Last week I was pretty bearish about Bitcoin. Everything speculative has been getting the kibosh, and the market has been in freefall with the occasional bounce. In a bear market, I like to short rallies expecting the downtrend to continue. Instead of shorting Bitcoin itself, I prefer to structure my Bearish trade thesis by taking a short position in Microstrategy (MSTR) a large buyer of Bitcoin.

Moreover, I structure my short position in this case by buying puts! Here’s what happened after I took the trade LIVE in Master’s Club last week on Monday the 27th:

![]()

And the put options were up 50% in less than a week!

This coming Tuesday, RagingBull will be merging two of our most popular features, The War Room and Masters’ Club, into 360 Wall Street.

Folks, this is as value-packed as it gets!

And it’s all driven by 6 expert traders…each with at least 10 active years of experience…aimed at disrupting your approach to trading and helping you level up in your journey.

Here’s what this unprecedented package will offer:

- A daily newsletter — and more — that gives you a “360-degree view” of the market each day.

- HOT trade ideas delivered straight to your inbox each trading day…before the market opens!

- Access to an engaging LIVE chat room — hosted by trading experts.

- Instant App Alerts On Your Mobile Phone.

- Full access to the special “Momentum Scanner” that Jeff Williams and Jason Bond use to find fast-moving momentum trade ideas.

It’s time to put your trading back on track! No excuses!

Remember it all happens This Coming Tuesday! I.e. Today!

Microstrategy (MSTR) is a large buyer of Bitcoin. MicroStrategy held approximately a total of 129,218 bitcoins as of April 5. It was valued at about $6 billion at a price of about $46,742. Since then, that value is down over $3 billion. They made a purchase of at least 4,167 BTC for around $190.5 million between February 15 and April 5. They are since down more than 50% on that particular purchase also. I think Bitcoin has further to fall, and as a large holder of Bitcoin I was bearish MSTR.

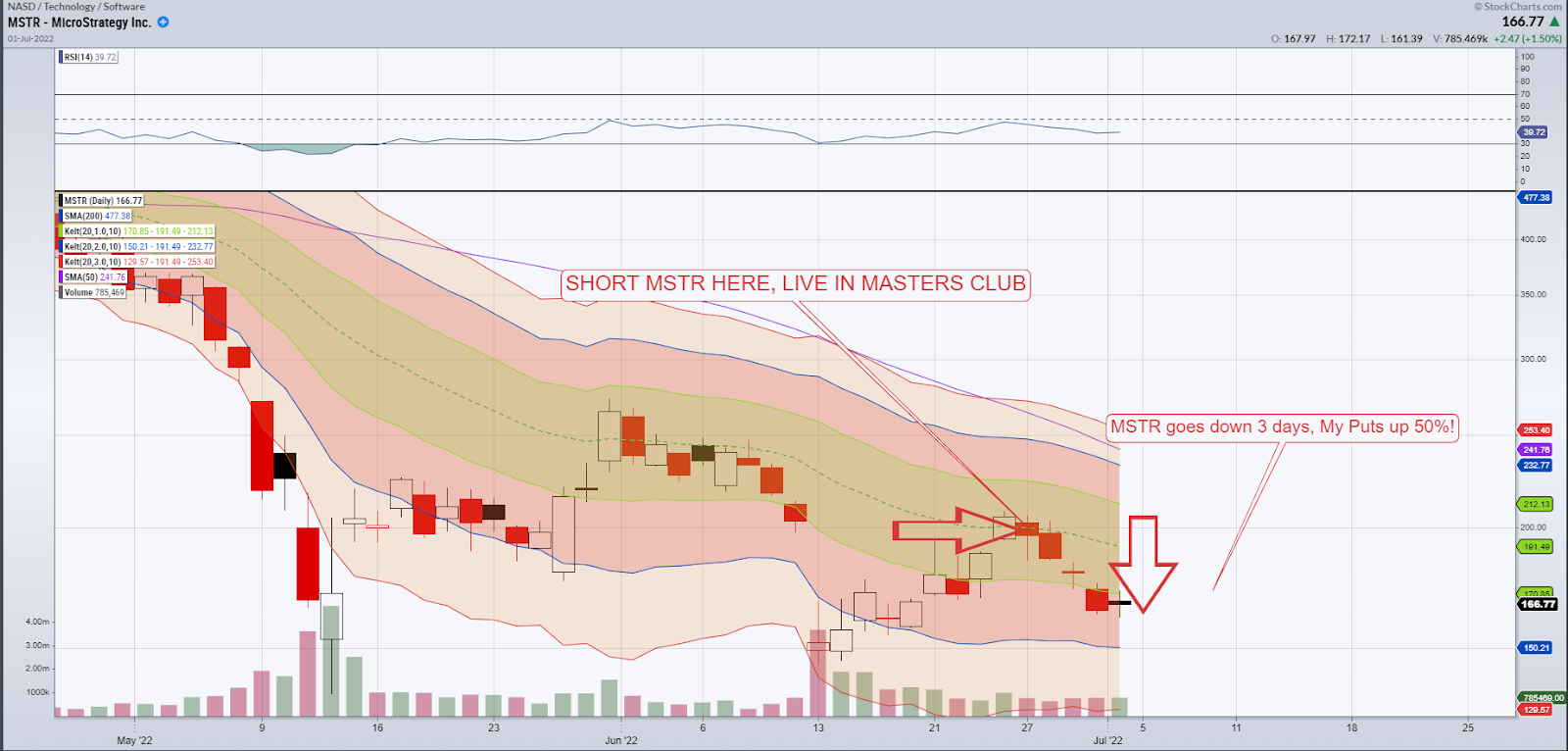

I got short on Monday last week Live in Master’s club, and here is my reasoning:

Sentiment

Overall the markets are bearish, especially on speculative growth stocks and assets. In my mind, it doesn’t get much more speculative than Bitcoin.

Technicals

MSTR had a nice bounce off the $150 level and filled the gap at $200. Technically, often, the goal of traders is to fill a gap, and once that is achieved, the price can once again begin to move lower. Given that MSTR was still in a downtrend on the bigger picture, this presented me with a good opportunity to short into this bounce. As a trader, it is my job to get long strong stocks and short weak stocks. But price matters, so I took this bounce as an opportunity to get short. I did this by buying puts!

The Trade

I bought the $200 puts expiring July 15 for $27. That gave my idea a few weeks to work. As of Friday, these puts were trading at $42.45, up over 50% from my entry in under a week. While “investors” and bag holders are getting clobbered, nimble traders are able to take great setups in this market.

![]()

The puts were up over 50%, and here’s how the underlying MSTR stock traded after my entry:

To get access to daily updates, education, and changes to my portfolio, become a part of the Total Alpha team Today!

If You’re struggling with your trading, become a part of the Total Alpha community, and receive the education you need! CLICK HERE NOW TO SUBSCRIBE!

There’s a 30-day satisfaction guarantee, so if you’re not happy, no worries, but I think you’ll love what we’re doing at Total Alpha! Click HERE to Subscribe!