When one thinks of the world’s greatest investors, names like Buffett, Munger, Tudor Jones, and Soros pop up.

However, there might be a new shooter in town.

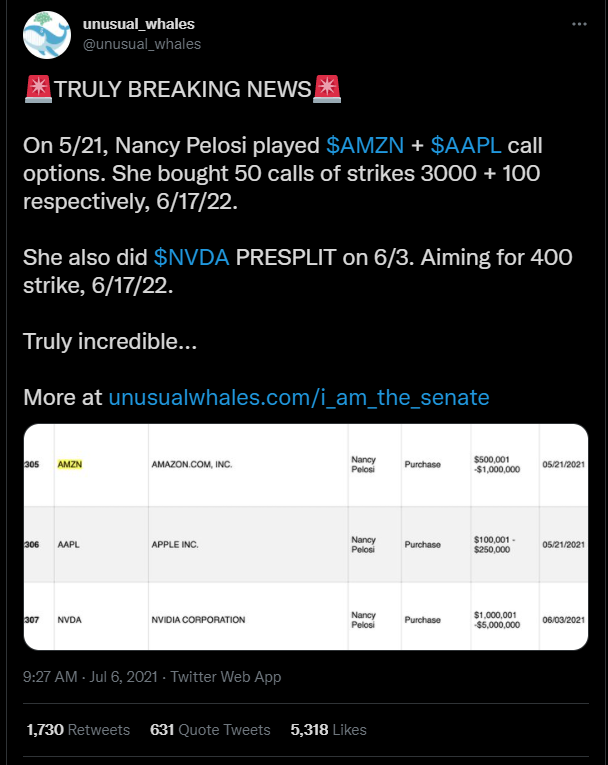

Great timing or was she tipped off?

Either way, there are a few tools available that allow everyday traders a chance to see useful information that can help them find good setups.

We’ll share that with you along with the latest big bets we’re seeing the options market now.

How To Track Big Bets In The Options Market

Every option trade which takes place in the public markets must be reported.

For example, the second a well-informed trader makes a big options bet, the information becomes readily available.

Several trading platforms make it available to their customers. And there are also scanners that you can purchase that give you the info in real-time.

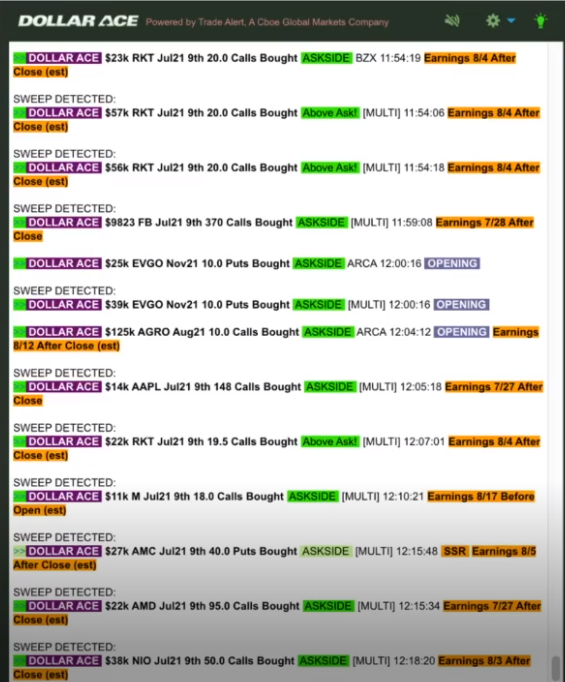

We’ve developed one called the Dollar Ace Scanner, highlighting large and unusual option orders on cheap OTM options. Dollar Ace subscribers receive live streaming access to it as part of their membership.

How It Works

The idea is pretty straightforward. Institutional and professional traders have access to the best research and tools available.

In most cases, buying OTM options can be a sucker bet. That’s why it’s so exciting to see dead in the water option trades fire off.

Does the person or group behind these trades know something we don’t?

Now, we won’t get all Joe Rogan on you, and start firing off conspiracies.

But the truth is, there is real money behind these trades, and it’s worth paying attention to.

Here are some of the things we’re watching and why:

- Near-term option bets. At expiration an option will either close in-the-money or expire worthless. That means if someone is buying something near-term, they need to see action right away.

- OTM bets. OTM bets have a significant hurdle to overcome—time decay. That’s why it’s jaw-dropping to see someone slam into a six-figure options trade which has time working against them.

- Above average options volume. On an average day Apple (AAPL) will trade 1.2m options. Unusual options volume is regarded as anything 3X above or higher.

- Aggressive buyers. There is always a bid and ask price on an options contract. However, we like to find aggressive buyers who hit the ask price or even trade above it to get a fill.

- Repeat buyers. One large trade in a single option strike is nice. But seeing several across different strike prices and expirations is even better.

What Options Buyers Are Getting Into This Week

- SBGI : 80X usual options volume. A trader came in and bought 8800 Aug21 $35 calls for $0.75

- RKT: 2978 July 9th $20 calls lifted for $0.19

- AGRO: 4.5X usual options volume. 2500 ARGO Aug21 $10 calls slammed into for $0.50

Bottom Line

Nancy Pelosi is one heck of an options trader. Some folks will be angry to hear about her recent transactions. However, savvy traders are watching the options market for unusual activity. While we never know who is behind these trades, we know there is real money behind them. And that alone is worth watching.

Comments are closed.

1 Comments

I am amazed by your analysis, I would like to know your opinion on the best entry / exit in the charts.

thank you.