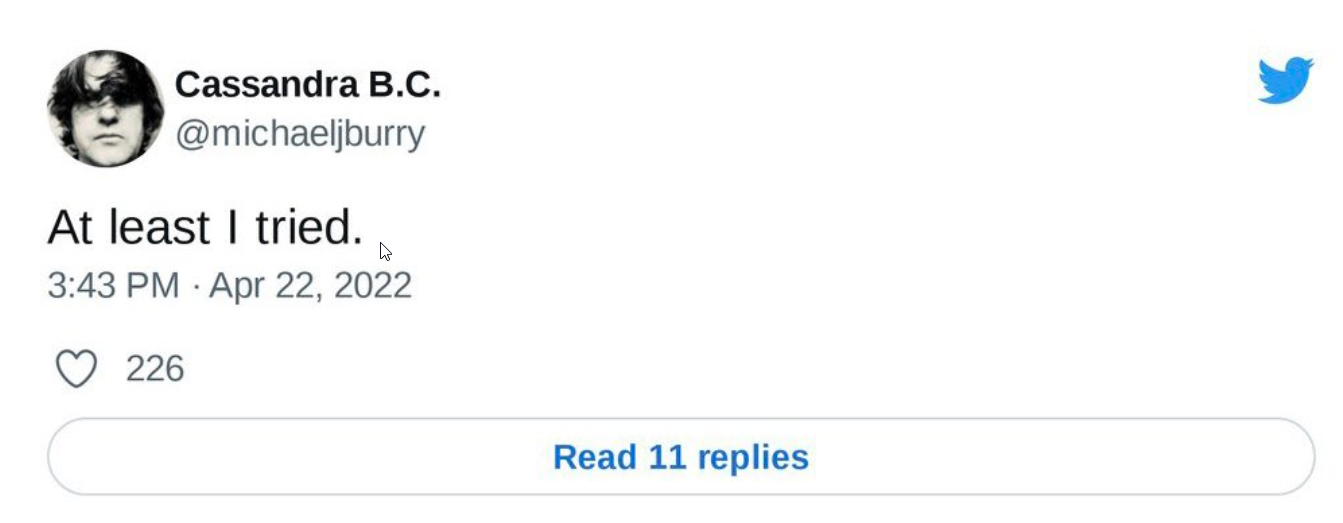

It was a blood bath out there last week. The QQQs were down over 6% in 3 days after some Hawkish comments from Fed Chair Jerome Powell. The sentiment was as bad as I’ve seen in a long time, everyone on social media was panicking and claiming the crash had arrived, there was even an I told you so from Big Short Michael Burry.

Well, when everyone is leaning one way, I like to take the other side of that bet, and that’s why on Monday, my Bullseye trade idea of the week was to long QQQs. It worked perfectly as we got a major bounce and closed on the highs.

Every Monday morning I send out my best trade idea for the week before the market opens to Bullseye subscribers. After analyzing the market the week before, and running through charts over the weekend, this is my favorite and most primo setup for the week. This week my trade idea was to Buy the Dip in the QQQs and it worked almost immediately!

Baron Rothschild once said, “the time to buy is when there’s blood in the streets.” Well, Monday morning sentiment couldn’t have been any worse. The QQQs were down over 6% in 3 days, and everyone on social media was claiming the crash had arrived. Well, where were these people 6 months ago? Growth stocks have been crashing for almost a year and the QQQs were already down around 18% off the highs. Even Michael Burry from Big Short fame posted an I told You so on Friday:

Now in the long term, Dr. Burry may be correct, but when market sentiment is so heavily biased one way, I like to take the other side of that bet in the short term, especially when we’re close to a major support level like we were yesterday.

That is why I made the QQQ’s my Bullseye trade of the week, and it worked perfectly. Here is how it played out:

Here is the detailed trading plan I sent out to Bullseye subscribers yesterday before the market open:

QQQ – Invesco QQQ Trust

Technically, the gap level has been broken and there are no buyers anywhere to be found.

And it is looking like the bears are running against the 13/30 hourly moving averages and pushing the markets lower.

But with the pivot lows near $320, I’m feeling that buyers will start to poke their head around buying the markets here again.

Putting technicals aside, there are other reasons why traders are fearful about the markets.

Simply put, we have extreme pessimism right now in the markets combined with the biggest bellwether tech stocks reporting earnings this week.

Everyone is afraid of a “NFLX-type” result from either GOOGL, AMZN or FB

… but I think that is a remote chance.

I think this is a “buy the fear” kind of week – but not go into it blindly and guns a-blazing.

My Trade Plan:

This week will be all about risk management, so I’ll be looking to make quicker trades here.

I want to make sure that I maintain a good stop loss to protect myself and also not wait too long to take a profit if the trade goes in my favor.

I am planning to buy this trade in 2-3 pieces. I am hoping to get filled on a small piece close to the market open today.

Then, I am ready to buy more if QQQ gets to $320. I will then stop out of half of this trade if QQQ looks like it will close under $317, or it trades under there for more than 2 hours.

I will still keep this in play though and wait to see if QQQ can reclaim $320 again, and then I will take a full position once again.

This could be a complicated trade, but I want to plan for the worst out there before I start my week.

On a week like this, the upside could be massive because no one is expecting it.

I will set $335 as target #1 and $343 as target #2 if things go my way. It’s going to be an exciting week of trading, that is for sure!

My Trade Details:

- Buy QQQ May 6 2022 $330 Calls near $5.50 near the market open

- Buy more near $320

- Stop out under $317

- Target 1 : $335

- Target 2 : $343

To YOUR Success!