The markets are changing up a bit. With the increase in volatility we’ve seen recently, I’ve adapted and switched up my strategy a little to suit the environment we’re in. I’m usually a swing trader looking to hold trades for a few days to weeks.

However, as the markets have changed, I’ve adapted and reduced the number of swing trades I’ve put on and have held a higher cash position than normal.

I’ve also decided to trade more intraday, reducing my timeframe from a number of days to a few hours. Yesterday I put on a live trade in GOOGL in Master’s Club that netted me +$36k in a couple of hours.

Here is the clip from yesterday’s session and a recap of my trade which I walked subscribers through step-by-step live before it happened!

The market was selling off a bunch yesterday, ripping off some faces. The market loves to do the meanest thing possible, and yesterday’s selloff tested the resolve of many traders. I too was a bit surprised with how much the QQQ‘s and some of my favorite stocks sold off. But coming into the day, I was prepared, with a high cash position and understanding that I needed to stay nimble in this market environment.

You see, when volatility increases, so do the sizes of the moves in both directions. It is a day trader’s paradise, but only for those who have the discipline to cut positions quickly that aren’t working and the resilience to keep taking good trading setups.

Let’s take a look at how the day unfolded:

1 minute chart of the QQQs with entry highlighted

The QQQ’s

I began the day looking to get long the market. I was hoping for a brief selloff to take a trade expecting Friday to mark the low in the short term. The QQQs failed right on the open and began to sell off, much more than I expected.

I was waiting patiently for a bottom to form. From my experience, when there is sustained selling, I don’t like to buy the first bottom, as the market tends to stop out those early buyers and make lower lows. So I waited for the second base. However, my trade setup didn’t form as the moving averages had not yet crossed over; thus there was still no sign of stability in the QQQs.

So I kept waiting. Now when the QQQs made their 4th swing low for the day, I took a stab at a long. It’s unusual for the market to sell off so hard so fast, and I understood that this was a pre-emptive trade, but given how over-extended the move was, it was a good spot for a starter position.

Given how much the QQQs sold off, I was willing to give it some room with stops below the 350 level. Although the QQQs did make new lows on yet another move lower, that proved to be an area of consolidation before buyers stepped in to take control.

The GOOGL Trade

The real juicy trade setup occurred in GOOGL live on Master’s club at 11:10 am. The QQQ‘s had stabilized, and my intraday chart setup had occurred. I liked GOOGL because it had shown relative strength to the QQQs in the previous weeks. The trade setup was perfect. GOOGL made a double bottom, the moving averages I look at began to crossover, and price began to hold above. It was an unusually large move already, and oftentimes bottoms can be formed post 11 am as all the early traders with FOMO get demolished.

1 minute chart of GOOGL. Entries are highlighted with arrows, exits with circles

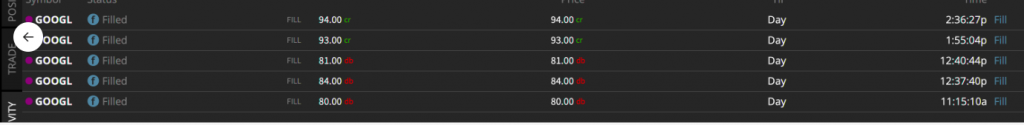

So I bought the 2600 GOOGL calls expiring next week on October 15 for $80. As GOOGL consolidated, I added to my position on a pullback, as it showed continued signs of strength. Then as GOOGL started to get extended above the 200 MA, I sold those same calls for $93 and $94 just 2 hours later. This is why day traders love volatility! And why I become a day trader when I see these types of market conditions.

![]()

My entries and exits in GOOGL timestamped

Bottom Line

When the market changes good traders have to adapt with it, or sit out until conditions suit their strategy. High volatility is great for day traders that know what they are doing.

So when volatility spikes I become a day trader when I see my trading setups form and reduce my trading timeframe. Stringent risk management is required when trading intraday with size during high volatility.

I spelled out my GOOGL trade in my Master’s Class session LIVE and in real-time yesterday. It played out perfectly as I was patient and timed it just right.