Yesterday Elon Musk terminated his deal to acquire Twitter (TWTR), which sent the stock down 11%. However, this led to some money flow into the Donald Trump SPAC DWAC, which is conducting the acquisition of his network TRUTH Social. The logic is simple, Elon was supposed to take over Twitter (TWTR) and focus on free speech, relaxing what’s acceptable to tweet.

This would have also opened the door for Donald Trump to return to the platform. Now that the deal is off, the next place to turn for right-leaning views and a piece of Donald Trump is Truth Social. This sent DWAC, which has been beaten down, soaring 20%.

To get access to daily updates, education, and changes to my portfolio, become a part of the Total Alpha team Today!

DWAC is a Special Acquisition company that announced it had entered into a definitive merger agreement, providing for a business combination that will result in Trump Media & Technology Group becoming a publicly listed company.

Trump Media & Technology Group’s mission is to create a rival to the liberal media consortium and fight back against the “Big Tech” companies of Silicon Valley, which have used their unilateral power to silence opposing voices in America.

Trump Media & Technology Group (“TMTG”) launched a social network, named “TRUTH Social.”

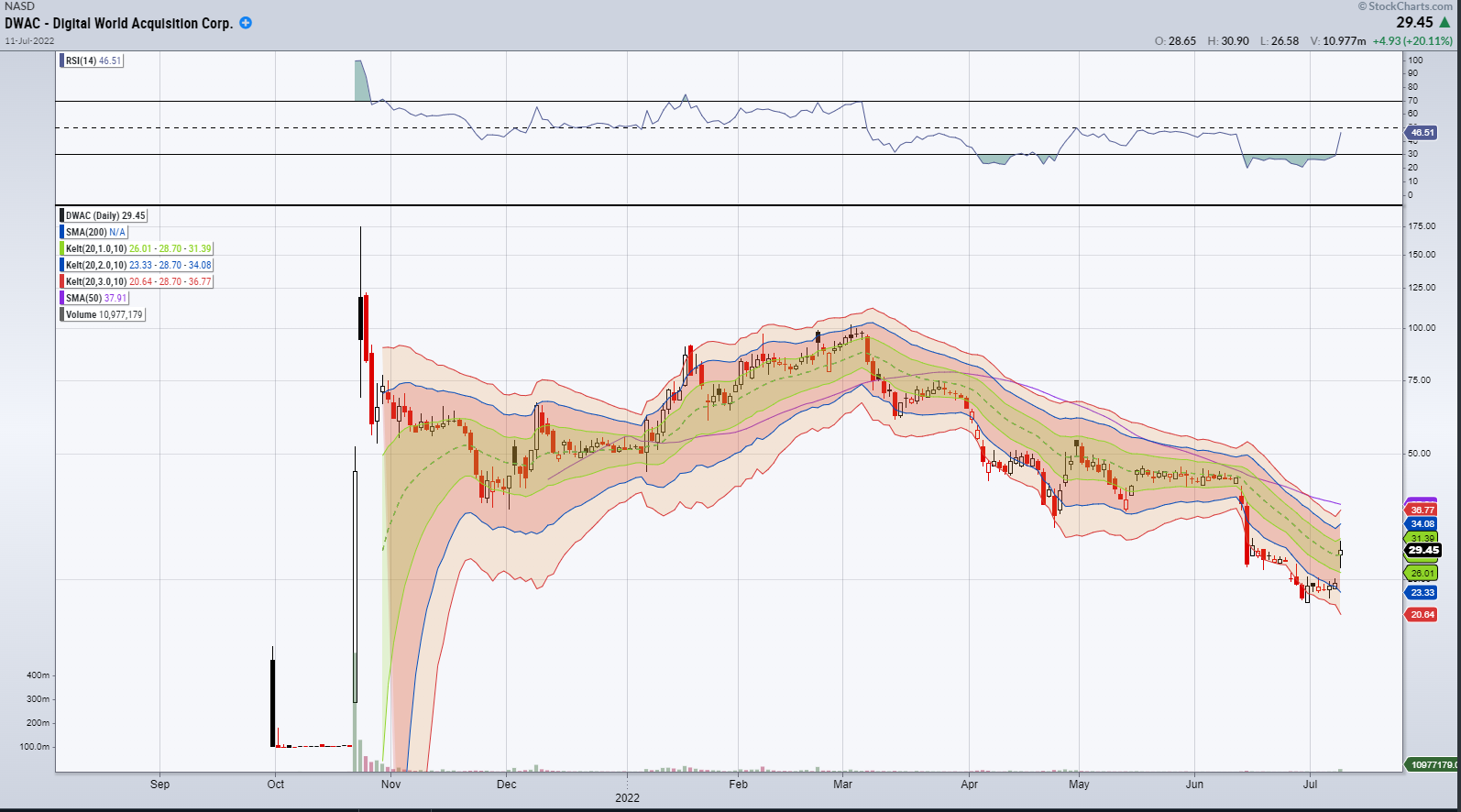

In October of last year, the news of this acquisition news sent the stock soaring from under $10 to $175 at its peak in just 2 days. That is the power of the Donald Pump! Since then, however, the stock has faded off to the low 20’s.

Subscribers to Total Alpha have access to Live Educations sessions daily and access to my REAL-MONEY portfolio as I navigate these tough markets! Don’t miss my next trade, subscribe NOW!

After the news that Elon would be backing out from his proposed Twitter deal, DWAC traded up 20% in the after-hours. Rather than chase the stock at these elevated levels, I chose to structure my trade Idea in a different way.

The Trade

When a stock is volatile due to a news event, its intrinsic value or IV often increases. This was the case here with DWAC. When the intrinsic value is high, this provides a benefit for options sellers in that the premium received for selling options is higher than usual. I did not want to chase DWAC at these high levels, but I still believed that it would hold higher. So I opened up the options chain and sold a put spread!

I sold the $26 puts and bought the $24 puts at $0.48. So long as DWAC stays above $26, I will pocket the entire premium of $0.48 on this trade. My risk to the downside is 1.52 ($26-24-0.48) if DWAC closes below $24 on expiry. The $24 puts I bought for the put spread protect me from any additional losses below $24. I think DWAC will hold up here for a while, and this is a great risk/reward trade for me.

If You’re struggling with your trading, become a part of the Total Alpha community, and receive the education you need! CLICK HERE NOW TO SUBSCRIBE!

There’s a 30-day satisfaction guarantee, so if you’re not happy, no worries, but I think you’ll love what we’re doing at Total Alpha! Click HERE to Subscribe!