The market selloff in January has been unforgiving, and yesterday post the Fed meeting was no exception.

Fed Chair Jerome Powell continued his Hawkish stance on Wednesday, with interest rates set to begin increasing in March. He also opened the door to more frequent, potentially larger hikes than expected. This caused a rapid turnaround in risk assets, which had been rallying into the meeting.

That wasn’t the only important news event yesterday. Tesla Inc (TSLA) also recorded its Q4 earnings, beating on the top and bottom line. But the beat, which was impressive, was not enough to overcome the risk environment we are in right now. TSLA was trading down just over 1% in pre-market this morning.

Given that TSLA has led this bull market over the last 2 years, what’s next in store for the electric car maker’s stock?

TSLA has been the barometer for the bull market. As TSLA continued higher and higher, destroying all short sellers in its path, so did the market as a whole, backed by some of the lowest and most prolonged monetary easings in history. However, with inflation no longer “transitory” and the Fed confirming its commitment to raising rates to hit its 2% long-term inflation target, the punch bowl that has fueled stocks and risk assets is being removed.

What does this mean for TSLA? Well, so far it has led to a 20%+ correction in the stock from its highs. What happens next will not only be important for TSLA shareholders but probably for every trader and investment firm in America, as we are very close to a line in the sand for long-term bulls and bears!

Fundamentals

Electric-vehicle maker Tesla Inc. set a record for profit but warned of supply chain problems in its Q4 corporate earnings report yesterday.

Tesla reported fourth-quarter revenue of $17.7 billion, up 65% year-over-year. The total beat a consensus estimate of $16.4 billion,

Tesla reported fourth-quarter earnings per share of $2.54, beating analyst estimates of $2.26 per share.

The company produced 305,840 vehicles in the fourth quarter, up 70% year-over-year. The majority (292,731) of the vehicles produced were the Tesla 3 and Tesla Y.

These were impressive beats and in a stronger market environment, could have sent TSLA roaring much higher. However, pre-market, it is down 1%. The market is in risk-off mode, and until that changes, it will be difficult for stocks to move higher if large funds continue to liquidate positions. Furthermore, TSLA is up over 800% since the Covid lows in March 2020. Despite beating all expectations for the last quarter, perhaps this growth is already priced in by the market, and it is now looking ahead to headwinds such as increased competition from traditional auto-makers.

Here are some comments from Elon Musk on yesterday’s conference call:

“2021 was a breakthrough year for Tesla and for electric vehicles in general,”

“After an exceptional year, we shift our focus to the future,” Musk said

Full Self-Driving: “Over time we think that full self-driving will become the most important source of profitability for Tesla,” he said, adding that if you run the numbers on robo-taxis it’s “nutty good” from a financial standpoint.

“I’m completely confident at this point that it will be achieved, and my personal guess is that we will achieve full self-driving this year.”

Vehicle Models: “The fundamental focus for Tesla this year is scaling output … both last year and this year, if we were to introduce new vehicles, our total vehicle output would decrease … so we will not be introducing new vehicle models this year … we will, however, do a lot of engineering and tooling to create those vehicles.”

Musk mentioned the Cybertruck, the Semi, and the Roadster models, which he said will be ready for production “hopefully next year.” Then he turned his focus to Tesla’s AI humanoid robot, Optimus.

AI Robot: “In terms of priority of products,” Musk called it the most important product development the company is working on this year.

“This, I think, has the potential to be more significant than the vehicle business over time … what happens if you don’t actually have a labor shortage? I’m not sure what an economy even means at that point. That’s what Optimus is about.”

The Tesla CEO said he expects the company to grow “comfortably above” 50% in 2022.

That all sounds very promising from the Lord of DogeCoin himself. If TSLA can deliver on this “guidance”, perhaps there is a lot more growth left in the TSLA story. However, I personally am a little bit more skeptical, at least in the near term.

Technicals

Looking at TSLA, I’m feeling bad for the eager bears after getting stomped on by the bulls.

TSLA plunged lower than the support level at $900, and the bears took this as a signal that TSLA was just going to continue heading lower with momentum to the downside.

But unfortunately for them, the bulls set a trap and used that as a place to step back in and move the market higher against them.

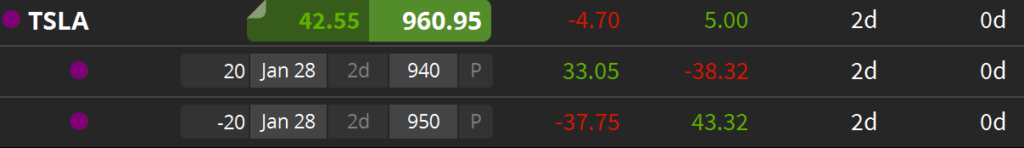

And now I’m thinking about riding this momentum as the bulls continue to push to the upside from here by using a credit put spread.

This was just a feeler trade I put on as a “Lotto” into TSLA earnings, it will be very interesting to see how TSLA reacts today to the Earnings Report once the market opens. It should be a very volatile couple of days! However, I will be watching TSLA on the bigger picture because there could be some significant moves depending on what happens longer term.

On the big picture daily chart, we see that TSLA has been consolidating between the $1200 highs and the $880 support area since October 2021. This range is very significant for what could happen next. The $880-$850 support level is a line in the sand for the bulls. If TSLA fails to hold this support area, I think it’s headed below $600 to the $550 level.

Personally, I think that is where TSLA is probably headed this year, below $600. I think it just has too much competition this year from legacy automakers that are going electric, and this will eat away at TSLA’s market share.

However, if TSLA were to hold the $880-$850 and Elon can finally complete “Full Self Driving” THIS year, as he has stated, there is no reason TSLA cannot continue to break $1200 and continue to make new highs. I am, however, skeptical of these claims, and given the current market environment, the top for this year could have already been made!

Comments are closed.

2 Comments

Sounds like a lot of uncertainty is to what is really going to happen going forward as you stated “IF” all these variables take place the stock will go up and if not the stock will go down. I think you make a very good analysis of all this.

Thank you

Look at output % of EV market. EVs are less than 15% of total market. If TSLA does 1.5mil cars and a truck 1200 easy. I’m playing at 900 for a profit. I will look at Nkla for cheap long shot.