You’ve probably heard that in the trading and investing arena, there’s the smart money and the dumb money.

Now, everyone has heard that and everyone always tells me they are the “smart money”

But are you really?

I mean, honestly. Are you really the smart money? Do you have a clearly defined edge in the market that sets you apart from other traders with a repeatable edge in the market.

Well, now your answer might change. And there is no shame in that. It is the same place 99% of traders are at – but you can actually do something about it.

Every day, the smart-money market makers are selling options to retail traders like you and taking their “sucker-bets”. You know, the bets that have extremely low odds of working out.

Sure the Apes over at Gamestop and AMC got lucky once, (those that actually took any gains they might have had) but I think that whole move was fuelled by easy liquidity and big institutions anyway.

Where are all these Reddit traders now? Probably back to work at Mcdonalds.

Jason Bond and I have been doing this for a very long time now.

I can tell you that I am not the “dumb money”.

I have learned how to identify what are the sucker bets and how to avoid them… or better yet, how to take those bets from the suckers!

The smart money is in the market day in and day out, selling options and making high-probability bets.

That’s what Wall Street Bookie is all about, trading like the house.

We are a force of nature when it comes to selling options.

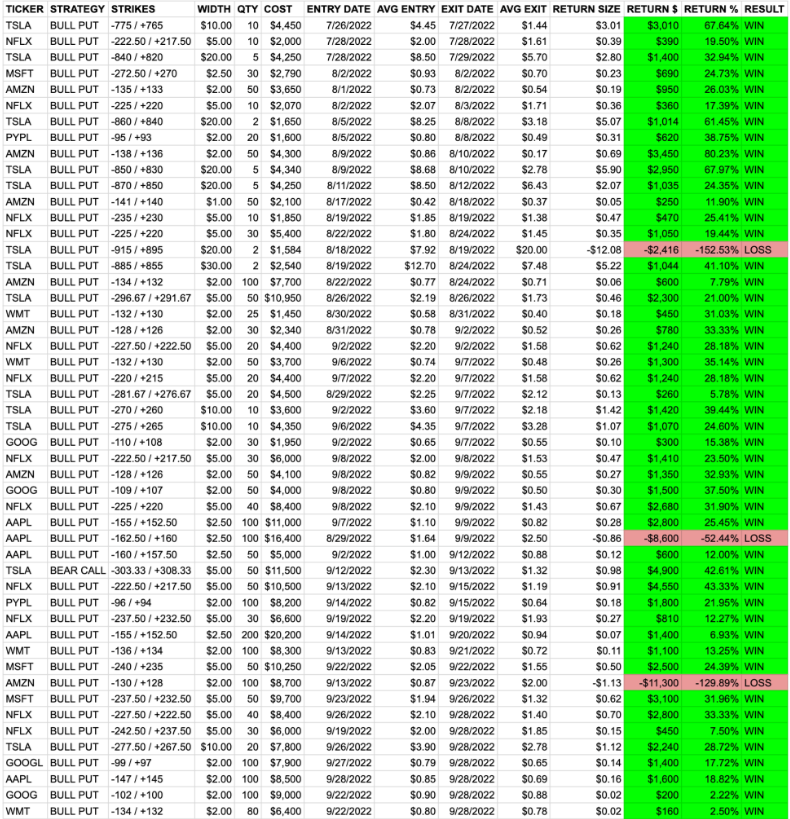

Jason re-started up this service in July this year. He then went on an insane run of trading, hitting wins on 47 of the first 50 trades.

There is never anything to hide here. You can look at his fully transparent trades right here:

When is the last time you went on a 47-for-50 run trading stocks?

I’ve recently decided to step in and join my very first student Jason Bond, to teach you my favorite options trading strategies.

The odds are just so stacked against you when it comes to buying stocks and options (especially options).

When it comes to selling options though… that is a whole different story.

Selling options and using “spreads” is a way of changing the risk profile of my trade Ideas. By doing this I can give up potential upside for higher probability trades. This is a strategy the pro’s that have been around for years use as base hits can be favorable to one-hit wonders like the Apes.

Here’s what I mean: A probability based trading strategy can change the odds of your trade ideas. Here’s what Wall Street Bookie can teach you:

- A simple decision can help improve your probability of winning option trades from 30-40% to 60-70%.

- A simple way to understand how “time decay” works with option contracts (and the specific “sweet spot” to target for expiration dates)

- One simple tweak Jason made to his options trading strategy that flipped the odds in his favor and helped him become more consistent

Why trading options the “normal way” is a losing strategy where the odds are already stacked against you (and what do instead)

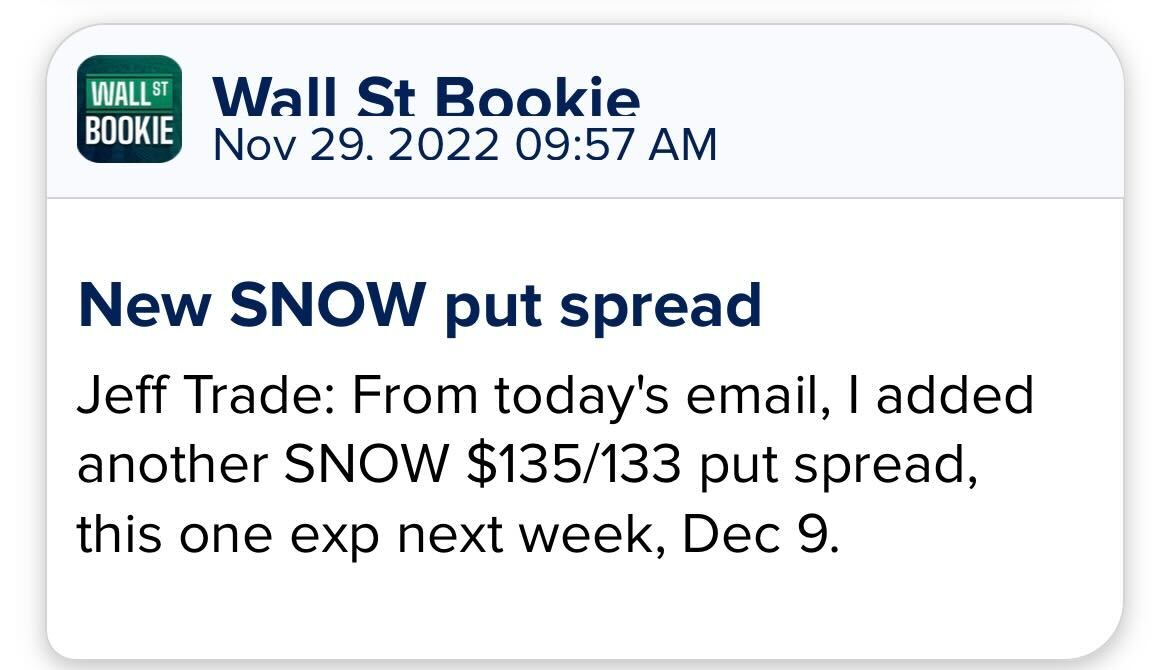

I just made my first trade on SNOW last week with Bookie members, and I just closed it out for over a 50% win.

Just like Bullseye, I am laying all of my trades out there to members before I even take them myself. I sent this out to Bookie members a few days ago after explaining the trade in detail in my morning email:

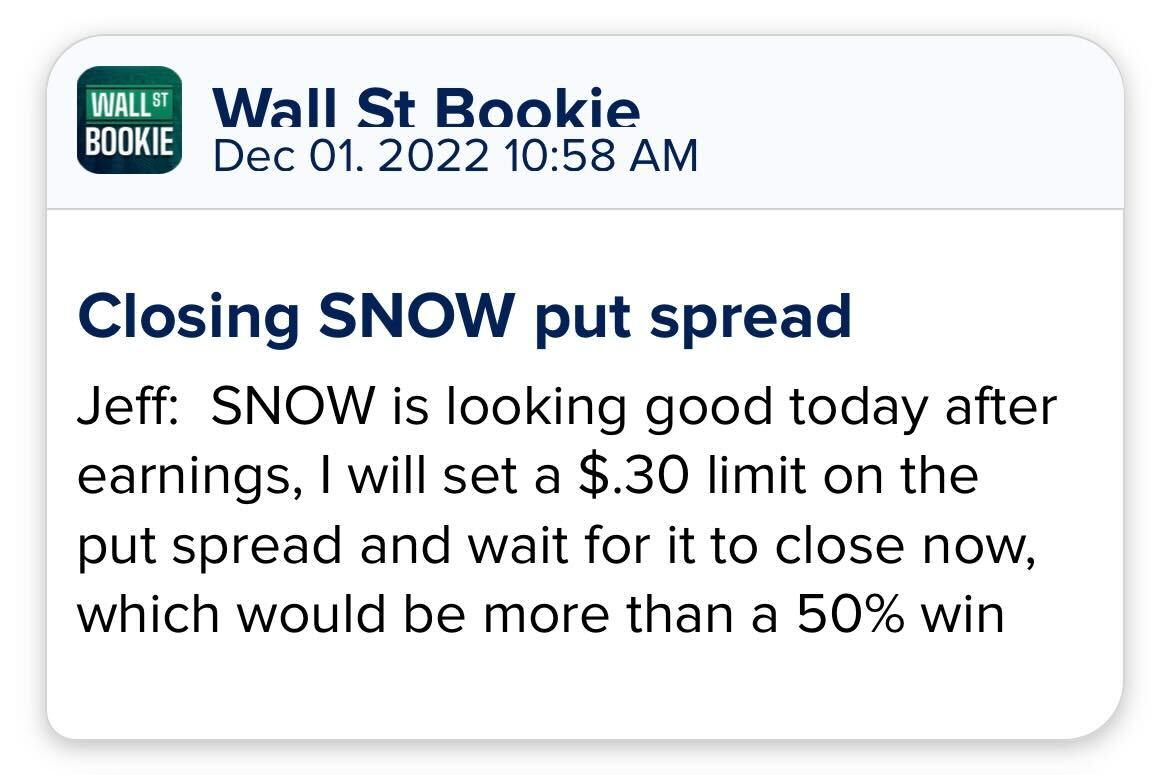

Then, today when the “sucker” lost the bet, I closed it out for more than a 50% profit – exactly as I planned and alerted members to in advance.

I am only getting warmed up and I want you on my side.

This is my favorite way to trade, as it completely changes the risk profile of my trade setup. I can’t wait to teach you all about it.

Due to such big demand, I have extended the double-discount offer for Bullseye members.

It won’t be around much longer at this founder’s pricing, so don’t delay.