Once a market has already made its big move, it can be difficult to find new, really great trading setups because the best moves have already been made! This is a time that separates great traders from degenerate gamblers. Good Traders know when to step on the gas and then when to ease off it, the gamblers will just look to hit it out of the park every time.

Markets can do 2 things at any given time, they can trend, or they can range. Once the big trend has made its move, it will usually consolidate before going again or reversing. There is an advanced options trading strategy that looks to benefit from a range-bound consolidating market and is one I sometimes use when I think a big move is coming to an end, at least in the short term. I put on an Iron Condor in the QQQ’s last week, and it’s still working.

For a limited time catch me in our new trading room 360 Wall St at 0 cost! Our all-star lineup is in there every day showing you their best trade Ideas, here’s the schedule!

Sign up here, and receive 2-3 of the best trade ideas for the day before the market opens from our trading experts straight to your inbox DO IT NOW!.

Setting the Trade

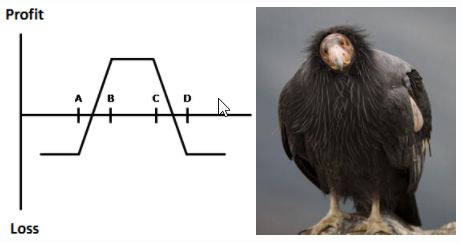

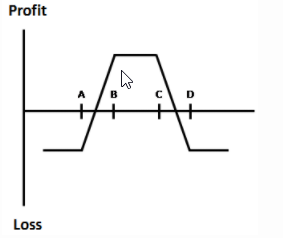

The iron condor is constructed using two short spreads. One is a bull put spread the other is a bear call spread. They are both credit spreads. These strategies get their name from the shape of the profit/loss graph, which vaguely resembles the shape of the big bird.

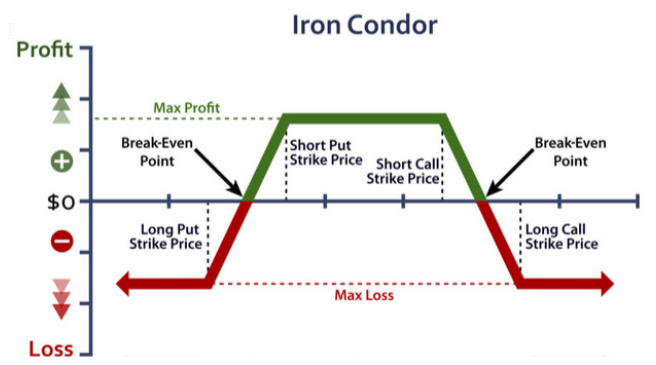

Said another way, I’m selling a bear call spread and selling a bull put spread. Both will be out-of-the-money. Because I am selling both spreads, an iron condor is always a credit spread from the seller’s point of view. As with all short option positions, the credit you bring in is the maximum opportunity on the trade. There are two break-even points in an iron condor.

The upper breakeven is the strike of the short call (“C”) plus the net premium received. The lower breakeven is the strike of the short put (“B”) minus that same credit.

The sweet spot for an iron condor is between the two short strikes, “B” and “C”. And, again, that’s right where I want the underlying to be at expiration. Ideally, I want all four of the options to expire worthless. Now, despite the complicated appearance of this trade, most brokerage accounts allow you to place this trade as a single order.

The iron condor is the combination of a short out-of-the-money vertical call spread (“C” and “D” in the above image) and a short out-of-the-money vertical put spread (“A” and “B”). So I would sell a call with strike C, buy a call with strike D, sell a put with strike B and buy a call with strike A. That is the iron condor.

Get Access To the Complete Options Academy Trading Course with Total Alpha, Learn to trade options like the pros Click Here

Lesson – Iron Condors:

Iron Condors are used for two primary purposes; to take advantage of a range-bound stock and

to trade high levels of Implied Volatility (IV) in expectation of a drop in IV in the future.

What does an Iron Condor look like?

There are 4 main areas to be concerned with when trading Iron Condors:

- As a stock stays range-bound between the short put and short call strikes, you will

receive a max profit on the trade.

- If the stock starts the fall outside of those zones, you will see slightly lower profits up

until the break-even point.

- If the stock is above or below the long put and call price, you will receive a max loss on

this trade

- If the stock is beyond the break-even point and the long put or call price, you will receive

a slightly less loss on this trade

My Iron Condor Trade in the QQQ’s

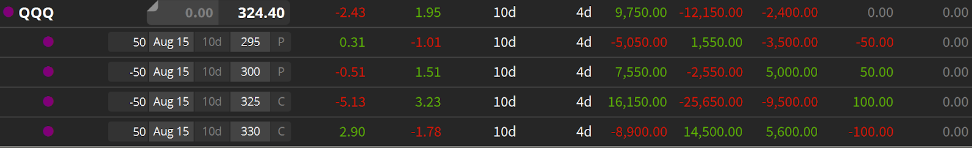

After the big run in the QQQ’s last week, I didn’t see a lot of great trading opportunities out there in the large caps. We saw a big bounce in the market, and overall over-the-long term I’m still bearish. So my trade Idea was to put on an Iron Condor, expecting that the market probably wouldn’t go much higher and take a breather for a little while. The QQQ’s were trading around $317.60 at the time, so I structured my trade in this way. I sold the $300 puts and bought the $295 calls (put spread), and then I sold the $325 calls and bought the $330 calls (call spread). The options expire August 15. Here’s what the trade looked like on

Friday:

Coming into this week, the QQQ’s are at around $321.75, so long as it trades between $300 and $325 by expiry, I will receive MAX profit on the trade Idea.

The Iron Condor is a great way to trade a sideways market with pre-defined risk!

If You’re struggling with your trading, become a part of the Total Alpha community, and receive the education you need! CLICK HERE NOW TO SUBSCRIBE!

There’s a 30-day satisfaction guarantee, so if you’re not happy, no worries, but I think you’ll love what we’re doing at Total Alpha! Click HERE to Subscribe!

For a Limited time, get access to my live trading sessions at 0 cost in the 360 Wall St chat room! Here’s the all star line up:

Also we’ll be sending you our latest newsletter- 360 wall st. Think of it as your “360 view” of the market each day, where you can benefit from multiple perspectives. Sign up HERE

Every trading day, you can expect to receive 2-3 of our traders’ top ideas.

It could be an option trade I really like, a crypto idea from Jake McCarthy, a momentum stock idea from Jason Bond, a fast-moving penny stock that Jeff Williams likes, a trade Davis Martin finds enticing, or maybe even something unusual that one of Ben Sturgill’s scanners has picked up. Sign up HERE, and get access to 360 Wall St at 0 cost, for a limited time.