Most beginner traders think you need to pick which stocks will go up or down to trade successfully. It is true that trading momentum can be a great trading strategy; stocks like TSLA or NFLX come to mind when they are in play.

However, stocks have a tendency to trend and then range, i.e. go sideways for a while. Contrary to popular belief, stocks do not always go up!

Today I would like to show you a strategy using options to trade based on a sideways market. I have put a few such trades on this week. It is known as the Iron Condor.

Market State: Trend or Range

Stocks can typically do one of two things: trend or range. When the market ranges sideways, momentum players can sometimes get frustrated or “chopped up” when stocks begin to consolidate. In these cases, their capital is not being put to good use because stocks are idle, going nowhere for a time.

Stocks need to consolidate to build energy for the next move, whether it be up or down. But there is a way to trade this consolidation, and that method is known as the Iron Condor Strategy. An iron condor is a delta-neutral options strategy that profits the most when the underlying asset does not move much.

Setting the Trade

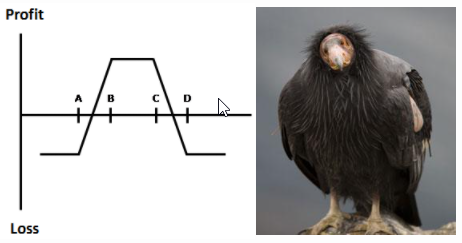

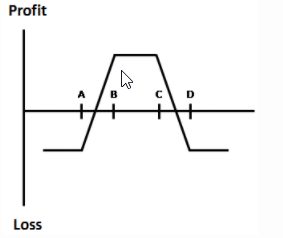

The Iron Condor is constructed using two short spreads. One is a bull put spread the other is a bear call spread. They are both credit spreads. These strategies get their name from the shape of the profit/loss graph, which vaguely resembles the shape of the big bird.

Said another way, I’m selling a bear call spread and selling a bull put spread. Both will be out-of-the-money.

Because I am selling both spreads, an iron condor is always a credit spread. As with all short option positions, the credit you bring in is the maximum opportunity on the trade. There are two break even points in an iron condor.

The upper breakeven is the strike of the short call (“C”) plus the net premium received. The lower breakeven is the strike of the short put (“B”) minus that same credit.

The sweet spot for an iron condor is between the two short strikes, “B” and “C”. And, again, that’s right where I want the underlying to be at expiration. Ideally, I want all four of the options to expire worthless.

Now, despite the complicated appearance of this trade, most brokerage accounts allow you to place this trade as a single order.

The iron condor is the combination of a short out-of-the-money vertical call spread (“C” and “D” in the above image) and a short out-of-the-money vertical put spread (“A” and “B”). So I would sell a call with strike C, buy a call with strike D, sell a put with strike B and buy a call with strike A. That is the Iron Condor.

Determining Risk/Reward

Now here’s how I determine risk, reward, and breakeven on an iron condor.

The trade reaches its maximum profit potential if the underlying is trading at any price between “B” and “C” (in the graph above). When this happens, the maximum reward is limited to the net premium received on the trade. If the underlying is trading below “A” or above “D” at expiration, i’ll suffer maximum loss, which is limited to the difference between “A” and “B” (or “C” and “D”), they are spaced evenly apart from each other, less the premium I received.

Break Even occurs at two different prices. “B” minus the credit received or “C” plus the credit.

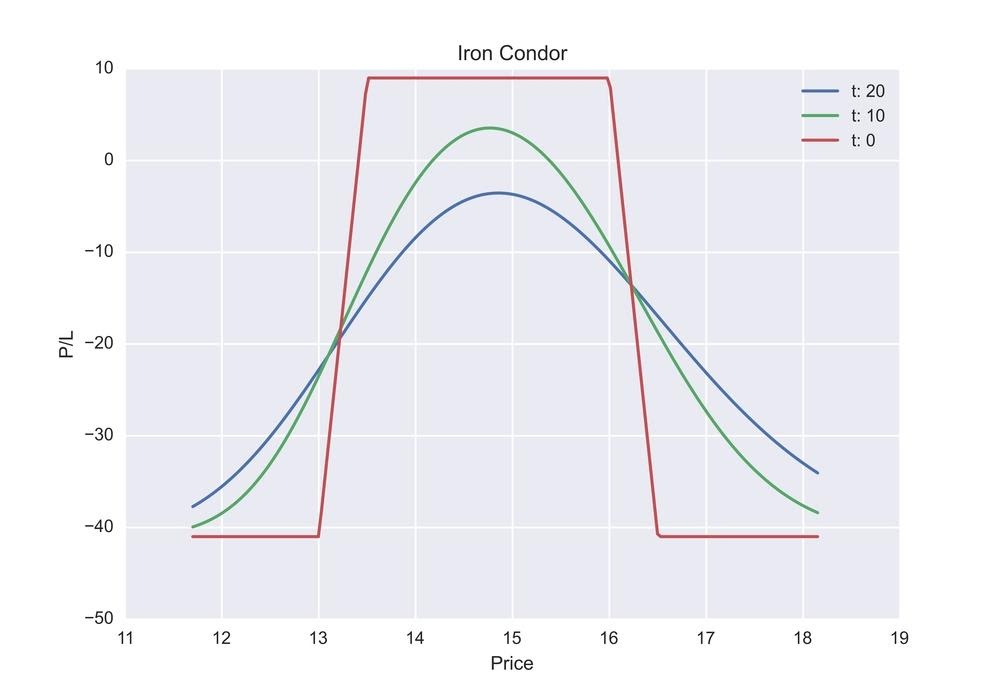

Just as with any short options position, I’m looking for the time value to decay the value of all four strikes in this trade. I’m also looking for implied volatility to shrink, especially if the underlying is trading between “B” and “C”. Essentially, I’m looking for all four options to expire worthless.

I’ve put on a couple of Iron Condor trades this week and look forward to reviewing those trades with you once they’ve played out.

Bottom Line

Markets go through periods of trending action and markets range. Different strategies should be applied to these different market states. During a ranging market an Iron Condor Options strategy can be implemented. The iron condor earns the maximum profit when the underlying asset closes between the middle strike prices at expiration. In other words, the goal is to profit from low volatility in the underlying asset. An iron condor is a delta-neutral options strategy that benefits the most when the underlying asset does not move much. I put on some Iron Condor trades in real time this week and will review those trades with you once they have played out.

Comments are closed.

3 Comments

Thank you

Thanks its good to learn before risk

I really appreciate your teaching in the topic of the iron condor. Thanks! I’m following your NFLX iron condor this week. Entered a paper trade in TOS. Very curious to see your response to the market in this trade.