Today I’d like to explain a special setup that occurs specifically on Fridays and is known as the Friday “Lotto” options play.

Most options on stocks expire on a Friday. Typically, weekly and monthly options settle at the close of trading at 4 pm on Fridays. An exception is options on the S&P 500 index (SPY) and other indexes, which can have mid-week expiration dates.

Given that there is very little time on a Friday before options expiry, this can present some unique trading setups.

Time Decay (THETA)

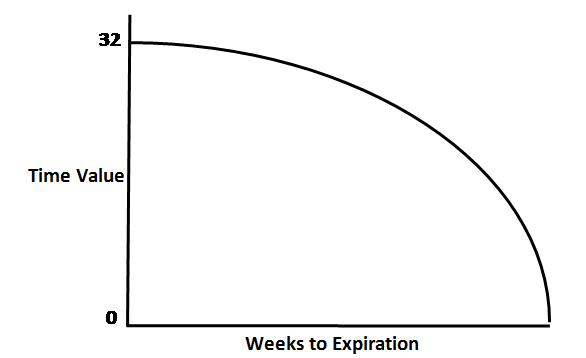

An option’s price is made up of intrinsic value and time (extrinsic) value. The closer an option gets to its expiration date, the faster that extrinsic value erodes. That rate of decay is the option’s Theta. It represents the amount of time value that will be lost the next day.

The closer the option gets to expiration, the bigger Theta gets. And, this increase happens at an exponential rate. Here’s an example of how Theta might erode an option’s time value.

![]()

And, here’s what that would look like when plotted on a graph.

Thus on a Friday, when the rate of decay Theta will be at its largest, the extrinsic value of the option will approach 0. This can provide option buyers with an advantage as options will be at their cheapest.

Trading A Catalyst

Moreover, if a stock is moving due to an unforeseen news catalyst i.e., some breaking news, it is cheaper than at any other time to trade this stock by buying options contracts.

Due to this phenomenon, you will also see some outsized moves on a Friday as call/puts buyers can force market makers who sell calls/puts to hedge their positions by buying or selling stock. This can add a wave of demand or supply in a stock and can increase the potential size of the move.

Let’s look at an earnings example from a week ago. Atlassian Corp (TEAM) reported excellent earnings on Thursday evening and had a nice 16% gap up on Friday morning to all-time highs. Given that it had an earnings catalyst, it is more likely that the stock will expand its Average True Range (ATR) by two or three times or more than usual.

For example, TEAM has an ATR of 12.43 as per Finviz. This means on a typical day (taking an average of 10 or more days), the stock will move $12.43. Thus, on corporate earnings day, we could see TEAM move as much as $37 if it were to have a range expansion.

TEAM had a $39.50 move in 10 mutes, shown on this 1 min chart

Well, on this earnings day, it moved $39.50 from low to high, with all of it done in the first 10 minutes. Given the lower cost of options on a Friday this was a great opportunity to buy some call options on the open given that the stock moved from $310 to $349.50.

Fridays give us a chance to buy options at their cheapest and participate in plays that may be much more expensive to play earlier in the week. This is the advantage of Friday lotto options.

As I’ve stated already, breaking news plays on a Friday can also provide amazing risk/reward setups. They are rare, but traders should be on the lookout for these on a Friday as they can give outsized moves as traders and market makers who are on the wrong side must adjust their positions quickly.

In addition, there is an opportunity to use options open interest to make sounder risk/reward trades in stocks without a catalyst as market makers look to make the most of the options they have sold expiring that week.

Trading Options Volume and Open Interest

Here is an example I was looking at on Friday in Amazon.com INC (AMZN) live during Masters’ Club. AMZN had sold off from an open of 3375 to make a low of 3329 around 11am . Given that 4 out of the last 5 days it has moved high to low of around $50 I was thinking that was a decent enough move on a day with no news. Furthermore, oftentimes a low of the day can be put in at 11am on a market stock.

5 min chart of AMZN, making a low at 3329 and closing into 3345 at the end of the day

Next, I took a look at the options chain to see where market makers may be positioned.

I focus on volume and open interest. As we can see above, there was an unusually high amount of calls traded at 3350 with volume of 8.32k and an exceptionally high amount of puts traded at 3330 with 7.77k. Most other strikes had 4k to 6k of volume traded. This led me to believe that there was a high probability market makers might pin the stock closer to 3350 and not above to take all the premium from the 3350 call buyers and from all the 3330 put buyers.

I put in a bid for the 3320 call for $16 post 11 am on the basis I did not think the stock would go below 3330 again and we would get a close nearer to 3350. I like to trade In The Money (ITM) options on Fridays as there is less pressure for me to stop out due to the lack of Extrinsic value in the option.

This was a great example of a volume and open interest play in a stock with no news. It turned out I had an almost perfect read, 3329 stayed as the low of the day, and AMZN closed the day at 3344.94. A $7 spike in the last 10 minutes meant I could get out half of my position at $24 and the rest at $25. This was the trading equivalent of a buzzer beater! Often you will see these types of moves late on a Friday as market makers pin the stock into the close. Market makers love to pin stocks in their favor on a Friday!

Bottom Line

Most options expire on a Friday. Given that the time value of options is the lowest on this day, rapidly approaching 0, unique opportunities present themselves on a Friday for call options buyers. This is because it is much cheaper to buy options than on previous days in the week. Stocks with breaking news can have extended moves in one direction on a Friday, exacerbated by increased demand or supply as Market Makers are forced to hedge options they have sold by buying or shorting stock.

There are also opportunities to trade options open interest on a Friday in market stocks with no news. This is because market makers can take this opportunity to pin stocks at prices favorable to them to earn the most premium from the options they have sold. Friday is a special day for market participants that like to buy options, as they can have an added advantage!