I just wrapped up a live training session on some of my favorite option selling strategies and also some new ideas I am ready to pounce on soon (I will have the recording available for you soon).

I know a lot of people tune out when I talk about “selling options,” but you should really pay attention. It is the single best thing I think traders can learn that will give them an edge in the market.

Trading is tough enough as it is. You need to build strategies that give you a built-in advantage.

Like I always say, rookies buy options… the pros sell them.

I also hear from people that selling options is “too boring.”

First of all, if you are trading to find “excitement,” I would strongly suggest finding a new hobby. Go to Vegas or something and get that out of your system.

Traders should have one goal and only one goal – to make as much money as possible. 💰

If this isn’t why you trade, then what are you really doing?

By the way, my partner, Jason Bond, has started a new small account journey where is taking a small $2000 account and trying to grow it as big as he can by selling options.

So far, he has doubled his $2000 investment in just 3 trades.

If you want to learn more about what Jason is doing, you need to check out his LIVE SESSION @ 8pm EST tonight in his

👉 Lightning Alerts trading room 👈

Simply put, making money is my goal in trading.

This is why I want to take advantage of anything the market will give me that can help with an edge.

While I am a decent stock picker, that is a really tough thing to do consistently over a long period of time.

What is a lot easier for me is simply to identify a level that a stock will likely trade above.

If I can simply do that, I can use my option-selling strategy to make money on it.

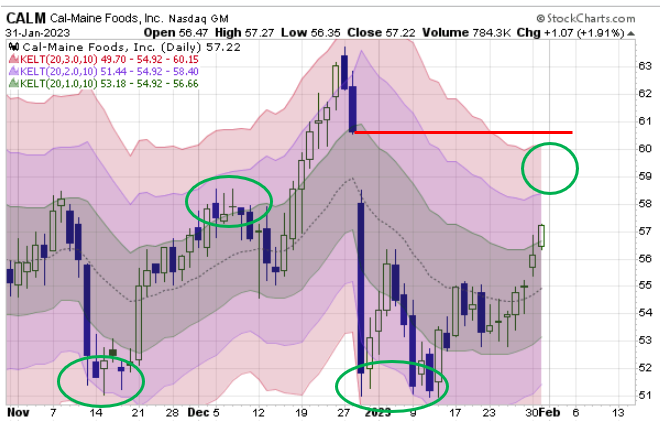

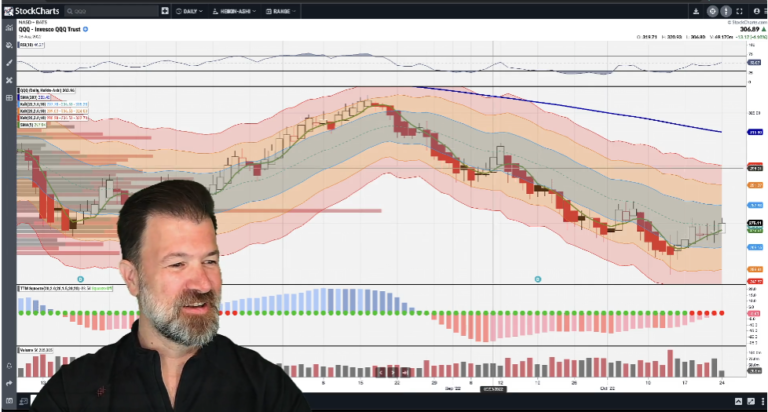

Here is a great example I recently used this on for a stock that I really like a lot – SMCI.

SMCI has been a very hot stock, and the pullback gave me a great opportunity to pick a level that I thought it would hold above, in this case, $70.

So, what I did was very simple. I sold options near that level every time it got close to $70 last month.

You can see it visually in the chart below:

Here is exactly how I set this trade up, twice actually – a perfect “double dip!”

Step 1. Identify a stock in a strong uptrend. Wait for a pullback and several days of “basing.” This is where the stock doesn’t make a new low, it just “treads water” for a while.

Step 2. Identify the support level. This is basically any level you think the stock will hold above. The higher the price, the more you will collect as an option seller.

Step 3. Execute the trade. In this case I want to sell a put spread (or vertical, as some people call it). A spread trade is when you make 2 option trades on contracts for the same stock, for the same expiration date, at different strike prices. You simply sell the more expensive option, and buy the cheaper one.

If this is a new concept to you, don’t worry at all. I am great at teaching this to people.

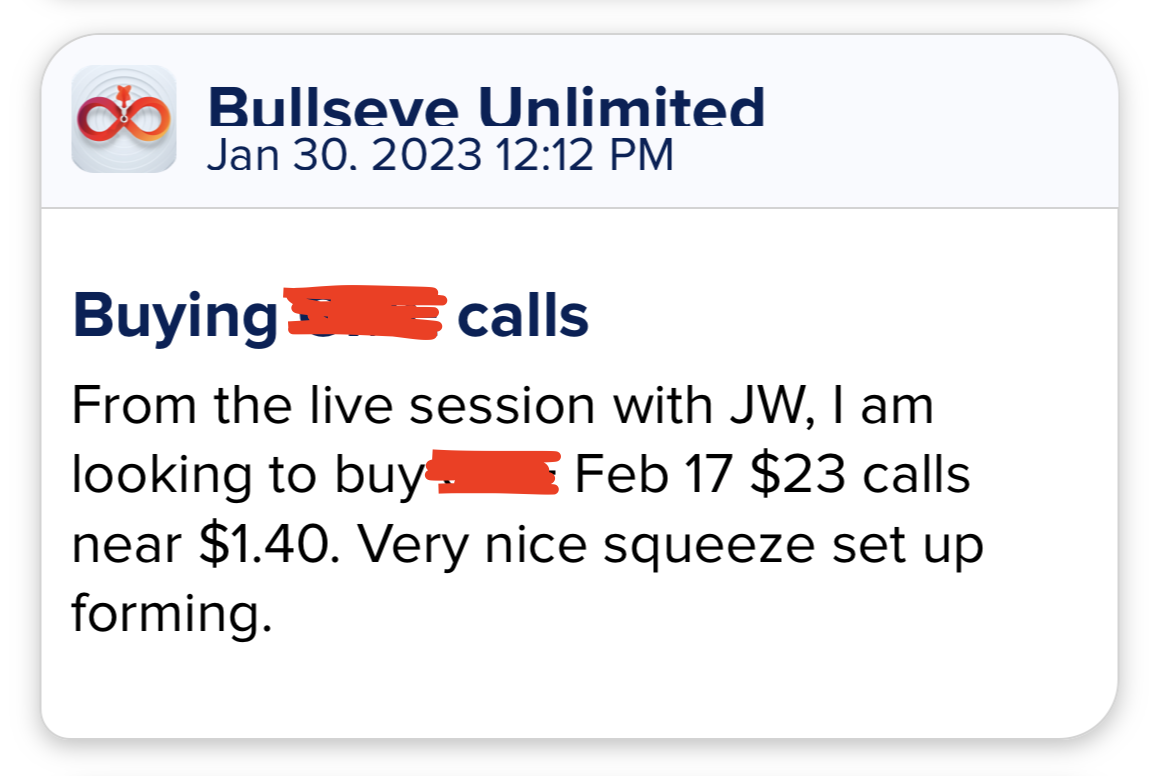

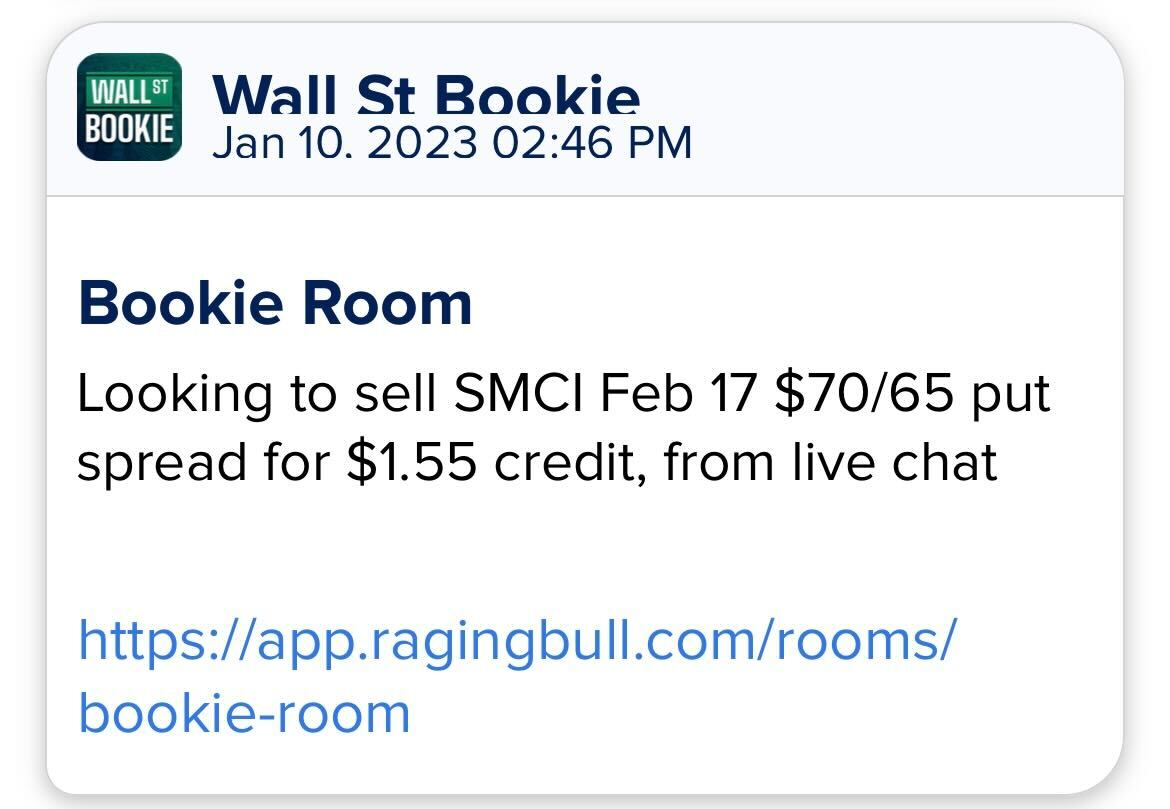

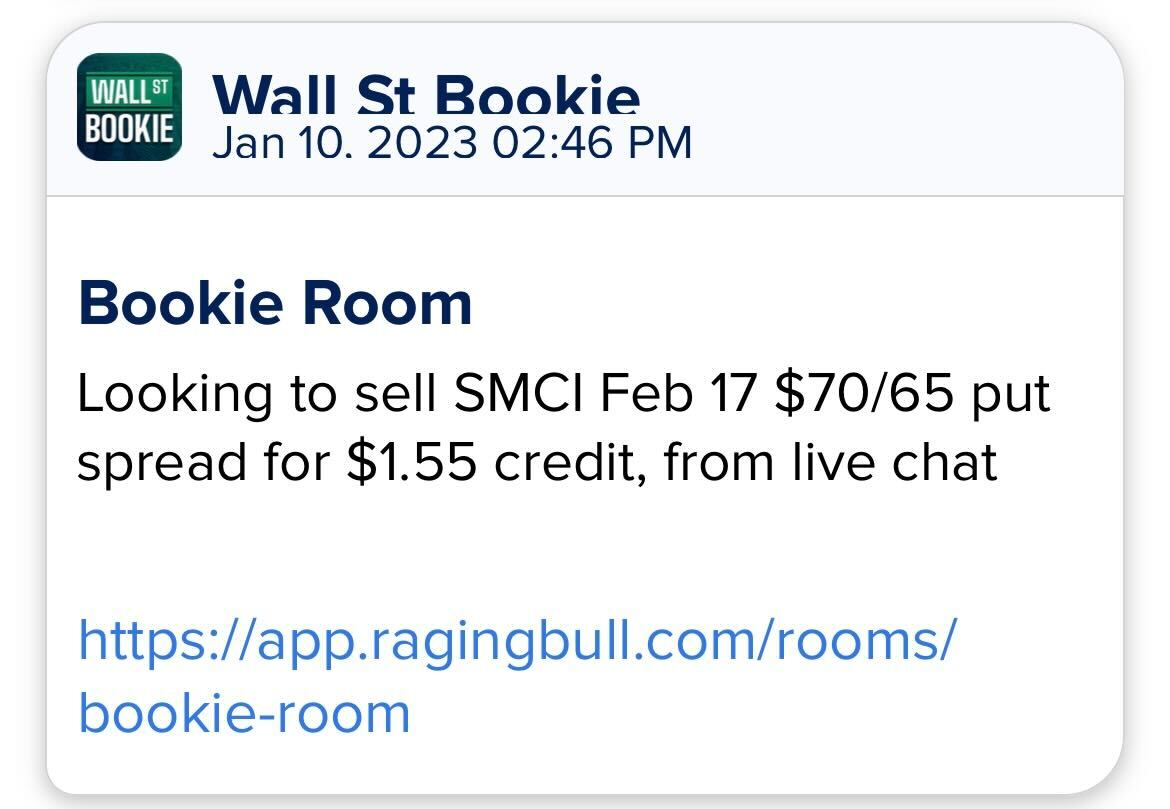

When I set up trade #1 in the chart above, I also sent out to my Wall Street Bookie members notifications all along the way.

When I started it…

Then a few days later, when I closed it…

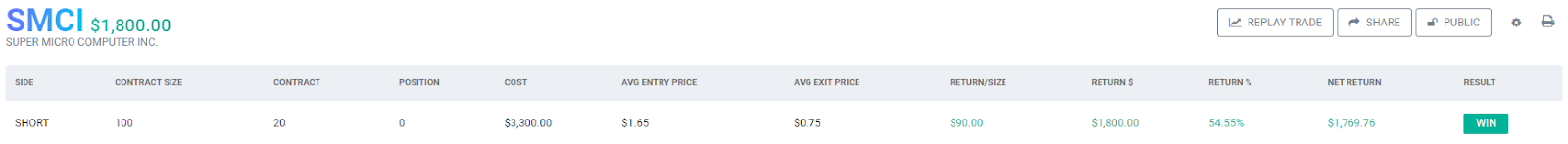

At the end of the day, I sold around $2400 worth of options to someone else… and then a few days later I paid them back, and kept the difference of $1275 as my profit.

And “Bookie” members saw this every step of the way. In fact, I even walked them through this entire process in the live training session before I made it (I recorded it if you want to watch it yourself).

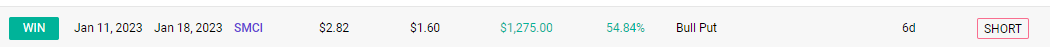

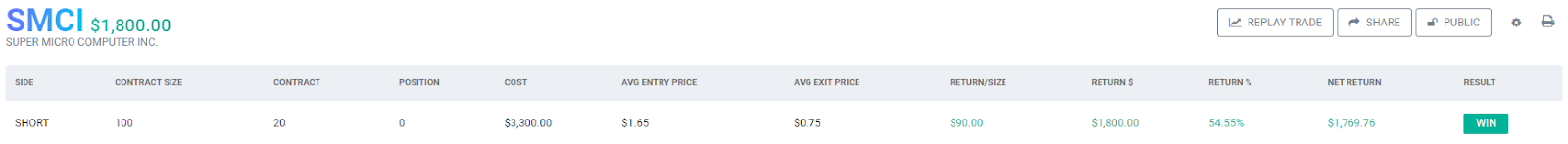

(actual trade result from my real-money trading journal)

Then, the very next day, SMCI stock price had a big drop, which I saw as another gift for an entry, so I set up the exact same trade as the one I just closed out but at a much better price!

So, of course, I talked about it in my daily email.

And then I told members my exact plans before I executed any trades…

Then, I have daily updates in my daily email communication with members. This is an unprecedented level of transparency when it comes to trading.

Members see every single trade discussed and my precise plans from start to finish – you just can’t find a better way to learn than that!

This trade took a while, almost exactly 2 weeks from when I started it, but when the price I wanted to close it at happened – I was filled automatically.

I wasn’t sitting around watching this tick by tick. I set up my order as soon as I started it, and waited for time to do its trick.

When the order was closed, I then sent everyone my alert, signaling what happened.

In this case, I sold someone $3300 worth of options, and then 2 weeks later, I repaid them (at a much lower cost) and kept the $1800 difference as my profit, as you can see in the screenshot from my trading journal:

If there is a better strategy out there for busy people who are looking for a way to trade with limited risk and a much higher probability of winning than simply buying calls, this is the ticket.

Now, I will warn you – this service isn’t for everyone.

I am only looking to work with people who are dedicated to learning and are ready to do things differently when it comes to trading.

If you are ready to level up your trading and put my cornerstone trading strategy to work, then this is your opportunity to work directly with me on this.

I pour my heart and soul into teaching this and showing members all of my actual trades (both good and bad) when it comes to putting this to work.

You will get my explicit game plan on how I am going to trade these ideas and then you will get to follow along from start to finish as I trade them.

Don’t let the funny name fool you – Wall Street Bookie is all business.

I am deadly serious when it comes to trading, and I am looking to make as much money as possible doing so.

This doesn’t mean that every trade works out perfectly, but it means that I come prepared with my best game plan on how I want to trade (along with my stop loss) on the best idea I have, every single time.

If you want to join me, then you have the opportunity to join at over a 60% discount right now.

I am committed to working and equipping a small number of traders to have their best year ever.

If you want to join Jason Bond and me on this journey, then now is the time to get started.

By the way, if you have any questions about “Bookie” call my personal VIP concierge, Jeff Brown @ 800-585-4488 or (jbrown@ragingbull.com) and he would be happy to talk about any special offers, payment plans, and help you in any way possible.

There are a lot of things that you can put off until tomorrow. Joining Bookie is going to be a game-changer for you, so don’t delay.