The YOLO traders are back! And that means some excitement has returned to MEME stocks after months of depression!

I’m back in 2 MEME stock trades that could explode much higher from here.

I discussed this trade live in Master’s Club as I do every Monday at 11 am eastern. Put it in your calendar so you don’t miss out on these live sessions from a 20-year veteran!

GME

GME is setting up pretty nice! It has had a lot of opportunities to sell off, and so far it hasn’t! Sometimes what a stock hasn’t done is just as important as what a stock is doing. I think that GME could easily take out $200 again.

I think these MEME stocks are worth looking at again! I think the MEME stocks are back, and that the YOLO gang is back active in the market. Shorts had built up in GME, and now they are under pressure. GME could have broken below 150, and it didn’t, so I think it’s set for a move higher! Let’s look at the Chart:

Daily Chart of GME

$150 was the launch spot, and I think that should hold as support. If I’m right, GME should not hold below $150 before it goes higher. Thus if I am wrong, I will exit the trade below $150.

The Trade

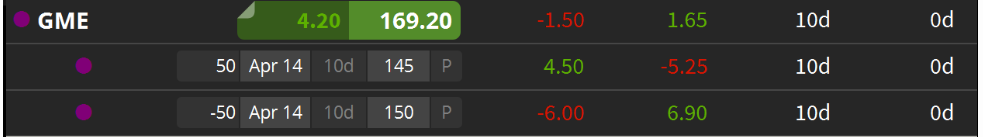

I could just buy the calls, but the calls are so expensive. I would rather take the safer but and sell a put spread in GME. I’d rather sell the puts, sell the high implied volatility, and let the high-risk YOLO guys see if they can make the money on the upside with calls.

I sold the $150 puts and bought the $145 puts to make a put spread expiring April 14 at $1.65. So long as GME stays above $150, I will pocket this premium. My risk on this trade is $5- $1.65, which is $3.35 if GME closes below $145 on April 14.

Key Takeaway

By selling the put spread, I’m just making the bet that GME will stay above $150. It is a much safer, higher probability trade than buying out of the money, expensive YOLO calls.

HOOD

Robinhood (HOOD), I hate this stock! But when I talk about beautiful trends setting up, this looks really good to me!

Daily Chart of HOOD

Looking at the chart, we had a huge volume spike last week as MEME stocks had their day in the sun again, and Robinhood got sucked into it! Since then, the stock has pulled back and consolidated and looks like it could rebound. I’m looking to put my stops below $12 as that’s below where the stock launched from and if it trades below there my trade thesis is invalidated.

I’ve chosen to express my trade idea through calls in this case. I’ve bought the $13 calls expiring 3 weeks out on April 22. This should be enough time for my trade Idea to work, and by using calls, I use significantly less buying power than buying the stock outright. I paid $1.35 for the calls, and if it can trade to my $16 targets, I should be able to sell them above $3. If the stock closes below $13, I will lose all the capital I put into the trade.

Again HOOD is a stock I hate, but the chart pattern looks too good to me here!

Key Takeaway

With options, it’s high risk, high reward with big percentage swings. However, this way, it’s possible trade with a much smaller amount than buying the stock outright, as little as $135 in this example.

To your success!