Buy and HODLers have been taken to the cleaners. “Traders” with poor risk management are being taken out of the game one by one. This is the toughest market I’ve seen in 20 years, one where only the strong, those with real trading skills, survive.

Despite all the obstacles traders need to overcome in these conditions, there are still some great trading setups forming. This summer, I’m giving access to our new trade room 360 Wall St at 0 cost. Our best traders will break down their best trade Ideas, and strategies live daily! You can watch the broadcast Daily Here:

Not only that, but if you sign up to our newsletter, you’ll get 2-3 of our Traders’ top ideas daily, before the market opens. There’s no better way to prepare for the trading day! Download the app and sign up NOW!

Not only that, but if you sign up to our newsletter, you’ll get 2-3 of our Traders’ top ideas daily, before the market opens. There’s no better way to prepare for the trading day! Download the app and sign up NOW!

I took a position in a low float yesterday, and it has all the signs that it could go BANG. Let me break down the trade idea, so you understand the mechanics of how this particular trade works.

FAZE had its SPAC merger last week with B. Riley Principal 150 Merger Corp. A total of 15, 883, 295 shares were redeemed at $10, reducing the float size by 92% (per Benzinga). What this means is that while the company raised a lot less cash than they wanted for the listing, the amount of shares outstanding is very small.

When the amount of shares in a company outstanding is small, this can lead to wild moves when big players smell blood. This is because big money can buy up a lot of shares and effectively push the stock much higher, IF the rest of the market also buys, in that there can be a situation where there are not many sellers left. These moves can become even wilder if a short seller becomes trapped fighting the stock. I’ve seen this setup time and time again over the last few years.

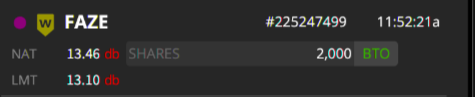

Thus when I saw FAZE break out, on significant volume yesterday, I knew I wanted to be in the trade but didn’t want to chase the stock.

Thus I put in a bid in and around VWAP (the volume weighted average price) at $13.10. Given that VWAP is an approximate average price for the day, and my trade idea is that tomorrow we move much higher, this is a good spot to get in.

We’ll find out today if the stock decides to do what I think it could, but I have a nice entry for a possible explosion in the coming days.

I discussed this trade LIVE in the 360 Wall St. room along with others. Take your trading preparation to the next level. Click here and join us live in 360 Wall st!