Yesterday the overall market, SPDR S&P 500 ETF (SPY), was up 0.25% on the day, while the Health Care Select Sector SPDR Fund (XLV) was down 0.99%. The IBB ETF was down 2.99%. Health care and biotech stocks were the weakest industries yesterday, led lower, predominantly, by a few stocks.

MRNA continued its pullback, coming off a further 15.64% and now 22.55% off the 52w high. BNTX was down 13.76% yesterday and off 22.59% from its 52w high. PFE pulled back 3.9% yesterday and now finds itself down 4.65% from the high it put in two days ago.

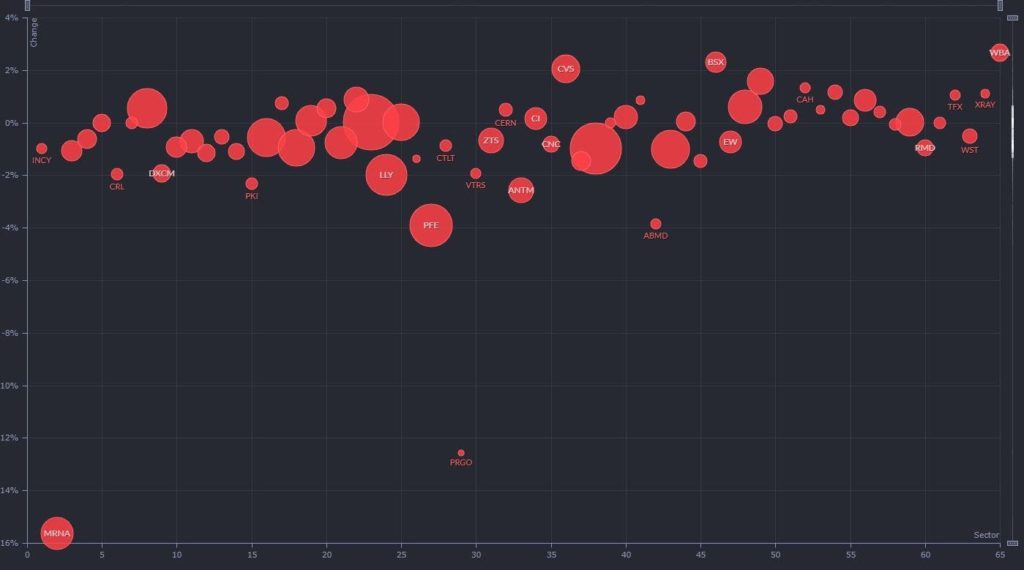

In the above map, from Finviz, it is clear that while the overall market was mainly green, stocks in the healthcare and drug manufacturers sector were relatively weak.

With this bubble chart from Finviz, it is more apparent that most large-cap health care stocks were negative on the day. Weakness in large-cap healthcare stocks like PFE, LLY, DXCM, PRGO, ANTM, and UNH dragged the entire sector lower. MRNA was by far the weakest S&P 500 healthcare stock, for the second day in a row, with the stock being down 15.64%.

With the relative weakness in popular healthcare stocks, I want to go over crucial support levels in a few names to prepare for a possible bounce trade.

First off, let’s take a look at the biotech ETF: IBB

The IBB was down 2.99% yesterday and got below a crucial support at $170. As the IBB trades below $170, it will be essential that the ETF does not get below $165 because this level acted as support when the stock broke out. I do not want to see $165 support turn into resistance. Ideally, the stock bases over $165 and digests the move seen in the ETF, and regains $170.

Support Levels in BNTX:

BNTX has come off sharply since topping out two days ago. The stock is now 22.59% off the high and was down 13.76% yesterday. Now that the much-needed pullback has taken place, I will be focusing on critical areas being met with buying and looking for a potential bounce trade to form.

Immediate levels of support will come from yesterday.

The low yesterday was $336.20, which is now the short-term key level of support. With the stock gapping up and trading at $375 in early pre-market, I would not like to see the stock trend lower and hold below yesterday’s low. IF BNTX fades off the open and makes a higher low above yesterday’s low, I might get long against the low of the day to watch for the bounce trade. This stock has a massive range, and therefore the resistance and support are far from one another. Resistance is $400, and support is the $336 area.

Support Levels in PFE:

PFE, which was down 3.90% yesterday, has significant support close by. The stock has experienced a stellar month so far, up 16.80%, even after it pulled back almost four percent yesterday.

The support closest by is $46. The primary support levels that I am most interested in watching price action are $45 and $44. Both of these levels were previous levels of resistance which turned into support.

Support Levels in MRNA:

MRNA has experienced a rapid and explosive pullback lately. However, even with a sharp pullback, the stock remains up 63.87% on the month and 268.84% year to date.

Going forward, I will be keeping a close eye on the $350 area, which is where the 20d SMA is. If the stock fades further today, I will want to see this area turn into support. This area is also a significant breakout area that was previously resistance.

Near-term support levels are yesterday’s low of $372 and resistance from yesterday of $390. These two key areas will act as immediate support for today’s action. If the price can consolidate firmly over $390, as it is currently doing in the pre-market, then a push higher over $400 could be on the cards.

However, if the price cannot hold above $390, then a move towards yesterday’s low of $372 will need to be met with buyers to stabilize and attempt to push higher. A higher low above $372 would signal a potential bottom, and I might look to get long against the low.