The market overall has been pretty rough over the last few weeks, and many have been struggling in these tough market conditions. You might be one of these traders.

Despite the rough seas and the worst market conditions, I’ve seen in 20 years, there are still good trade setups out there, although they are few and far between, so patience is key.

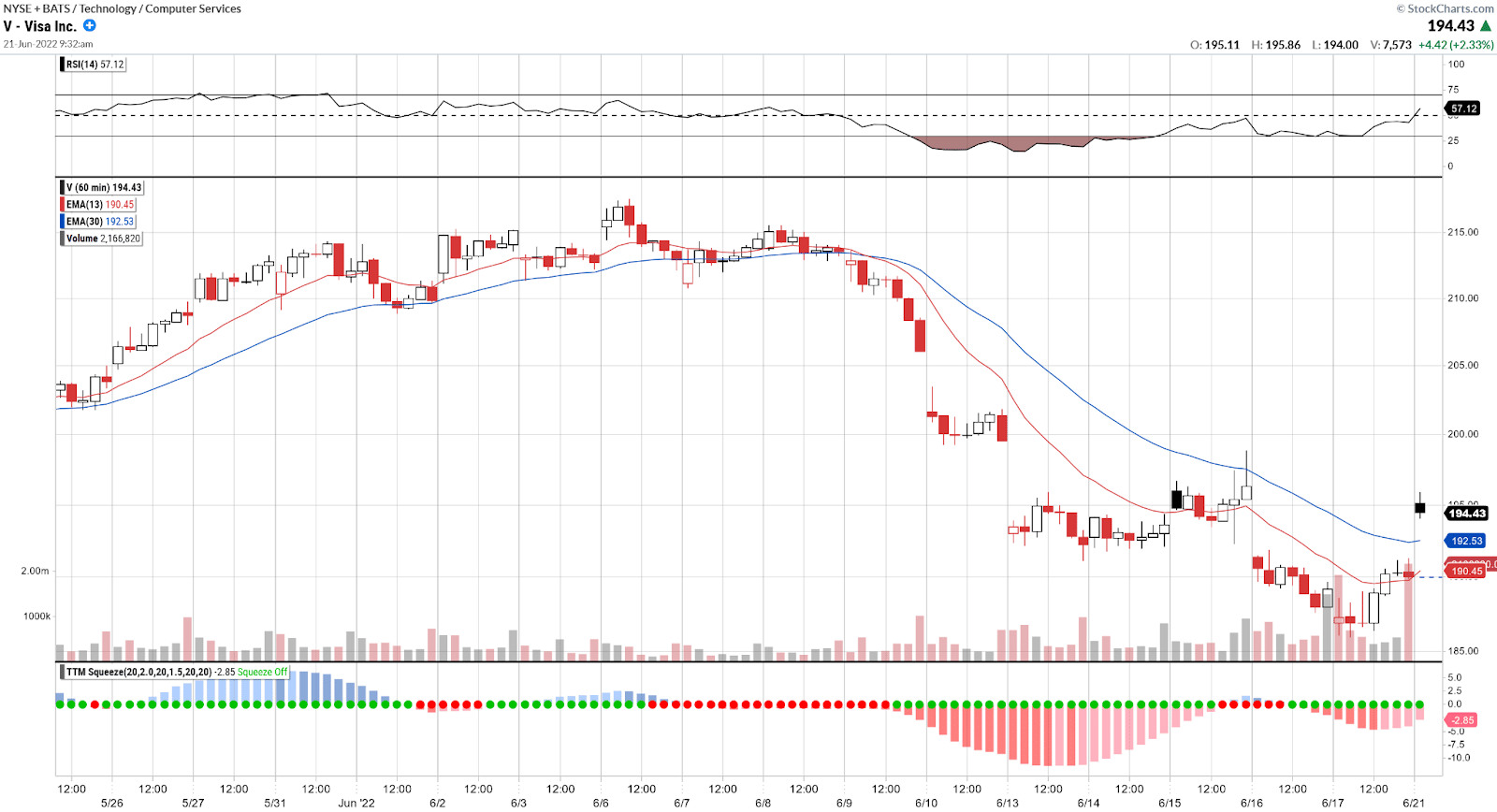

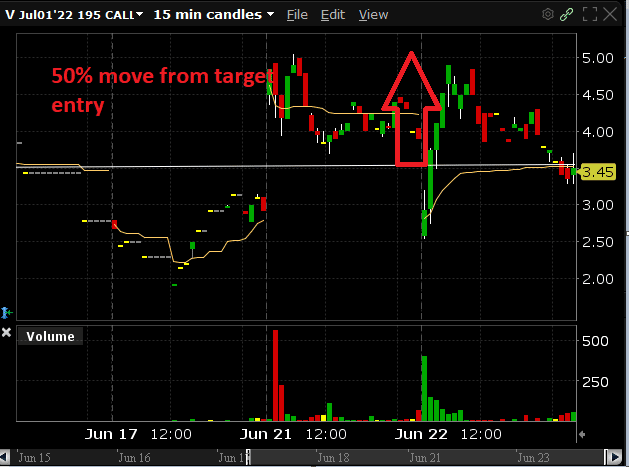

For example, my Bullseye trade of the week this week in Visa (V) moved 50% higher, so while most are getting crushed, I’ve been having a great time finding these rare gems in this dirt of a market.

Don’t miss my next favorite setup coming Monday morning! Click Here!

Every Monday morning, I send out my best trade idea for the week before the market opens to Bullseye subscribers. After analyzing the market the week before and running through charts over the weekend, this is my favorite and most primo setup for the week.

I believe that if you can manage one single trade a week and do it well, you can filter out all of the noise happening with the market overall.

There’s a lot of thought that goes into the Bullseye trade of the week. I’m looking to find good trade ideas that are outliers in the market.

Get Bullseye delivered to your e-mail Monday Morning! Don’t miss next week’s best setup! Click Here

Here was my reasoning for the Bullseye Pick, which was sent to subscribers Tuesday June 22:

V – Bullseye Pick Of The Week

Jeff Bishop on June 21, 2022 at 09:47 AM – edit post

Good Morning, Traders!

I think there is so much negative sentiment in the market that the contrarian in me is sensing a significant bounce in the market soon.

I will be talking all about it in the live training session @ 11am EST today, so join me then!

That being said, there are a lot of stocks that I think could rally significantly this week.

I am tempted to just buy QQQ calls and let the chips fall where they may (in fact, I still might do this in the live trading with Total Alpha today!) but for Bullseye, I want to get a little more selective this week.

I am going with Visa (V) which is part tech stock, part processor, and part bank now.

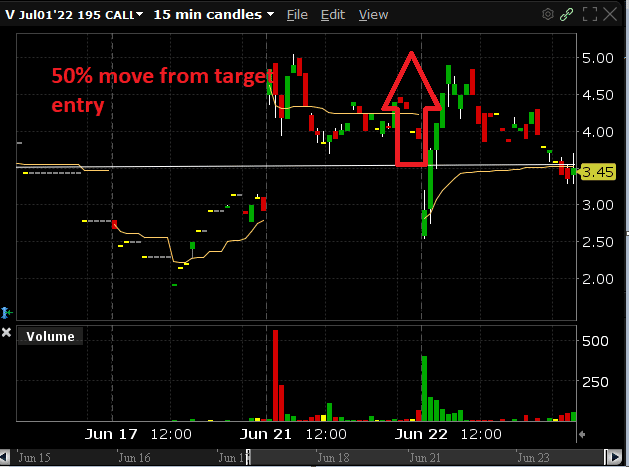

V – VISA

You get a lot of different exposure when you buy the world’s biggest payment processor.

Right now, the stock is making a 4th attempt at the bottom. While I don’t know if this will hold in the long-run, I do think this is setup for a very nice bounce soon.

I normally don’t like to buy oversold stocks in a downtrend, but I am going to make an exemption this week because when it does reverse, the moves have proven to be very violent to the upside.

As part of my gameplan, you know I always want to talk about the downside first. If this trade doesn’t work out, I want to use a break under $187 as my stop on the trade.

If this goes the way I plan, then near $200 will be my first profit target, and then around $208 for the 2nd.

Depending on how the market opens today, I might decide to move up in price and buy just a little bit at a higher price than I would like but then again, patience usually pays off in this market.

My Trade Details:

- Buy Jul 1 2022 $195 Calls near $3.50

- Stop under $187

- Target 1 : $200

- Target 2 : $208

Here’s What Happened Next:

On Tuesday, my $3.50 target entry did not get filled. However on Wednesday’s open, the options on V traded below $2.60. After that, in under 2 hours, those options traded as high as $4.90, leading to more than a 50% move from my target entry and possibly much more if one was able to pick some up below $3. Not bad for a couple of day’s work!

Don’t miss my next favorite setup coming Monday morning! Click Here!

I spend every weekend – a holiday or not – scouring the markets and finding these trades for YOU

And whilst Bullseye trades is the cream of the crop, that only scratches the surface of my trading strategies. To get complete access to my portfolio and DAILY updates, join Total Alpha TODAY!

If You’re struggling with your trading, become a part of the Total Alpha community, and receive the education you need! CLICK HERE NOW TO SUBSCRIBE!

There’s a 30-day satisfaction guarantee, so if you’re not happy, no worries, but I think you’ll love what we’re doing at Total Alpha! Click HERE to Subscribe!

As always, I will go over my thoughts on this trade live @ 11am EST so please join me and hundreds of others then!

To YOUR Success!