Lately, I have been pounding the table on the biotech sector. Recently, I wrote about the breakout in the IBB.

I mentioned that the next target in the IBB was the high of $174.04. Well, yesterday, the IBB made a new high and closed at $174.85. I see incredible momentum and strength in the sector.

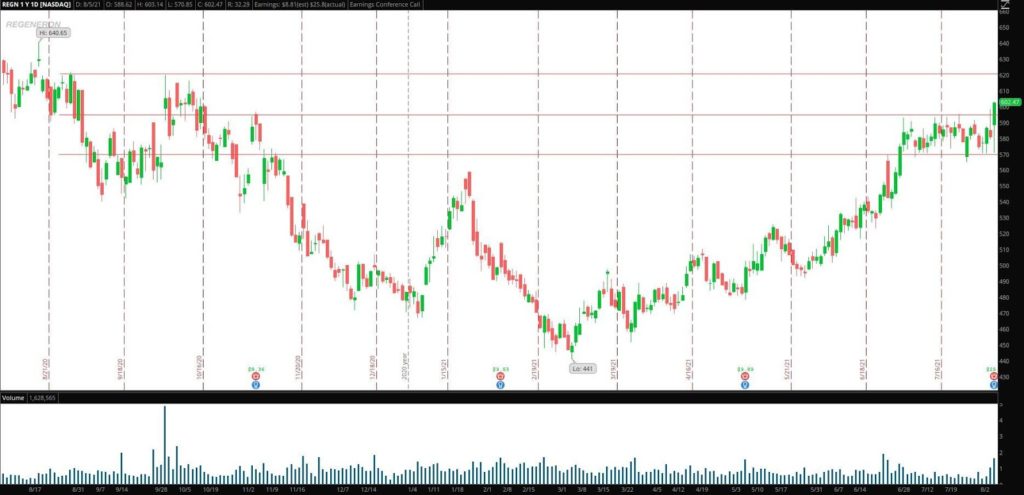

In the same article, I also mentioned that if REGN could hold above resistance at $595 – $600, It could experience sharp momentum to the upside. Yesterday that happened.

Before I take a closer look at REGN, I want to recap the IBB action swiftly.

Since breaking out of the consolidation, the ETF has shown no signs of slowing down. I love how this move has played out so far. After the IBB broke out above $165, it spent a few days consolidating above previous resistance, turning it into support. This action is a sign of a sustained move higher. IBB then broke out of the multi-day consolidation and has experienced three trend days higher, resulting in a new high of $174.85.

Yesterday, the IBB was up 1.57%. On the month it is impressively up 8.31%. Year to date, the ETF is up 27.37%.

I believe it is essential to always look into this ETF when covering an individual biotech name. Not only does REGN have a weighting of 4.12% in the ETF, but identifying the overall trend of the sector will tell me whether an individual stock is showing relative strength or weakness relative to the overall sector.

For the breakout in the IBB to be sustained and ultimately have momentum higher in the short term, I believe it will be necessary for the sector to digest the current strength. This could mean that the ETF will need to base above previous resistance for a week or longer before continuing to push higher. $170 is now key support, as well as the prior high of $174. Those are two critical levels to keep an eye on.

Regeneron Pharmaceuticals (NASD: REGN)

REGN, per Yahoo, discovers, invents, develops, manufactures, and commercializes medicines for treating various medical conditions worldwide.

The company has experienced annual sales growth over the last five years of 15.70%. Earnings per share in the previous five years have grown by 40.80%.

Year to date, the stock is up 24.71% and 20.81% on the quarter.

REGN has an average target price set by analysts of $632.91, which is considerably higher than where the stock closed yesterday ($602.47).

Market Cap: 65.13B

Float: 101.58m

Average Volume: 754k

Short Interest: 1.81%

ATR: 14.93

What Caused The Breakout In The Stock Yesterday?

Yesterday REGN posted brilliant earnings. Per Yahoo, the company beat on earnings and sales, driven by strong growth in Eylea and Dupixeant and a significant contribution from its antibody cocktail for COVID-19.

Second-quarter earnings of $25.80 per share were a significant beat over the estimate of $19.55. Earnings increased 260% from the year-ago quarter as a result of higher sales. REGN revenues in the quarter surged 163% year over year to $5.14 billion and beat the Zacks Consensus Estimate of $3.89 Billion.

REGN also fulfilled its second agreement with the U.S. government to manufacture and deliver 1.25 million doses of REGEN-COV at the lowest treatment dose authorized by the FDA and recognized $2.59 billion of REGEN-COV sales.

What’s Next For The Stock?

After basing between $570 and $595, the stock broke out on volume yesterday. On the higher time-frame chart, the key levels to be aware of going forward are:

- Support $590 – $600.

- Resistance $610 – $620.

With such a positive catalyst and breakout, it is hard for me not to see the stock going higher. If the sector pulls back, it could hinder REGN from achieving higher targets in the short term. The same can be said with the overall market. A correction or pullback in the market could also cause stocks to retrace. With that being said, price action is firmly to the upside across the market, and so I do not believe those scenarios will play out in the short term.

Now that the stock has broken out the consolidation, there could easily be further momentum to the upside. It will be important that the stock is able to find support at higher prices so that the up move can be sustained.

I believe that if the stock can base above previous resistance, around the $600 area, then a move toward the next target areas of $610 – $620 can be achieved in the short term.

Comments are closed.

1 Comments

I love this .could you tell me about your service.

thanks

yenpham