In the eyes of the IRS, you are either a long-term investor or a short-term trader.

More specifically, you either hold a position for longer than one year or less than one year.

When it comes to trading, these are some of the primary tax implications that one needs to be concerned with, since the latter (short-term traders) gets dinged with higher taxes.

One common strategy traders use to help minimize capital gains taxes is “tax-loss harvesting,” which is the act of selling securities at a loss to offset a capital gains tax liability.

What you may not be aware of, however, is that Uncle Sam doesn’t like when you sell a security at a loss then turn around within a certain window of time and buy that security back.

Given the frequency with which so many of us place trades, it can often be hard to keep track of whether we’re participating in this practice.

Today, I am going to cover the key details of this rule and show you one way to avoid triggering it.

What is the Wash Sale Rule?

The wash-sale rule was implemented as a way to prevent investors from selling a security at a loss for the purpose of claiming the tax benefit, then immediately buying the same security again.

The Wash-Sale period is defined as 30 days before and 30 days after the sale date, totaling 61 days (including the sale date).

If a trader wants to sell a security at a loss and buy the same or a “substantially identical” security within 30 calendar days before or after the sale, the wash-sale rule will take effect.

When this situation arises, a trader won’t be able to take a loss for that security during the current year’s tax return.

Instead, the losses must be added to the cost basis of what is known as the “replacement security,” or the “substantially identical” security that was repurchased in place of the security that was previously sold for tax-loss harvesting purposes.

In addition, the holding period of the original security gets tacked onto to the holding period of the replacement security.

I know, I know…this is all very confusing.

Here’s an example of how this might work:

If you buy 20 shares of ABCD stock for $100 per share ($2,000 of stock), then, thirteen months later, the stock falls sharply on earnings, so you sell your 20 shares for $80, or a $400 loss. Two weeks later, ABCD is trading at $50 per share and you repurchase the 20 shares for $1000. This triggers a wash sale.

In this example, you’re not allowed to use the $400 loss as a deduction on your current year’s tax return and the $400 will be added to the cost basis of the “substantially identical” security that was repurchased.

That bumps the cost basis of your $1000 replacement position up to $1400.

Then, if you later sell that stock for $2,000, your taxable gains will be $600 instead of $1000.

Finally, since you previously held ABCD for at least a year, it will be registered as a long-term capital gain, which is taxed at a lower rate than a short-term capital gain.

How can you avoid repurchasing a “substantially identical” security?

Interestingly, the government has not provided a straightforward definition of what it considers “substantially identical.” Investors will have to use their best judgment to avoid the wash-sale rules.

Fortunately, there are some more obvious examples of what would not be considered a “substantially identical” security.

Unfortunately, two of three I am about to show you are more difficult for retail traders to get their hands on and understand.

The three more obvious alternatives are:

- Bonds issued by one institution, but with different maturity dates and different interest rates

- Preferred stock of the same company

- Stocks of different companies even if they are in the same industry

For retail investors, it’s the last item on this list that offers the fewest barriers to entry.

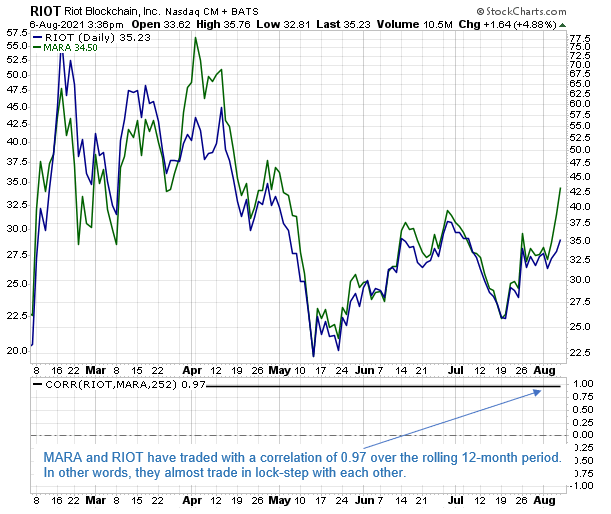

For instance, if you recently sold a crypto stock like Riot Blockchain, Inc. (RIOT) to take a tax loss but did not want to miss out on what you felt was an upcoming rally in this sector, you can buy shares of Marathon Digital Holdings, Inc. (MARA), which, as Figure 1 below shows, trades with a very strong correlation to RIOT.

Figure 1

Wash sale rules extend across all accounts, family members and business lines

Be careful, wash-sale rules apply across all your accounts, including those outside the account where you made your original sale.

Oh, and wash-sale rules also apply to transactions in your spouse’s accounts.

While the IRS requires that each individual brokers report wash sales on the same CUSIP (essentially, this is like a unique nine-character social security number for every security) made via their own platforms, it’s up to each trader to track sales made across all of their accounts, as well as the accounts of their spouse.

If you think you can skirt this issue by using ETFs and options, think again.

Essentially, if the security has a CUSIP number, then it’s subject to wash-sale rules.

Oh, and you can’t even escape the wash sale rule by selling a security at a loss in a taxable account and then immediately repurchasing it in a retirement account.

That’s because the IRS has come up with a rule (Rev. Rul. 2008-5) to prevent this from being acceptable.

Finally, if you plan on getting around this issue by selling a security at a loss on Dec. 21 in an effort to fit it into the current tax year, with the goal of buying it back in early January, this won’t work either since the wash-sale rules are not confined to the calendar year.

5 Comments

Very nicely explained with examples.

Good, Thanks

Thanks for clarifying, Jeff! This is such a confusing issue, and you have made it much easier to understand! KD

Excellent article. Although basic but need to hear it from a professional.

Thank you for sharing your thoughts. I really appreciate your efforts and I will be waiting for your

next write ups thank you once again.

Hi friends, how is the whole thing, and what you wish for

to say on the topic of this paragraph, in my view its genuinely awesome

designed for me.