It’s been rough sailing the last couple of weeks in the market. With high inflation and higher interest rates, the past couple of months has been a disaster for a lot of investors and traders.

Understanding the market environment, I’ve taken a step back and avoided a lot of the carnage. But now, for the first time in weeks, I’m seeing some signs of life in the market, and have taken a bullish position in the QQQ’s. The Professor agrees, and after being bearish with some great ideas that you can read about here, he’s got some new Bullish Ideas of his own!

To get access to daily updates, education, and changes to my portfolio, become a part of the Total Alpha team Today!

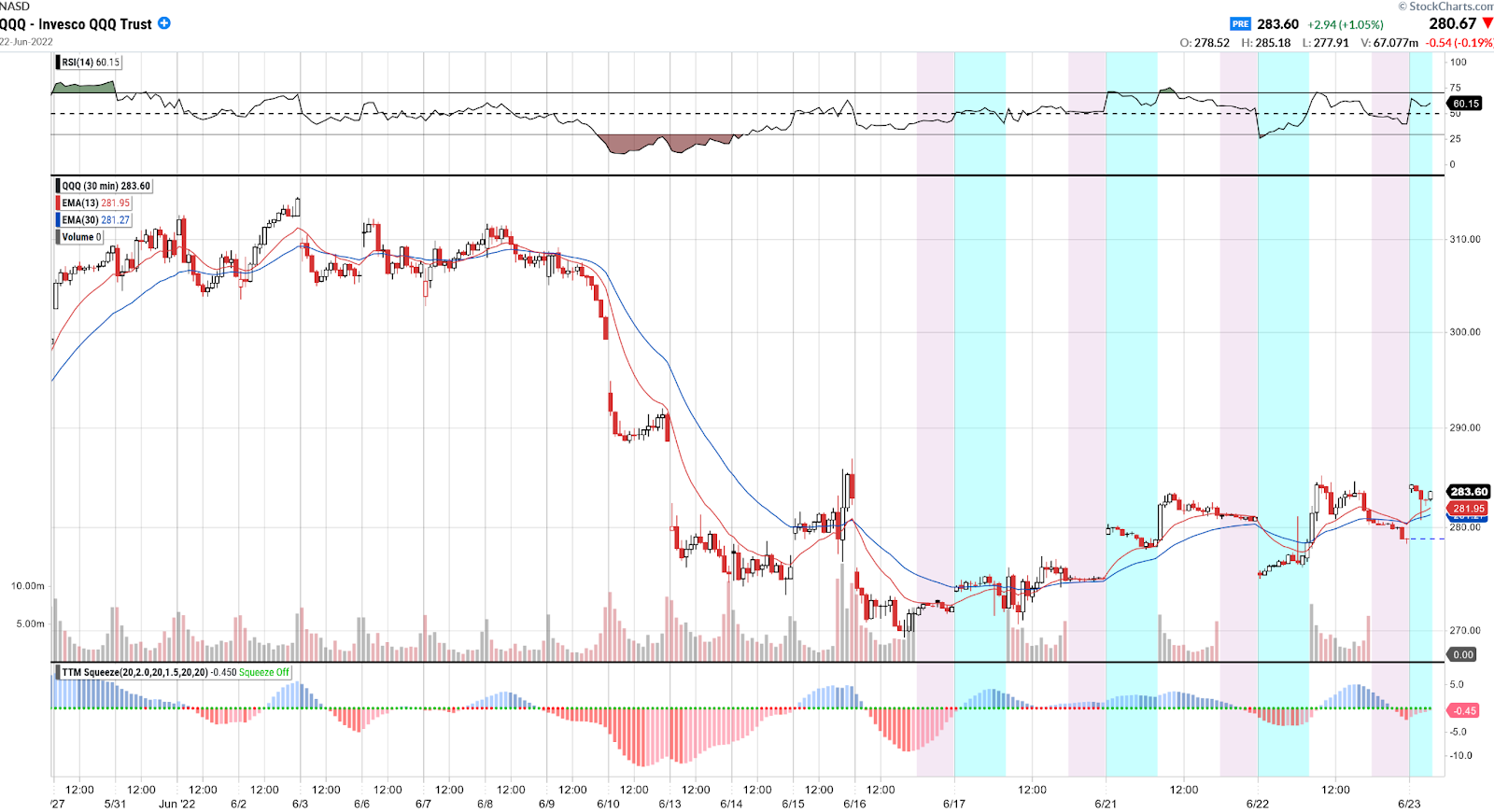

I think the market is done going down in the short-term. It’s not strong by any means, that is not yet, but I think it holds here at the very least. If it does show significant strength, I’m ready to start taking some positions in my favorite stocks. But for now, I’m going to sell a put spread, betting that the market holds up here in the short term:

Subscribers to Total Alpha have access to Live Educations sessions daily and access to my REAL-MONEY portfolio as I navigate these tough markets! Don’t miss my next trade, subscribe NOW!

Here’s my thought process:

QQQ

What to watch for:

- Keep an eye out for the 13/30 hourly moving averages to act as momentum to the upside for the bulls to trade against

- This could be a short-term bottom for the QQQ with buyers trying to find a place to rally the market to after the sell off last week

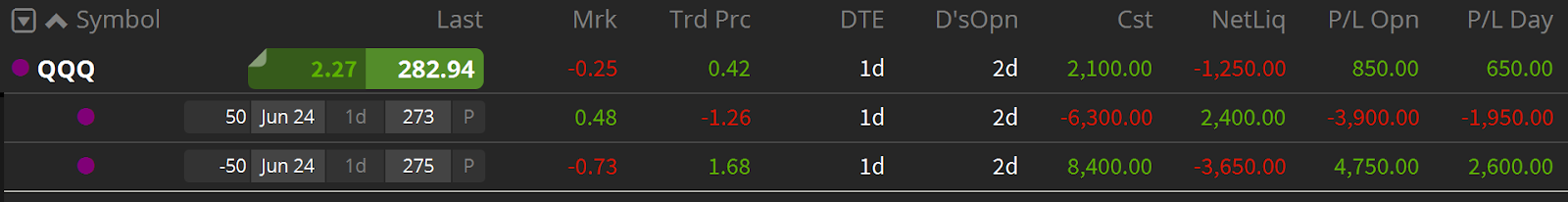

Here’s How I’m trading it:

On Monday, Live in the Master’s club I sold a put spread:

It was very short-term, I sold the 275 puts and bought the 273 puts at $0.45. The QQQ’s were trading around 280 at the time. Basically, I’m risking $1.55 ($2 risk-$0.45 sold) to make 0.45c but in my mind, the odds of this trade working are very high.

As I write this, the QQQ’s closed at $284.85 with the market gapping up pre-market, providing nothing crazy happens today to the downside, this should work out to be a nice trade for me.

To get access to daily updates, education, and changes to my portfolio, become a part of the Total Alpha team Today!

The Professor Also has some Bullish trade Ideas. He nailed some terrific short calls but is seeing some nice bullish trades setting up here. Here’s what he sent out to subscribers on Tuesday!

CSCO

CSCO is holding above the 200 moving average with the buyers looking to hold this level for a move to the upside.

I want to watch the TTM Squeeze momentum histogram for continued buying pressure.

Right now the OBV is showing positive momentum and buying pressure, indicating that the underlying volume is still bullish in this name.

AFL

AFL is holding above major moving averages but still below the 200 moving average.

The TTM Squeeze and Momentum histogram is showing bullish buying momentum to the upside.

The OBV is showing bullish buying pressure as bulls look to run back towards the 200 moving average

MET

MET is showing a similar trend, with the TTM momentum showing positive buying pressure at this time.

With the move higher, the OBV is confirming the buying pressure seen now as the stock moves higher.

PEP

PEP is showing a run to the upside today as traders breakout from the consolidation range at the bottom under the moving averages.

As buyers push for a run towards the next moving average, the TTM Momentum indicator is suggesting buyers are in control here.

The OBV is also suggesting buyers are in control here as the plot makes a new high on the chart.

To get these trade Ideas as soon The Professor comes up with them, subscribe to Total Alpha now!

If You’re struggling with your trading, become a part of the Total Alpha community, and receive the education you need! CLICK HERE NOW TO SUBSCRIBE!

There’s a 30-day satisfaction guarantee, so if you’re not happy, no worries, but I think you’ll love what we’re doing at Total Alpha! Click HERE to Subscribe!