Gang, I’m feeling ready, excited, and pumped to take on 2022 and make it a year to remember.

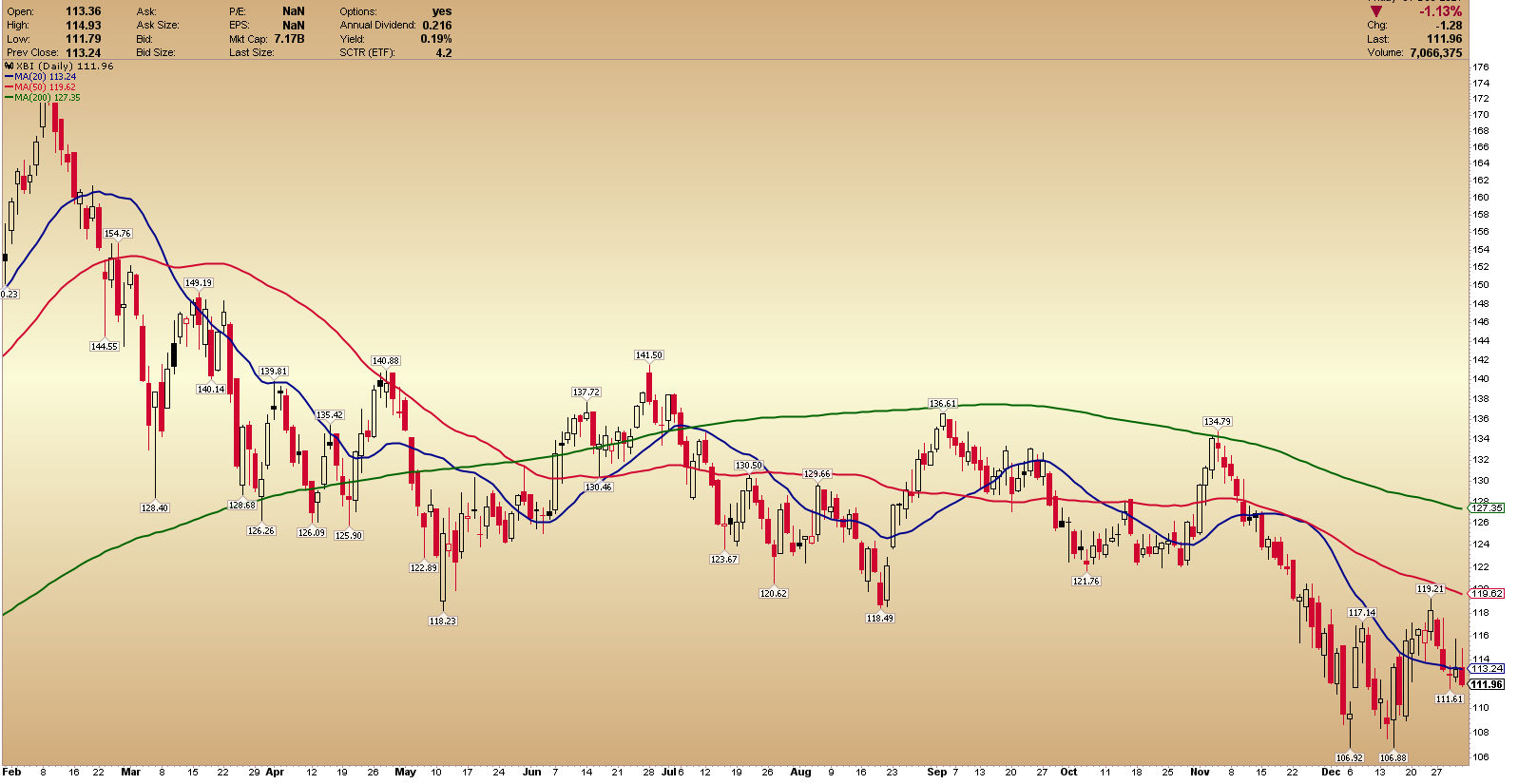

Before I get into a specific biotech idea and share my thoughts, let’s take a quick look back at 2021 for the XBI.

The XBI closed the year out, finishing down 1.13% on the day.

Unfortunately for the biotech bulls, the yearly performance was far worse than the year’s final day.

The XBI closed the year down 20.47% and 35.95% off the 52W high.

Overall, I am happy to see the year close for the XBI and a new year to now begin!

The XBI has now developed key support around the $110 area in the short term. Going forward, I would like to see the price continue to base firmly over this area and confirm a higher low.

After that I would ideally like to see the XBI attempt to reclaim and hold above resistance, around $118 – $120.

A bullish and firm XBI in 2022 could undoubtedly lead to further opportunities on the long side for small-cap biotech stocks. However, even in the current state, I see many potential setups and opportunities.

I am currently seeing one such opportunity in ETON, which I have also shared with my members.

ETON Pharmaceuticals (ETON)

ETON, according to Yahoo, is a specialty pharmaceutical company that focuses on developing and commercializing pharmaceutical products for rare diseases.

Recently, ETON had a positive news release. On December 20th, 2021, ETON and ANI Pharmaceuticals announced the commercial availability of Carglumic Acid Tablets. This was the first and only FDA-approved generic version of Carbaglu (carglumic acid).

Even with the positive catalyst, however, the stock could not break out of the consolidation.

Since making a low of $3.54 in early December, the stock has made a series of consecutive higher lows and higher highs. The stock has also held firmly over the 20MA, currently at $4.08.

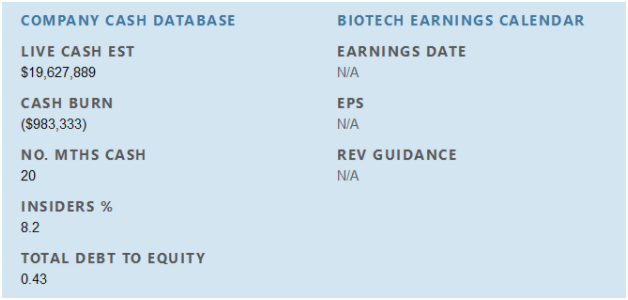

Here is a company snapshot for ETON, which shows some helpful information about the company’s live cash, cash burn, and insider %.

Source: ETON Biopharmcatalyst.com

It’s also important to note that the stock has an important upcoming catalyst: New PDUFA target action date of January 29, 2022. Zonisamide oral suspernsion – (ET-104) Epilepsy.

My plan with ETON is pretty straightforward at this point, gang.

As long as the stock continues to base over the $4.10 and put in a higher low, I will continue to watch it and look for a possible entry.

My stop area would be in the area of $3.75.

I would be targeting $5 – $5.80.

$5 is a key area of previous interest, high trading volume, and a significant gap level. $5.80 is the high end of my target and represents the 200d MA.

I am looking for the overall volume to increase in the name and the stock to break out of the current consolidation.

If the stock can break out over the short-term resistance, around $4.40, and trade with higher volume than usual, my confidence will grow in this setup.

The Bottom Line

I like the setup and potential for the upcoming catalyst to create some hype in the name for a short-term trade.

In terms of the bigger picture, It appears to me that ETON is well-positioned to make a bang within the sector and industry, especially with the recent news, which reads well. However, in my opinion, it might be too soon to call this stock the next TSLA of the biotech space. Only time will tell!

1 Comments

When dual potential (both long and short term) such as this presents itself, my plan includes buing a portion to swing, and a portion to hold for the longer term.