Stock splits are an interesting phenomenon. Fundamentally, they don’t change the value of a company at all. There is an increase in shares and a subsequent decrease in stock price.

However, a stock split can have a significant impact on the short-term demand and supply for a company’s stock, and the psychological games going into and coming out of this event can provide nice trading setups.

Subscribers to Total Alpha have access to Live Educations sessions daily and access to my REAL-MONEY portfolio as I navigate these tough markets!

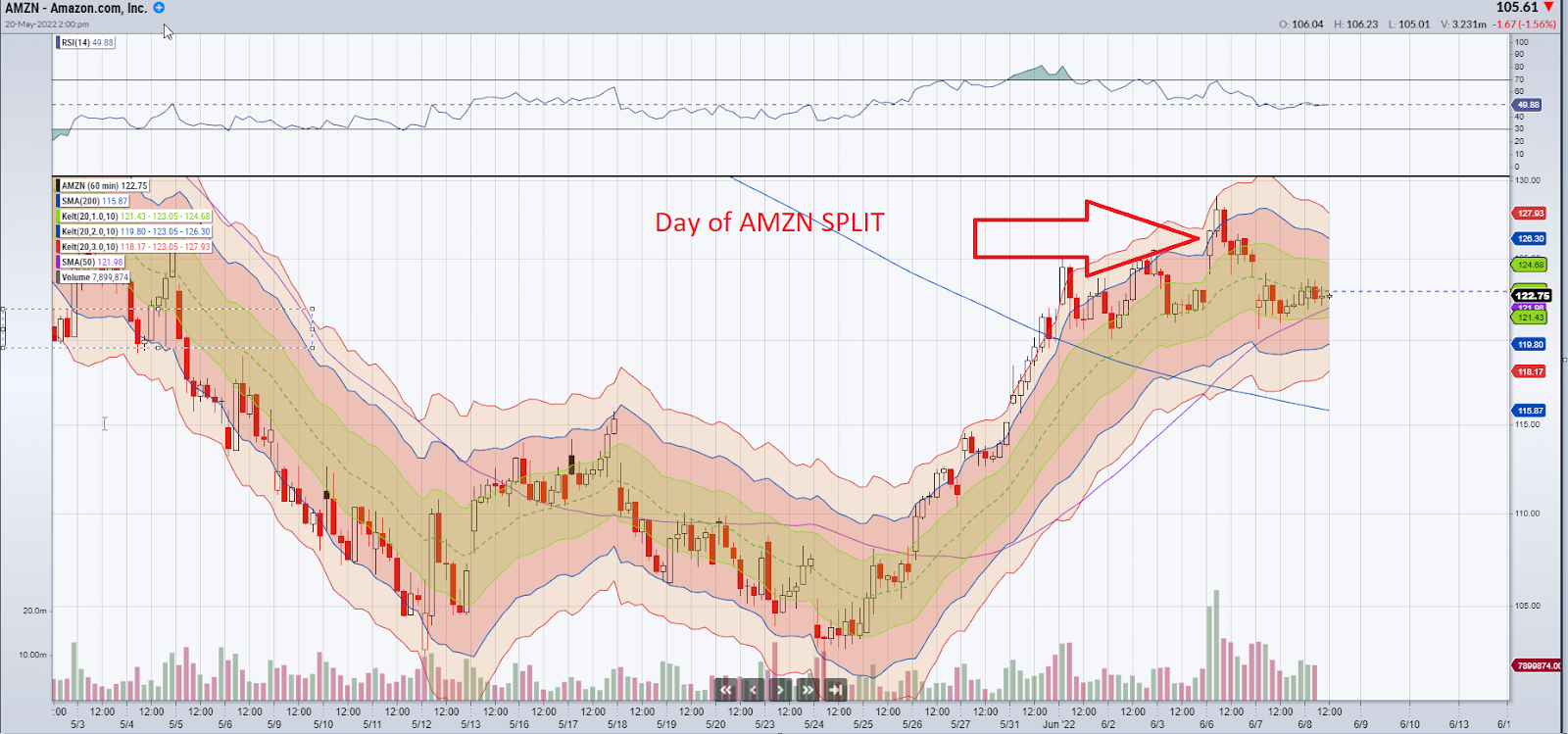

My thoughts coming into the Amazon (AMZN) stock split were this:

As the highly anticipated split from AMZN approaches, I think the buyers are just getting suckered into the hype here.

This is starting to feel like a “sell the news” event and I don’t want to get caught up in the excitement that is being generated around this.

So, I’ll be looking to sell a call spread and maybe add to my position in the upcoming days.

Subscribers to Total Alpha received, my thoughts and the exact details of my trade! Click here to get these trades when I make them.

In trading, nuance is everything. There were some big stock splits in 2020, and the companies involved moved higher going into the split, and as a surprise to, some continued higher post-split. These companies were TSLA and AAPL.

The market environment was completely different then. The stock market was awash with money from central bank money printing and Federal government stimulus packages with nowhere to else to go due to low rates. There was a euphoria amongst daytraders flush with confidence, having participated in the Covid stock boom, looking to double down.

The situation coming into the Amazon (AMZN) stock split this time around was quite different. We’ve been in a bear market in growth stocks for over a year, and in 2022 most of the best companies in the world, including AMZN are down 20% or more. So the big picture overall is negative for stocks despite the fact that i’m short term bullish on the market. So why so negative on AMZN?

If You’re struggling with your trading, become a part of the Total Alpha community, and receive the education you need!

Well the big picture is important, but every professional trader in the world knew this stock split was coming. And coming into it, AMZN was already up 20% from the lows. Whilst I believed the new low stock price for AMZN would encourage new retail investors with small accounts to pile in, and other traders who remembered 2020 to trade for a repeat, I was of the mindset that the smart money would use this liquidity to exit the positions they put on much earlier, and thus this would be a sell the new event. The environment right now is just completely the opposite to what we had in 2020.

Thus on the day of the AMZN stock split, I put on a bearish bet. Rather than short the stock, I sold an out-of-the-money call spread, and AMZN has traded lower since then.

In trading, nuance is everything. There is a fine line between good and bad trades in the markets, and years of experience and battle scars are what separates pro’s who have seen this before from newbies who can get eaten alive in tough markets.

If You’re struggling with your trading, become a part of the Total Alpha community, and receive the education you need! CLICK HERE NOW TO SUBSCRIBE!

There’s a 30-day satisfaction guarantee, so if you’re not happy, no worries, but I think you’ll love what we’re doing at Total Alpha! Click HERE to Subscribe!