Corporate earnings and interest rates drive stock prices. With interest rates near 0, we have seen the market charge higher and higher on expanding the Federal Reserve’s (FED) balance sheet.

Despite fears of inflation and discussions of rising interest rates, the market has shaken off all worries to continue higher. There is as of yet no sign of any change in this trend.

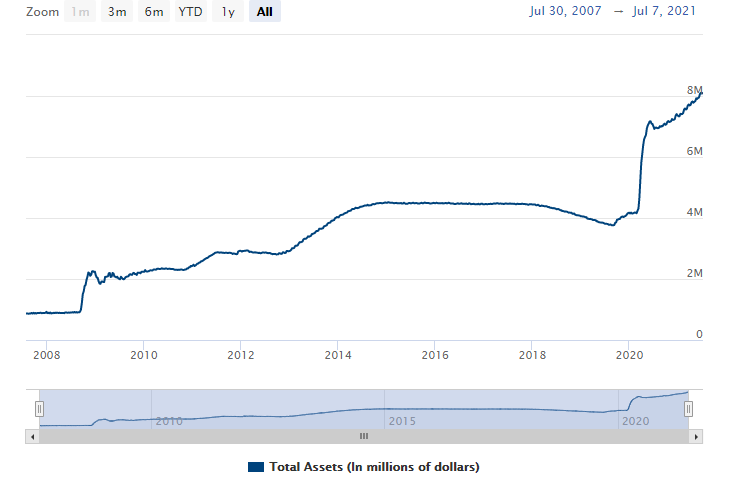

Balance Sheet Expansion

FED asset purchases, the only chart that matters?

The FED’s balance sheet had expanded from $2 trillion in 2009 post the Global Financial Crisis to $4 trillion in 2020 before the covid-19 virus hit. Emergency intervention in the financial market during the pandemic of 2020 and continued asset purchases in 2021 has seen that figure rise to $8 trillion.

While some market participants fought the market by shorting on economic worries, the demand for financial assets outweighed supply driven by the FED policy.

This asset purchase program has seen markets march higher and higher, and as long as Fed purchases continue, I wonder if it is even possible for the market goes down in a sustained fashion? So far, the answer has been no.

Inflation and Interest rates

We have seen pullbacks in the market recently amid inflation fears. CPI readings have overshot expectations at times, and the market has reacted to the Federal Reserve beginning to talk about tapering the stimulus.

However, as Fed balance sheet assets continue to increase, the market shakes off fears of sustained inflation and makes new highs.

From October to November, a 20% drop in 20-year bond prices signaled higher future long-term interest rates, perhaps being the reason for minor market corrections as the market began pricing in inflation and higher rates. However, as shown above, FED asset purchases were increasing, continuing to fuel a rally higher in stocks.

Since March overall, the 20-year bond chart above shows the market is pricing in lower longer-term interest rates than it had been previously. Thus despite FED signaling the beginning of discussions for tapering, the market is pricing in still lower longer term interest rates.

A similar situation occurred during Alan Greenspan’s term in 2005. Despite interest rate increases in the Federal Funds Rate, the 10-year interest rate refused to move, known as ”Greenspan’s conundrum”. That bull market lasted three more years until the Financial Crisis in 2008.

Thus, it appears that the only thing that can hold this bull market back is a reduction in the FED’s balance sheet or out-of-control inflation, which could be a real possibility but at the moment appears transitory.

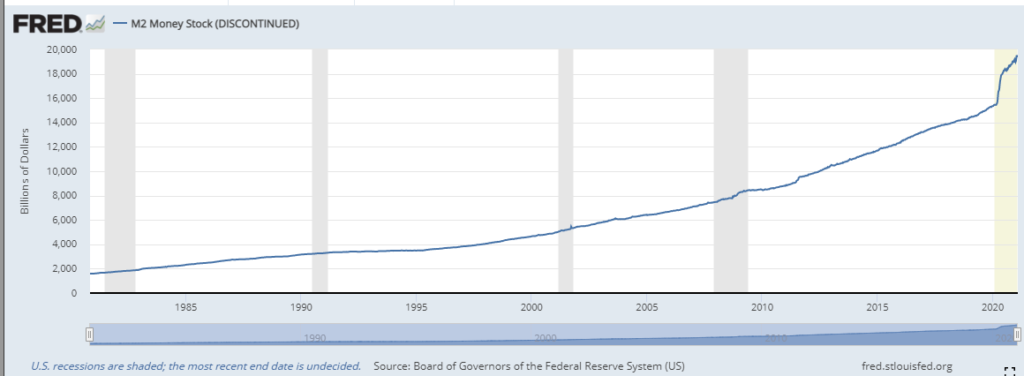

Money Supply

The amount of cash has also risen significantly since the beginning of the pandemic. As shown by the M2 money supply.

Given that there are record amounts of cash with nowhere to go, there is still pent-up demand to find a return on this money given low-interest rates. Perhaps this is why we see a flood of SPACs, cashed-up vehicles looking to take private companies public.

We also see significant investments in speculative cryptocurrencies and NFT’s. Recently an Unopened Super Mario 64 Game From 1996 Sells for $1.56M (cheddar.com). I don’t want to say we’re in a bubble…but we’re in a Fed-induced bubble.

With the stock market at all-time highs, fundamentally, nothing has changed yet. There is still so much money in the system looking for a place to go. Without severe inflation and unexpected rate increases, there is no telling how long this can continue.

Bottom Line

The FED balance sheet has continued to expand post-Covid-19. Even as Inflation indicators spike and interest rate increases are on the cards, the balance sheet expansion may be the leading cause of this vital market. With record cash on the sidelines with nowhere to go but equities due to low-interest rates, there is no reason for this trend not to continue.

2 Comments

Thank you for the education I really appreciate your insite from history. This is very useful info

Jeff, Great information to support continued general optimism for the stock market to continue its march forward. Appreciate the education you guys provide.