I’ve been working with my programmers here at Raging Bull to develop a new and improved scanner for my strategies, and it picked up some really nice moves last week, you can read more about that here.

It’s vital to have cutting-edge technology to stay ahead of the curve and keep up with the competition. I mean, you’re trading against some of the brightest minds and biggest institutions in the world, and if you want to compete, you have to take your trading seriously. The High Octane scanner helped the professor find his latest pick.

Don’t get left behind, the High Octane Scanner is included with every Total Alpha subscription.

Don’t miss these trading signals.

The High Octane Scanner looks for when the 13/30 hourly crossover occurs, and when the daily chart and fundamentals line up with this crossover signal, I believe there is an increased likelihood that the trade will work in my favor.

New Relic, Inc., (NEWR) is a software-as-a-service company, delivers a software platform for customers to collect telemetry data and derive insights from that data in a unified front-end application. It offers a suite of products on its open and extensible cloud-based platform, which enables users to collect, store, and analyze telemetry data.

Tech stocks have been getting smoked and in fact, have been trending lower for over a year. Newer is down over 50% from its highs and has been trending lower. It’s a trader’s job to get long strong stocks and get short, weak stocks, and stocks don’t get much weaker than NEWR has been!

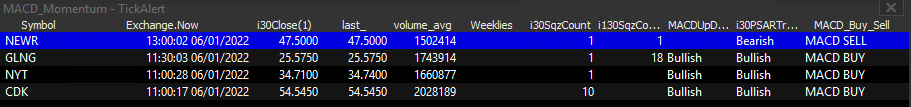

After hitting the High Octane scanner, The Professor did a deep dive into the stock.

To get access to daily updates, education, and changes to my portfolio, become a part of the Total Alpha team Today!

Here is what the daily and 30 minute charts looked like:

These were his thoughts sent to subscribers:

To get access to daily updates, education, and changes to my portfolio, become a part of the Total Alpha team Today!

NEWR is setting up for a MACD Sell with a Bearish PSAR and that’s getting into my A+ setup zone.

Why’s that?

You see, with MACD acting as momentum, and the bears setting up for a push lower, it’s just a matter of time before the stars align and the selloff begins.

But I don’t want to get in too early, of course…

Trade Details:

- Daily bear flag setting up with support at $45

- 30-minute bull flag intraday, with floor near $47

- PSAR at $46.73

Trade Plan:

- Enter at break of PSAR at $46.73

- Add at break of bear flag at $45

- Stop above bear flag at $50

- Target 1 : $40

- Trail remaining lower against moving averages

To get these trade Ideas as soon The Professor comes up with them, subscribe to Total Alpha now!

If You’re struggling with your trading, become a part of the Total Alpha community, and receive the education you need! CLICK HERE NOW TO SUBSCRIBE!

There’s a 30-day satisfaction guarantee, so if you’re not happy, no worries, but I think you’ll love what we’re doing at Total Alpha! Click HERE to Subscribe!