a recent earnings winner, it had a consolidation pattern and was looking like it could break out. I liked it because it had been holding up relatively well even in this weak market for growth tech stocks; ANET was showing relative strength.

Fundamentals

Arista Networks, Inc. (ANET) develops, markets, and sells cloud networking solutions in the Americas, Europe, the Middle East, Africa, and the Asia-Pacific.

The company’s cloud networking solutions consist of extensible operating systems, a set of network applications, as well as gigabit Ethernet switching and routing platforms.

It also provides post-contract customer support services, such as technical support, hardware repair, and parts replacement beyond standard warranty, bug fix, patch, and upgrade services.

ANET traded up over 20% in November, after an earnings beat. They report Q3 EPS $2.96 Beats $2.73 Estimate, Sales $748.70M Beat $737.94M Estimate. Furthermore, the company issued a strong sales forecast for the fourth quarter and also disclosed a $1 billion stock-buyback plan. Whilst a lot of other tech-related growth stocks have been taken to the woodshed since March, ANET has been in a strong uptrend. It is my job as a trader to get long strong stocks and short weak ones!

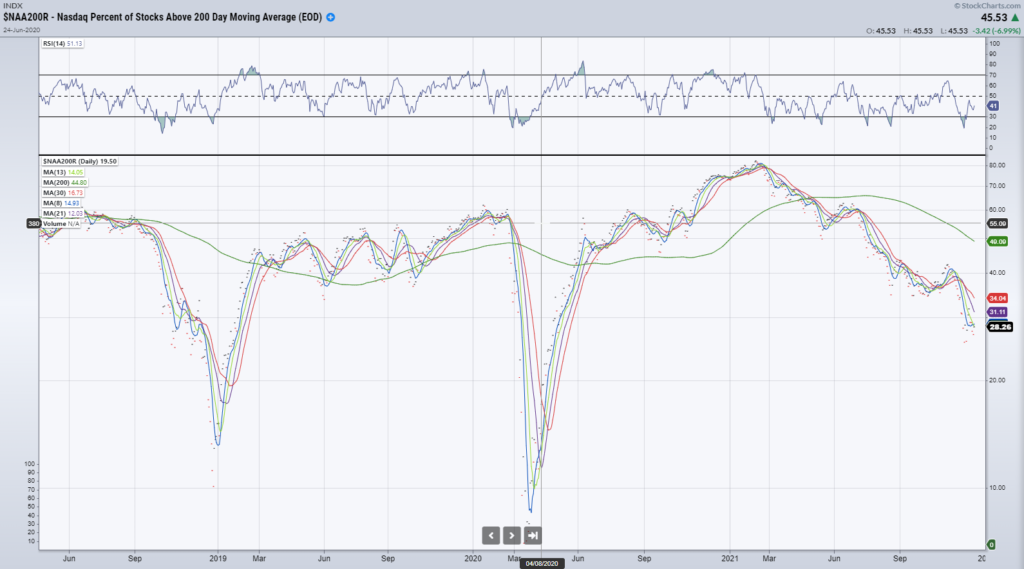

As we can see from the chart above, around 70% of all NASDAQ stocks are trading below the 200MA. This is horrible market breadth, the whole market is supported by only a few stocks so you’d better pray that GOOGL, AMZN, AAPL, or TSLA stay supported otherwise we could be in for a rough time ahead!

It’s really hard to find good stocks to trade on the long side right now and I’m not really interested in the market overall! I thought that ANET pulled back with the market decline, so it was sold off due to macro conditions, not stock fundamentals.

ANET showed relative strength on Monday. Whilst the QQQ’s were down, ANET was green, this is a sign of a very strong stock trading on independent order flow! If the market were to turn higher, I expected ANET to really ramp up and break out! There were not many stocks green on Monday, so the strength in ANET really was impressive!

Trade Idea

Looking at the chart, a breakout of 134/135 and I expected a quick move to $140 and then maybe even higher. This is exactly what happened!

As for risk management, I decided to use a conservative $125 stop which would give me a short-term trade with 2 to 1 risk/reward on a $140 target. If, for example, I wanted to hold this trade longer term for a $150 target, I would put a stop below $120, the longer-term resistance!

$120 was a solid base from 3 panic days! Whilst other tech stocks were getting taken to the woodshed, ANET held up! While other stocks were getting dumped, it looks like ANET was absorbed and being bought in the $120 area!

A super-strong stock in a weak market gets my attention! I wasn’t really interested in trading anything else, but ANET was acting just right!

I always say look at multiple timeframes. If we zoom out to the weekly, we can see that after 3 slow-down weeks, it only took 1 week to make up for 3 weeks of selling. That is the sign of a strong stock with a lot of demand, and this was making a textbook flagpole pattern!

So coming into Monday, here was my trade plan:

My Trade Plan:

- Target Price: $140

- Stop Price: $125

My Trade:

- Higher-risk “spicy” idea: ANET Dec 23 2021 132.5 Call near $1.80

- More conservative idea: ANET Dec 23 2021 125 Call near $6.50

Bottom Line

As a trader, it is my job to get long strong stocks and short weak ones. In a very weak tech market, where many growth stocks have been down 30-50% or more since March, ANET stayed in a strong uptrend.

After a strong week last week, ANET looked poised to break out to new highs. Once again being strong on Monday when the QQQ’s were down, ANET showed relative strength. Then the Indexes finally had a strong day on Wednesday, ANET broke out to all-time highs and hit my target of $140.

This was a perfect example of a strong earnings play consolidating then breaking out to new highs!

Comments are closed.

4 Comments

Made $4000 on Wednesday from Anet

12/16/21 What happened to ANET Today??? Was it insider selling?

Hi Jeff, One issue with ANET option is that the Open Interest/Volume is extremely low. This increases the risk of not being able to Sell back.

Great job Jeff, sounds great, will try it