New traders often have problems overcoming issues such as Fear Of Missing Out (FOMO), chasing stocks, and overtrading.

Taking trades out of emotion is almost always a bad idea. An Alpha trader understands their good setups and waits patiently for the market to present them with an opportunity.

Great trading is like being a professional sniper. A sniper prepares their location and can sit patiently, waiting for hours for their target to appear. Once this happens and the target is in their line of sight, a sniper pulls the trigger without hesitation.

I’ve identified a stock I really like and am waiting patiently for my setup to form. When it does, I’ll be ready to pull the trigger.

Peloton (PTON)

Peloton Interactive, Inc. provides interactive fitness products in North America and internationally. It offers connected fitness products with a touchscreen that streams live and on-demand classes under the Peloton Bike, Peloton Bike+, Peloton Tread, and Peloton Tread+ names.

This was one of the best Covid-19 trades as demand for Pelotons grew during lockdowns in the U.S and Europe. Last year the stock was up over 500% from IPO levels. In 2021 however, as most of the world has re-opened, PTON is currently trading about 40% off its highs of $171 at around the $100 level.

Fundamentals

I like the company, it has great products and services, and it is a pioneer in the fitness streaming industry. Two issues have hurt the company’s performance this year. Recalls of Tread and Tread+ treadmill products in May played a part as well as the temporary halt in sales of the machines. This was due to some accidents involving children. Unfortunately, treadmills, in general, have safety issues involving children and I see this as a temporary setback as the company completes its recall and improves its product.

In addition, PTON cut the price of its original bike by $400. This was unexpected news by the market, and it reacted in a negative way. However, in my opinion, over the longer term, a price drop is not that bad as PTON seeks to increase its market share as it competes with offerings from Apple Inc. (AAPL) and Lululemon Athletica Inc (LULU).

Despite these issues, PTON still has 50% year-over-year revenue growth and the ability to continue this further with new product offerings such as the newly expected rowing machine. Given the significant pullback in its stock price, PTON could be setting up for a great buying opportunity.

Technicals

Let’s take a look at the technicals to see where a good entry might present itself.

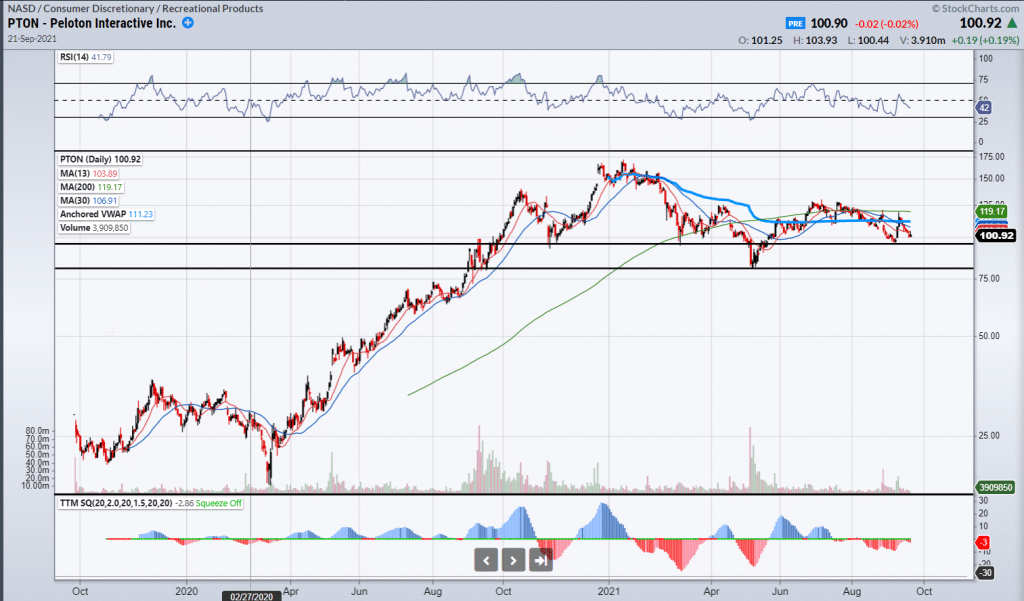

Daily Chart of PTON

On the bigger picture daily timeframe, we can see that we are below all the moving averages (MA’s) I have on my chart. The 13 and the 30 MA is pointing down while the 200 is sideways. From a technical standpoint, this is not great action. I would like to see the price get above the 13 and the 30 MA before I take a position. We can also see support at the $95 and $80 levels.

As I’ve mentioned, I am not ready to take a position unless PTON consolidates some more and gets above the 13 and the 30 MA. However, in the event that PTON breaks below $100 and trades towards the $80 support level, I will consider this a gift and be ready to pounce. This would be a rare panic sell trade where I will be looking to fade price action to enter a trade at very favorable prices.

Now let’s drill down to the 60minute timeframe to get a better look at near-term price action.

60-minute chart of PTON

On the 60 minute chart, all the moving averages I use are pointing down. From a technical standpoint, the trade is not ready for me to enter. I want to see the 13 and 30 MA’s even out and price to get above them. One positive is that price is consolidating above the psychologically significant $100 level. If PTON can make a higher low above $100 and get above the moving averages, it would meet my criteria for a viable trading setup. I would set stops below $95 and would have a near-term target of $120. Again, I will plan to save some ammo for a complete breakdown to $80 where I will be looking to “load the boat”.

Bottom Line

As the great Warren Buffett once said, “All day you wait for the pitch you like; then when the fielders are asleep, you step up and hit it.” A big part of my process is identifying stocks with potential and then waiting for my setup to form. I liken this process to that of a sniper who waits till everything is just right before pulling the trigger on their target. A stock I’ve spotted that is close to a trading opportunity is PTON. It is at attractive levels, and I like the potential of the stock to break out much higher. However, as yet, the technicals have not lined up. I will be waiting like a sniper for my criteria to set up. When this happens, I will let subscribers know by advance notice and will not hesitate to pull the trigger.

2 Comments

Good job explaining what to watch for and why.PS thanks for the work you guys do for the people trying to just do better in life. Don’t want any freebies just opportunities. Thanks. Ron. Slagle

you hit it on the right time