Westerners might be surprised to learn that the Russian Ruble has the largest pile of official gold to fiat currency cash in their financial system.

Gold is usually a flight to safety trade. When there is geopolitical instability, the price of gold usually spikes, as it has done so in recent weeks.

Here are some recent headlines:

Russia-Ukraine Tensions Power Gold to Eight-Month Highs

Geopolitical worries fuel gains even as expectations for interest-rate increases weigh on the climb

It also usually increases in price when there is a lot of money printing and dollar devaluation. In fact, it usually trades inversely to the U.S dollar i.e. when the USD is strong, gold is usually weak, when the USD is weak, gold is usually strong.

Interestingly though, since Covid in 2020 gold was up a mere 20-30%, which is not a lot compared to some other assets. I believe gold is setting up for an amazing longer-term trade.

Nobody wants to own gold, everyone wants to own crypto! People have thrown out gold; they’ve completely forgotten about it. They’re like, give me some of those Crypto Coins! Give me a virtual token with a dog on it or something! I would much rather own a bucket of gold coins than some Doggie Coins or whatever else they have out there today.

Real-life gold coins are also non-fungible, it’s a token, I can actually hold it and put it in my pocket, it’s nice!

The best time to buy something is often when nobody else wants it!

The Fed

When the Fed prints a lot of money, usually the price of gold goes up.

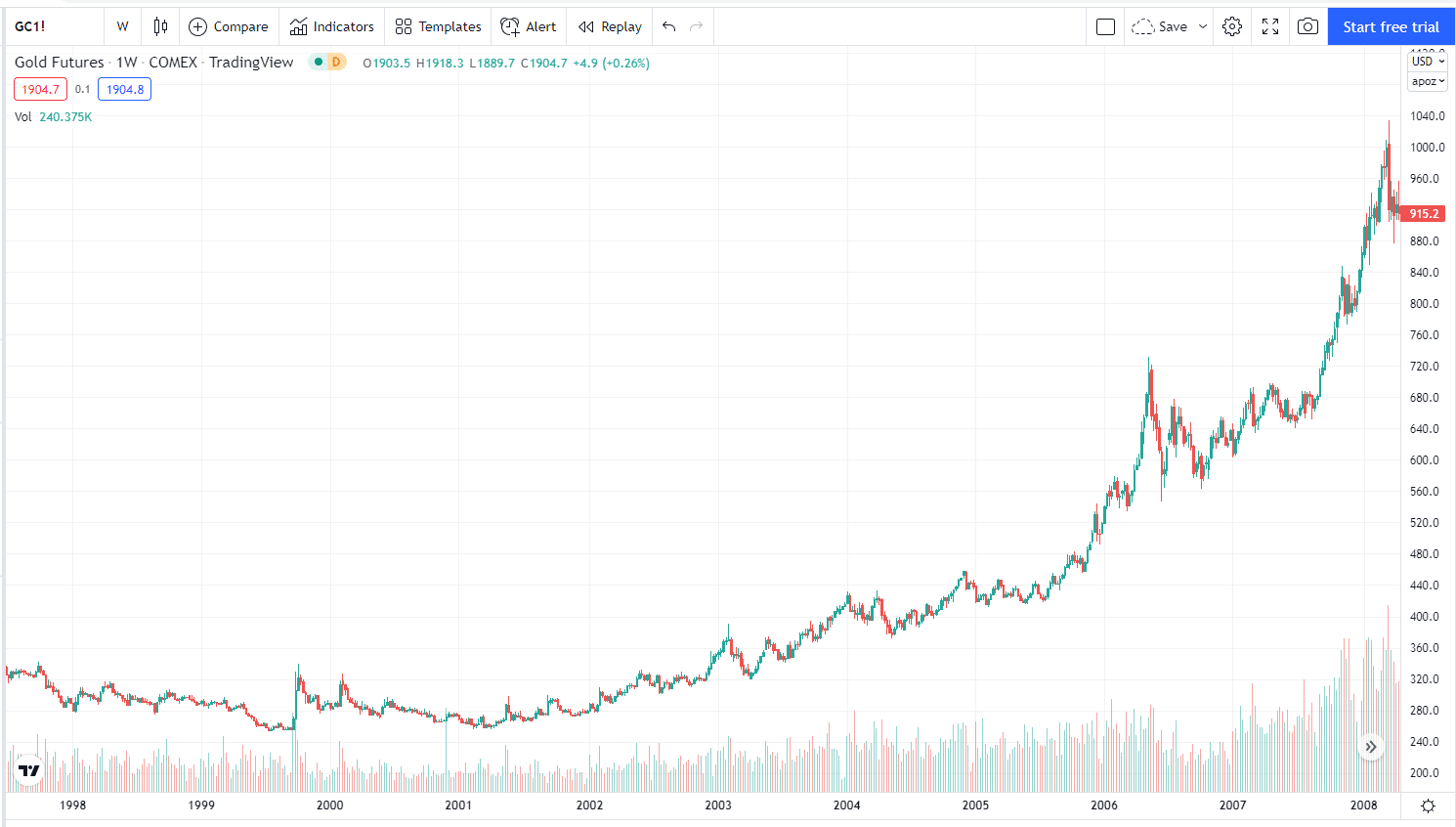

We can see above, after the 2000 tech bubble crash, when interest rates dropped and the Fed printed a bunch of cash, gold Futures went from below $300 to over $1000 by 2008 when the Global Financial Crisis hit.

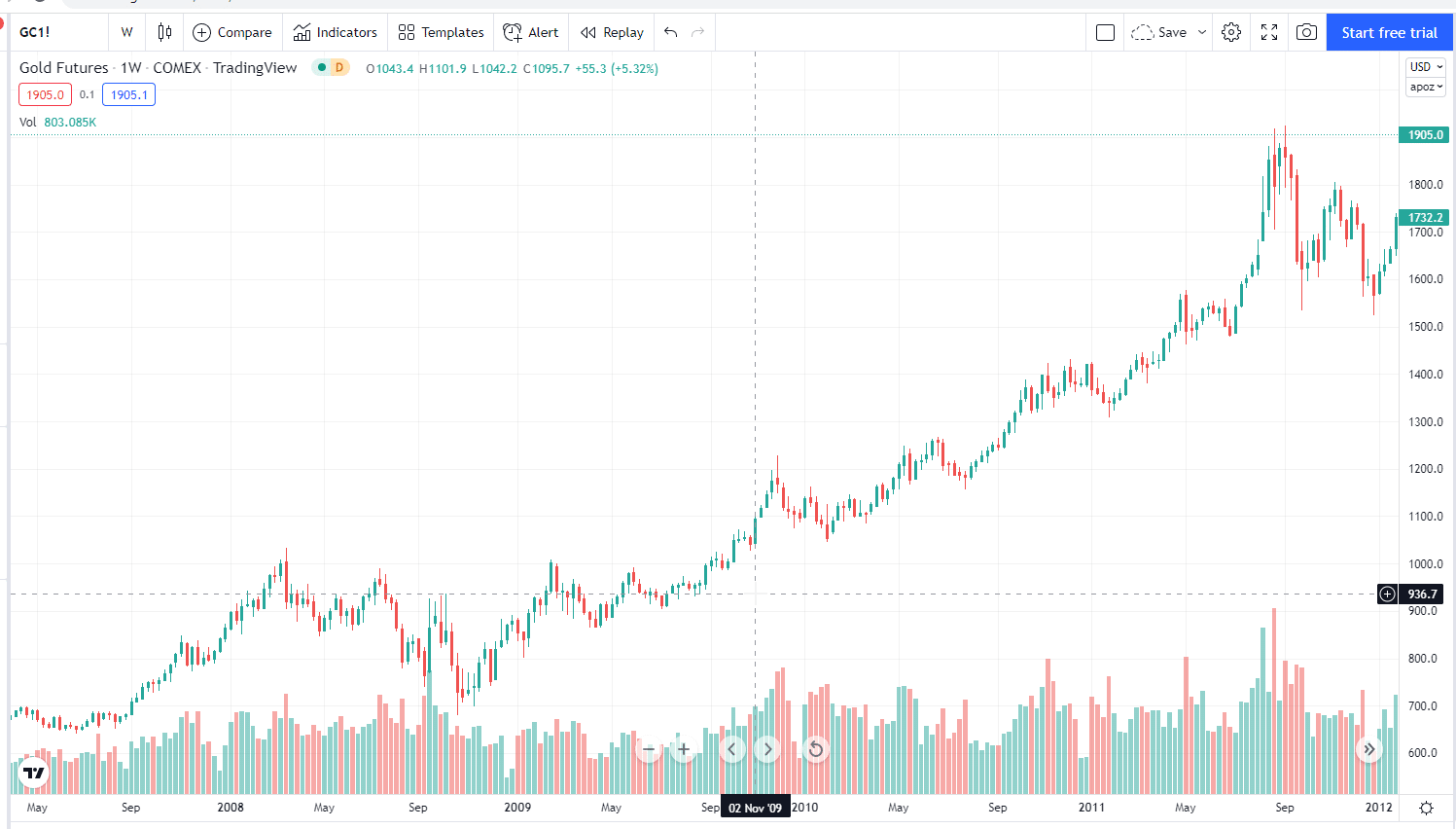

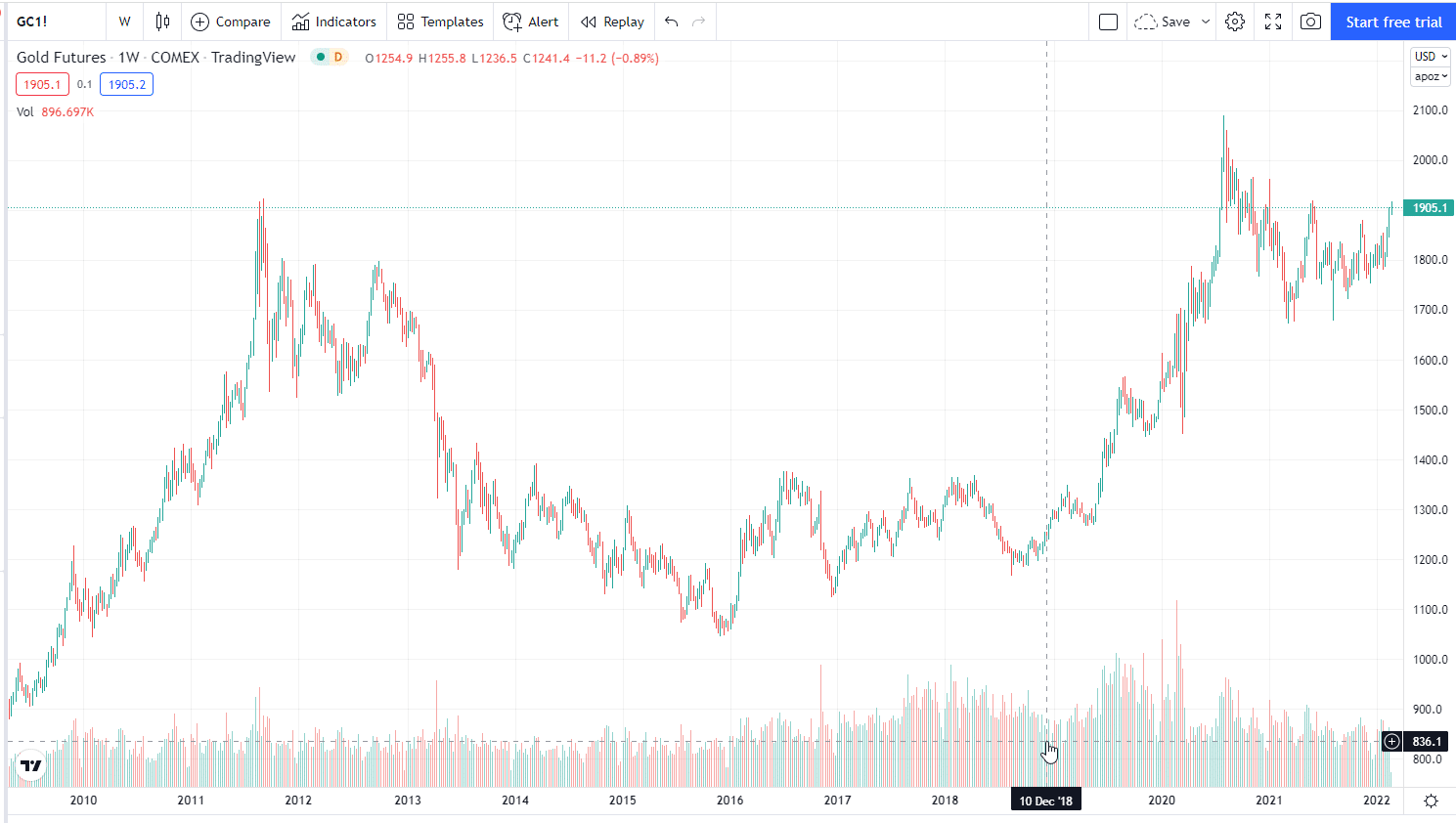

After that crash, when once again the Fed printed huge amounts of dollars post-2008 to get out of the depression, gold went from around $700 to over $1900 in 2011. Since then it has been consolidating for almost 10 years, see below.

This time around, post-Covid, while growth stocks tripled and 5 bagged, and Bitcoin went from below $5000 to over $50,000 due to the increase in Fed money supply, gold went up, but not a lot. Over the last couple of years, gold has been up around 20-30% post-March 2020.

Perhaps this has a lot to do with Bitcoin, which during this time went up 10x, and took over the mantle of an inflation hedge from gold. I believe many investors who would usually invest in gold to hedge against inflation, as we saw post-2001 and post-2008 on Fed money printing, switched to Bitcoin this time around. However, now that risk-on assets are getting crushed it could be gold’s time to shine!

Technicals

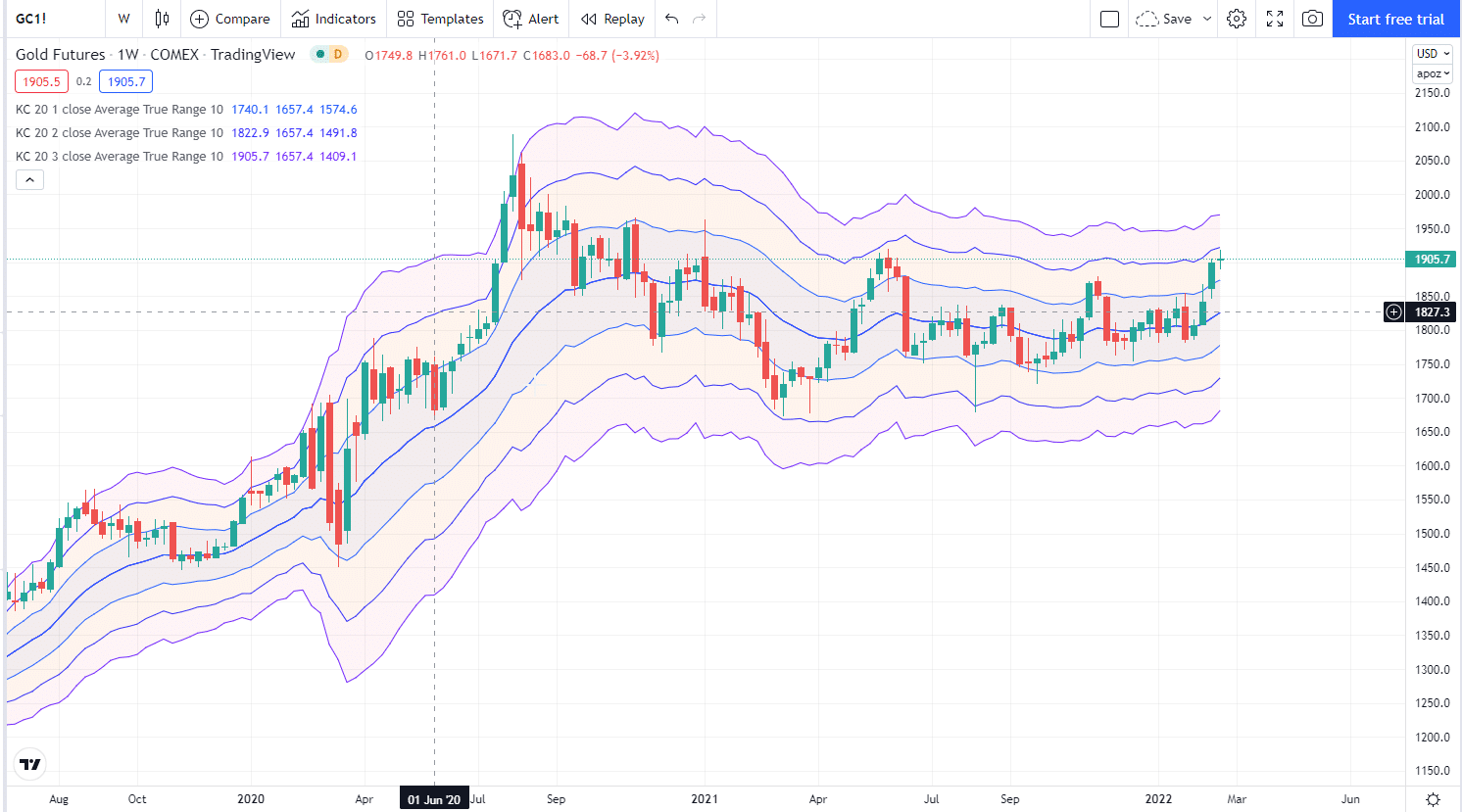

Gold has been setting up for a squeeze pretty much the whole year! It’s a really nice longer-term setup!

I think gold is ready to make its move, it’s already started to break out, and I’ll be watching it closely on pullbacks.

Gold has been trading sideways on the weekly chart for a very long time now. It’s been consolidating and is now trading above the mid-point of the Keltner channel. That’s a really good range setup for a possible breakout! This is a really nice longer-term picture trade.

I think it’s one of the best setups out there in the market. While growth stocks are getting taken to the woodshed, and charts all over the place are broken, gold is holding nicely.

When you think of a market that is scared of inflation, higher interest rates, and dumping stocks because it’s not finding value, gold is not a bad place to be. It is a flight to safety trade.

If I was going to start looking at LEAPS (which I am) i.e longer-term options for longer-term trades I could make, gold would be a top 3 trade for me right now. I think everything is setting up here for a longer-term move to the upside. I usually trade gold through the ETF with the ticker symbol GLD, which I can also trade with options.

Given that this is a longer-term trade there is no reason gold can’t be up 50% or more over the next year or two. In fact, if gold can make new all-time highs, history has shown there is no telling how high the price can go.

Comments are closed.

6 Comments

Good insight as usual from the pros Thanks

Wow

I think your thoughts on gold are correct for the long-term, say six months out. But I think gold has a lot more downside to go before it finds a bottom. It appears to me that gold will get down to around $1.700 before it finds a bottom, or is at a point where I might want to start bottom fishing. If a potential war with Russia/Ukraine does not drive up the price of gold, then it just tells me that the medium-term trend (down) has more to give. I would not be surprised to see gold hit $1,500 within the next two to three months. I agree that gold has a very bright future, say $5,000 over the next few years, but right now in the short/medium term it would seem the more l likely direction is down.

Thanks for your commentary. The next few weeks should be interesting.

Tom N

Jeff,

One more bit of commentary: You mentioned the US dollar. With the Fed planning rate hikes starting in March it would appear that the dollar is about to soar. Since the European Union Central Bank having stated they are not going to raise interest rates and that they are going to continue QE for the foreseeable future that will cause the EURUSD to become quite interesting very soon. The Euro makes up about 58% of the currency basket. If the US Fed does start raising interest rates the dollar is going to rise and people who think the Euro is going to outpace the dollar are going to be very disappointed. I would not be surprised to see the DXY hit over 100 in the next few months. I am long the UUP (out to June) expecting this to happen. Historically, stocks rise during the time the Fed raises interest rates. This coupled with a surging dollar and a flat Euro suggests gold will fall, as investors will make more money from stocks and the dollar than they could make from gold in the short term. To me, the best place to put my money is where it will make me more money and gold as a hedge, right now anyway, is not a good bet. Like I said in my earlier comment, golds long-term outlook is amazing, but in the short/medium term gold has a long way down to go first.

Just how I see it. My leap is in the UUP. GDXJ will yield the best possible profit potential for gold’s upcoming downside starting right now. If a person were to be looking to make money on gold, then establishing a short position in the GDXJ right now will yield some epic profits. The type of profits you will write in your trading journal as some of the best trades you have ever made. LOL! Just how I see it.

Isn’t it amazing how two people can look at the same chart and get totally different viewpoints?

Best regards,

Tom N

upside down head and shoulder. I will watch.

So is your opinion to use a 2 pronged approach using some efforts in the options market, followed by purchasing GLD stocks on top of the options? Right now I have a small options trade in GLD ending on March 18th. and another in May. I am a small account options trader.

Thanks!!! Steven