Did you know that when you sell options you can receive upfront credits? That’s right, when you become an options seller, instead of putting down up-front like you would when buying stock or options, you receive a credit upfront!

If you haven’t heard about this before, ask yourself why? I think it might be because those Wall Street fat cats would rather be selling options to you, and prefer you not know about it!

When you sell an option, effectively, you become the house, like a dealer at the casino, receiving the bet from buyers before the trade plays out.

Now selling options outright is really risky, but by hedging this risk with a buy for a lower price, you can control your risk and still receive a credit.

This strategy is known as options spread trading, and is a way to tilt the odds and completely re-arrange the risk profile of your trade.

There’s a reason the “smart money” market makers sell options all day. Options contain Theta, a Greek letter that in trading stands for time value, and by being on the sell side, this is the extra premium you receive for selling options.

So which side do you want to be on? The smart-money? or the retail Apes shooting for the moon buying out-of-the-money options?

Selling options and hedging it through a spread has another effect. By giving up the right to “infinite potential,” which is very rare and hardly ever happens, I can increase my win rate significantly.

Think of it like selling insurance, once in a blue moon Warren Buffet will have to pay out for a hurricane, but most of the time he’s counting premium!

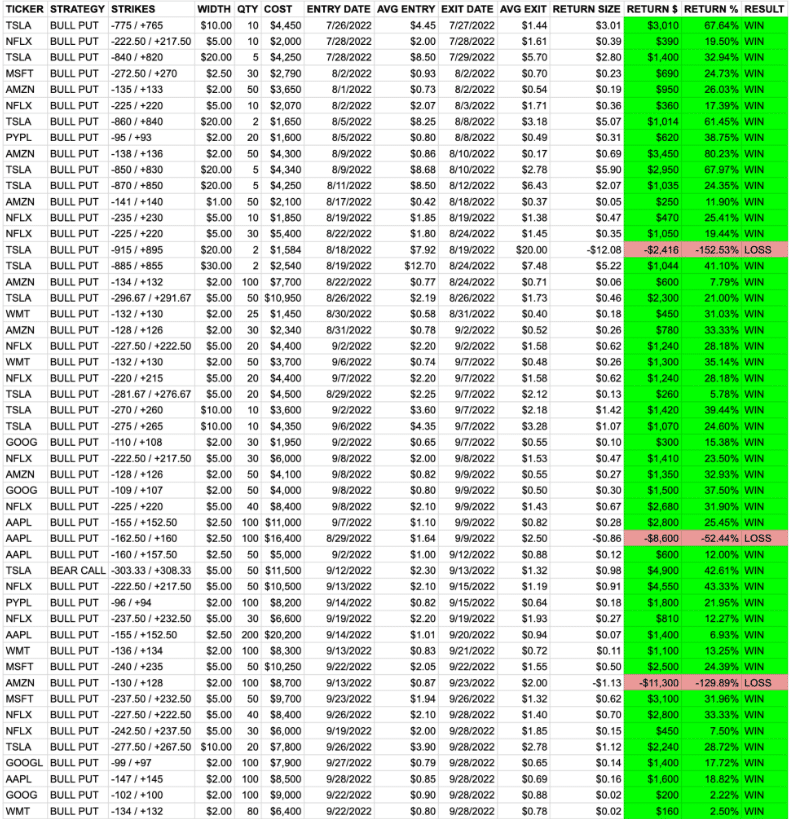

Just check out what my partner Jason Bond has been up to since he launched Wall Street Bookie, a service focused exclusively on selling options and trading spreads:

He went on an insane run of trading, hitting wins on 47 of the first 50 trades

There is never anything to hide here. You can look at his fully transparent trades right here:

When is the last time you went on a 47-for-50 run trading stocks?

I’ve since partnered up with him because when I see someone doing well, I want to get involved too! So we’re giving our best spread tread ideas every single day to Wall Street Bookie subscribers.

This is my favorite way to trade, I don’t know about you, but I just like winning more often than I lose. I don’t need the adrenaline (and stress) of those swing for the fences types of trades.

If this sounds a bit confusing, it’s okay, we were all newbies once. We’ve got a bunch of videos archived teaching you all about spread trading so that you can become an expert over time. And every day, Jason and I will break down our best spread trade Ideas!

Right now, we have a limited time 60% discounted offer – only our existing members

I would love to teach you these types of strategies week after week – and believe it or not, it really isn’t that hard to learn!

If you like my Bullseye programs you will absolutely love taking your learning to the next level with Wall Street Bookie.