The message I am going to pass along today may be the most important one I bring you ALL year.

And it starts with one word– Tendencies

This is one word that I promise you’ll need to understand if you are going to be a successful trader.

No, I’m not talking about being able to understand if a stock tends to rally or decline after touching key technical levels (though I would really like you to be able to spot these tendencies!).

Instead, I am talking about your ability to recognize the tendencies of your opponent.

And now, more than ever, that includes the tendencies of JPow and the Fed.

Before we go any further, it’s important that I introduce you to a concept known as Game Theory.

Teachable moment:

Game theory is defined as a branch of applied mathematics that provides tools for analyzing situations in which parties, called players, make decisions that are interdependent. This interdependence causes each player to consider the other player’s possible decisions, or strategies, in formulating strategy.

Even though I am a trained economist, I am not about to tell you that I have built some fancy model to predict the Fed’s interest rate decisions.

Instead, my 20+ years of trading experience have allowed me to develop something even more powerful.

What I am talking about is the ability to use Game Theory to anticipate the Fed’s next moves and plan my trading strategies ahead of those decisions.

By they way, if you have never seen the story of John Nash (Nobel prize winner for developing “game theory”), you should check out “Beautiful Mind”. I love that movie.

Now, why am I bringing all of this up today?

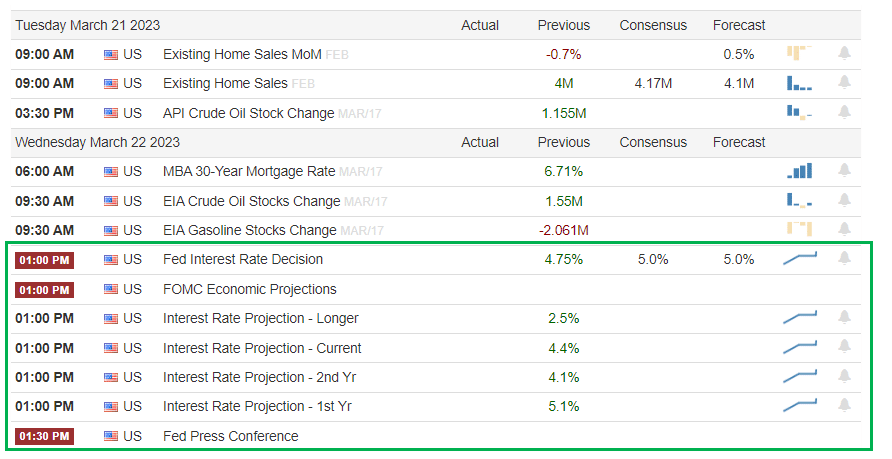

Because, after a CRAZY week in the markets last week, it’s time to strap in once again ahead of the Fed’s next rate decision and a JPOW press conference on Wednesday.

Folks, in trying to help everyone from bankers to average Americans, the Fed, led by JPOW, has moved our great country toward an economic quagmire.

And in case you haven’t noticed, Fed officials have become quite good at moving markets in their desired direction by using public speaking engagements to generate volatility.

If you join after that, make sure you go back and watch the recorded video, on-demand when you have time.

As a red-blooded American who HATES outside manipulation of what used to be a free market, I have done everything in my power to learn the ways of the Fed.

And that’s why I am particularly excited about my Bullseye Trade of the Week this week, because I painstakingly selected it to benefit from what I see as the Fed’s next big move on Wednesday.

This weekly trade idea comes out BEFORE the market opens every Monday morning, and it’s NOT too late for you to look at what I sent to my members just a few hours ago.

From my instant app and email alert that I sent to my members this morning, they are able to learn about:

- The stock or ETF I’m looking to trade

- The technical and fundamental analysis that are fueling the plan

- The EXACT options contract(s) that I am targeting

- My desired entry price

- My target and stop loss plan for the trade

- MOST IMPORTANTLY: Members learn HOW, and WHY I’m zeroing in on these trades, so they can begin to apply these techniques to their own trading!

Remember, JPOW may be ready to open his mouth and crush risk takers AGAIN this week.

These volatile market conditions are what my Bullseye Trades members live for, because I understand how economic data can force the Fed’s next move!

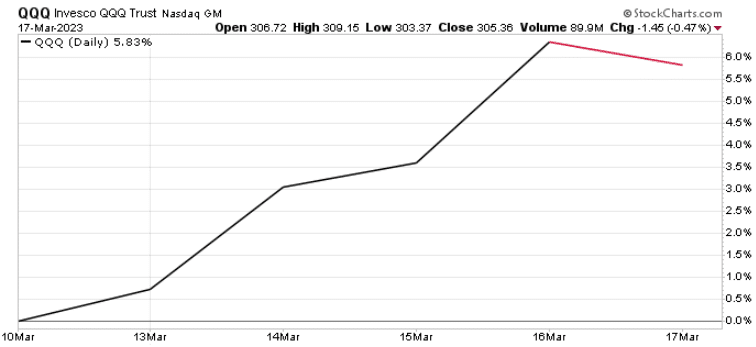

Heck, just last week I warned you that the market had become overdone on the downside, setting the stage for stocks to stage a rebound.

And the rest is history, as QQQ rallied a little more that 6% at its highest point last week:

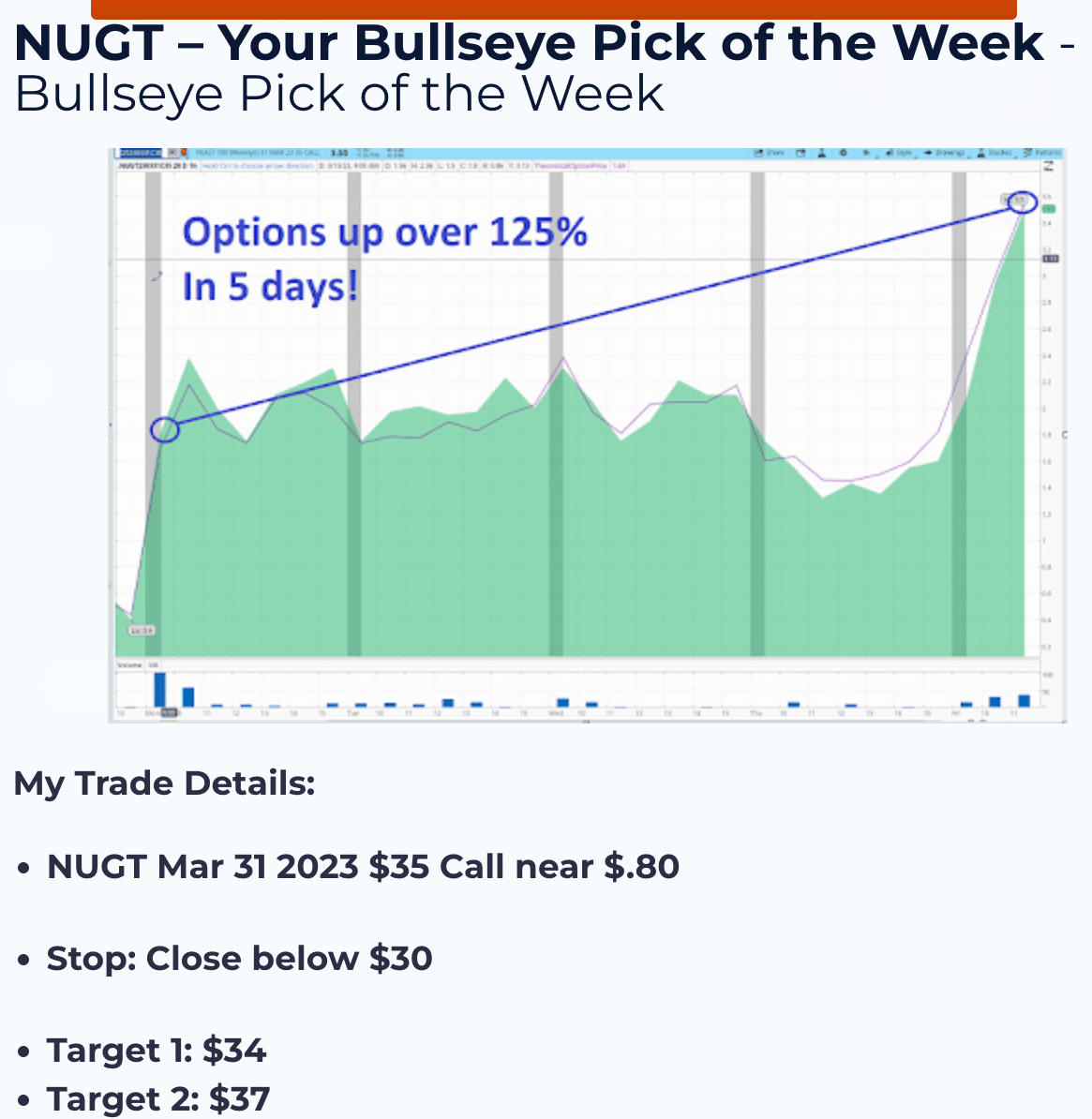

And what about last week’s Bullseye Pick of the Week???

Well I have to say it performed pretty damn well especially in light of the incredibly tough trading environment.

(well, NUGT is up nearly 200% today after another strong showing for NUGT, but who’s counting?!)

It literally rocketed right out of the gate, and never pulled back enough for me to get in it (remember I don’t chase trades!). But kudos to any members that rode that trade out for the full week!

👉 And, speaking of my members, Bullseye Trades is earning an AMAZING 4.7/5⭐⭐⭐⭐⭐rating on TrustPilot (96% of people rate me as 4 or 5 stars, and this is for stock trading education, not an air fryer!!!).

I’m incredibly grateful for all the support, including one of latest reviews that was graciously left by a satisfied member:

For a short time only, I am now offering monthly plans to help you get ready for what next week holds.

***Not only that, your entrance also comes with THIS ⤵️

So what’s holding you back?

If you are still on the fence, I urge you to take some time and review my previous Bullseye Trades on this page.

I am sure you will see how this will be a great tool in your trading arsenal.

I have made this service as easy to follow as possible.

Not simple like “just copy my trades,” but simple in the way that I want to make it extremely easy to understand what I am doing and most importantly WHY I am doing it.

Learning how a trading veteran approaches the market each week and lands on a top idea to trade will be a game changer for you in the year ahead.

Time is ticking, don’t miss out on the next big opportunity coming on Monday!