The market is flashing some warning signs. NFLX had terrible earnings and is losing customers as household budgets get hit; you can read more about that HERE. TSLA had amazing earnings yesterday and still got the Kibosh!

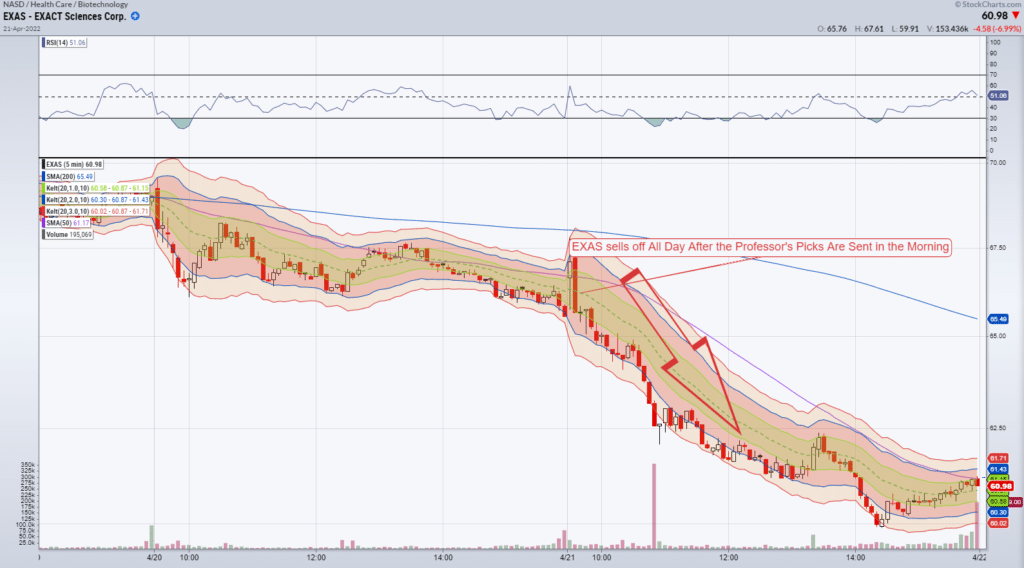

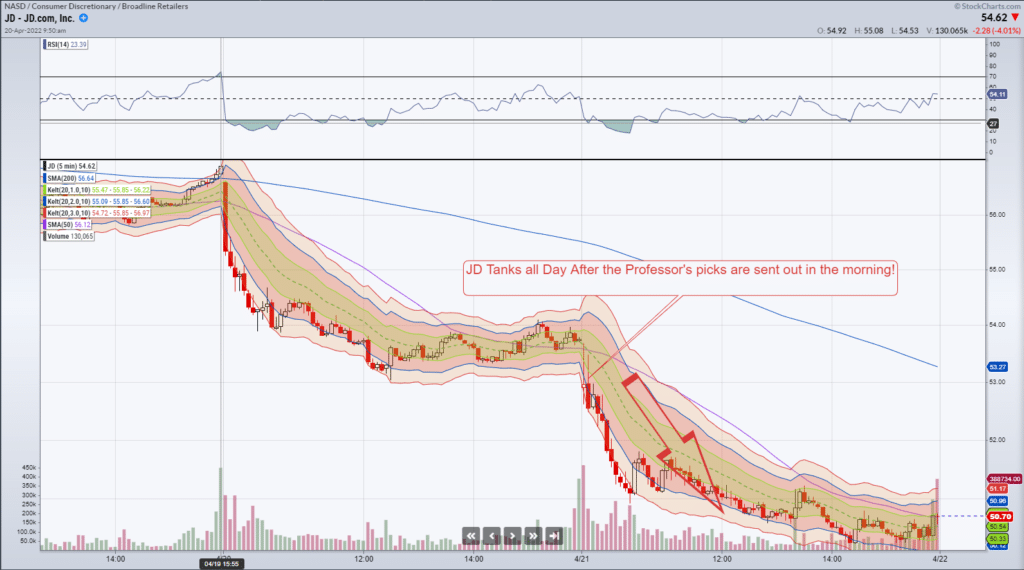

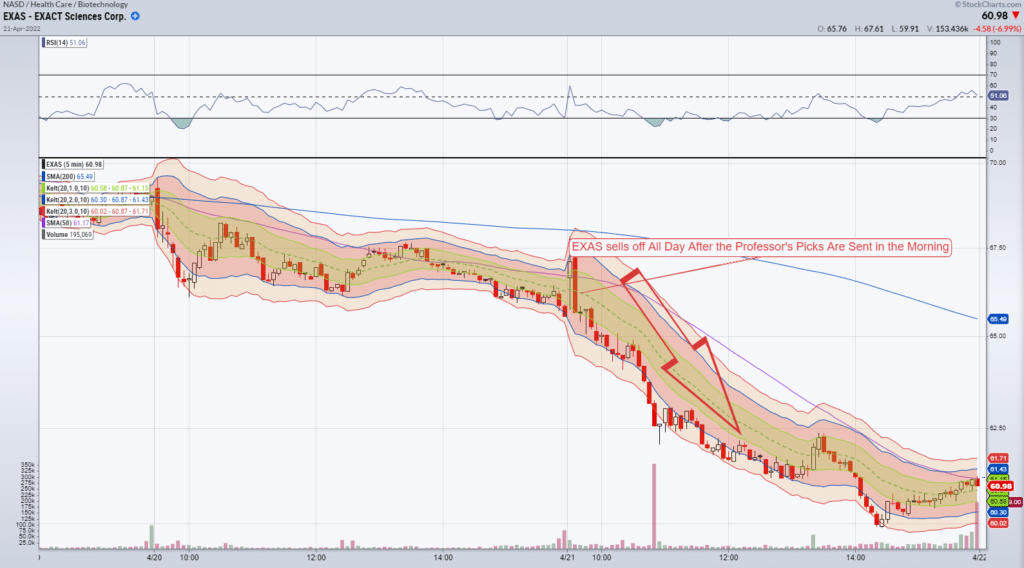

After discussing why he was Bearish on the market on Wednesday Live in Master’s Club, The Professor sent out 2 bearish picks to subscribers yesterday morning, and they tanked the entire day!

Inflation looks set to possibly put us into a recession, and that’s not good for stocks. Unless the Fed changes its tune, it looks like rough sailing ahead. I think that betting against stocks is the thing to do right now, and I might do a webinar about that next week. Here’s what the Professor’s picks did after being sent out yesterday morning:

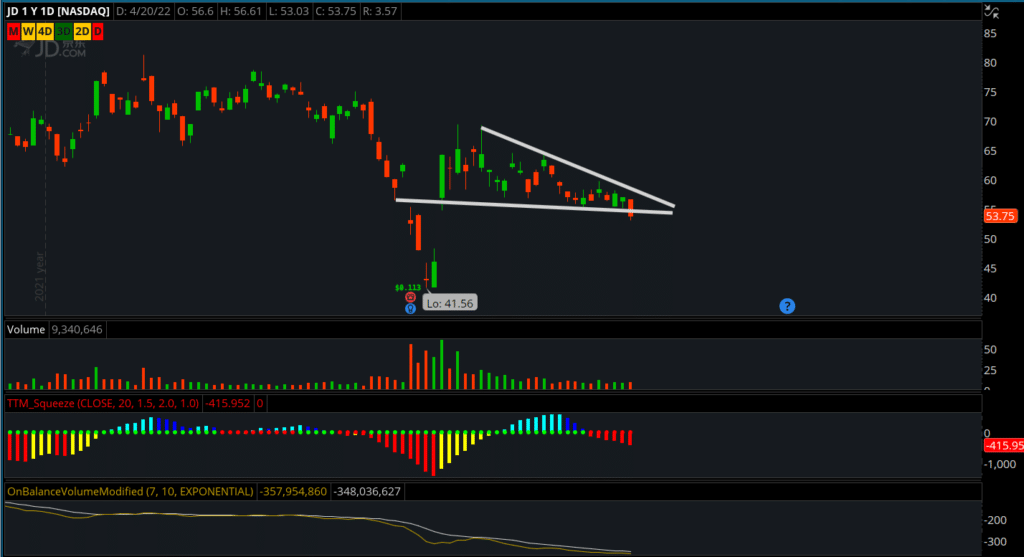

JD

EXAS

Below is the detailed trading plan sent out to subscribers.

JD Daily Chart

Trade Setup:

- Triangle : A falling wedge/triangle pattern is forming here. It is in a downtrend and appears to be resolving to the downside with bearish price action.

- TTM Squeeze : The TTM Squeeze is showing red dots and the momentum histogram is negative and trending lower. This is telling me there is bearish volume coming into the name right now

- On Balance Volume : OBV is bearish and trending lower from here

Trade Details:

- Target 1 : $52.89

- Target 2 : $49.76

- Target 3 : $46.3

- 20 May 52.5 puts

EXAS 4 Hour

Trade Setup:

- Bearish Wedge/Bear Flag : The bearish Wedge Pattern / Bear Flag pattern is showing that the bulls are starting to get beat up and leaving this trade at this time. With the lower support getting tested, it is just a matter of time before it breaks to the downside.

- TTM Squeeze : The TTM Squeeze is showing red dots with a negative histogram. There is slightly positive trending values, but I feel the bears will get the momentum to trend back negative soon once they break out to lower prices

- On Balance Volume : OBV bearish with a downward trending indicator and looking like it wants to head even lower from here.

- Beware earnings

Trade Details:

- Target 1 : $63.46

- Target 2 : $61.67

- 29 APR 65 Puts watch bid/ask spread