Just yesterday, Fed Chairman Jerome Powell confirmed what many on Wall Street already knew, which is that inflation is no longer “transitory.”

With inflation once again becoming a concern for markets, the days where US equity indices make higher highs with ease may be behind us for a while.

When markets become increasingly volatile as they have in recent days, your skills as a trader are really put to the test.

That’s when novice traders can really benefit from live trading tutorials, where both trade ideas and invaluable lessons are shared.

Today I want to show you a winning trade I presented in real-time on Tuesday, and I want to share one of my latest trade ideas in a stock that actually made a two-week high on Tuesday.

There’s nothing like learning how to trade when the market’s selling off

Each and every day, RagingBull’s gurus share their expertise across a number of different services, and yesterday was a great example of how I was able to read the technicals of the iShares Russell 2000 ETF (IWM) in real-time and quickly explain what I thought was going to happen next.

As Figure 1 shows, I traded IWM puts in what turned out to be a “game time” decision accessible only to those using the Wall Street Octagon service.

Figure 1

Note: From now through the end of the year, Total Alpha Members have access to the Wall Street Octagon Room, where I’ll be live in the chat room throughout the day.

Another important part of all the RagingBull services is the daily updates that each of our experts provides.

In my Total Alpha update from Tuesday morning, I alerted members to a stock that was breaking higher above one of my favorite technical patterns.

The stock in question is The Trade Desk Inc. (TTD), and the pattern was a bullish “triangle.”.

According to Yahoo Finance, The Trade Desk, Inc. operates as a technology company in the United States and internationally. The company operates a self-service cloud-based platform that allows buyers to create, manage, and optimize data-driven digital advertising campaigns in various ad formats and channels, including display, video, audio, in-app, native and social, and on various devices, such as computers, mobile devices, and connected TV. It also provides data and other value-added services, as well as platform features. The company serves advertising agencies and other service providers for advertisers. The Trade Desk, Inc. was incorporated in 2009 and is headquartered in Ventura, California.

Figure 2 below is the actual image I shared with members as the stock was beginning to move above this pattern.

Figure 2

But there is so much to becoming a successful trader than just chasing technical breakouts.

For instance, when trading options, timing is far more important than simply trading the underlying stock.

That’s why I make it a point to emphasize the importance of being patient in your trade selection.

In the case of TTD, as it was breaking out, I said, “In order for me to want to get into this trade, I can’t chase momentum at this point. I’m going to wait for a pullback (if we get one) in order to enter this trade at a better risk/reward ratio.”

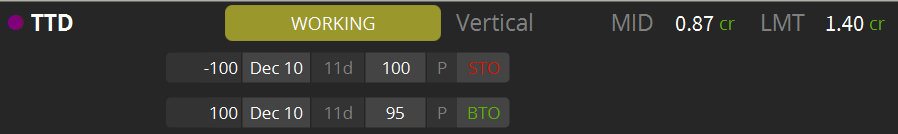

Always wanting to provide members with a complete trading plan for each idea, I also provided the following trade specifics to enter a “vertical bull put credit spread” with a limit price of $1.40.

Figure 3

And the educational aspect of this trade didn’t stop there, as I went into even greater detail, walking members through the options selection process of the trade, in Tuesday’s Master’s Club video lesson.

Figure 4

At its core, this trade is all about taking advantage of a stock that I really like for its fundamentals, and for the fact that it’s trending higher as the broader market is still showing signs of weakness.

And as Figure 5 shows using the original trade parameters shown earlier in Figure 3, another key aspect of these trades that I try to reinforce to members is that being able to identify the right levels to use to establish favorable risk/reward setups is critical not only to the trade’s success but also to a trader’s ability to keep losses small when they inevitably occur.

Figure 5

To YOUR Success!

1 Comments

TTD trade: I understand seeing credit spreads is to buy or sell where market not going.