I am seeing a vast number of breakouts occurring across the market at the moment. These breakouts are happening across multiple time frames and sectors.

I always like to be prepared for technical breakouts. I do this by arming myself with the critical support and resistance levels, knowing the inflection points in breakout candidates, and setting alerts for those prices.

However, something equally important as identifying the breakout in a stock is identifying a false breakout in a stock.

The Stuff Setup is a setup that forms after a stock breaks above or below a key level of resistance or support, the volume increases, and buyers or sellers pile into the stock for the breakout/breakdown. The breakout or breakdown is immediately met with a wave of resistance, and the stock reverses, thereby confirming the false breakout or breakdown.

This setup is often found in all types of stocks and can be seen on both the long and short sides.

What makes a stuff setup?

- A level has developed. A critical level of support or resistance has formed intraday or on a higher time frame.

- The key resistance or support level is an inflection point.

- An increase in volume occurs when the stock gets above the inflection point, thereby signaling a breakout.

- After the breakout occurs, the move quickly fails, and the stock fades below the breakout point.

- A wick represents the immediate rejection and reversal in the breakout.

Two candlestick patterns confirm the false breakout.

The Shooting Star

This image, from IG, represents the Shooting Star pattern. This pattern is commonly formed when a stock experiences a false breakout or Stuff. The long wick of the candle represents the false breakout attempt by the buyers.

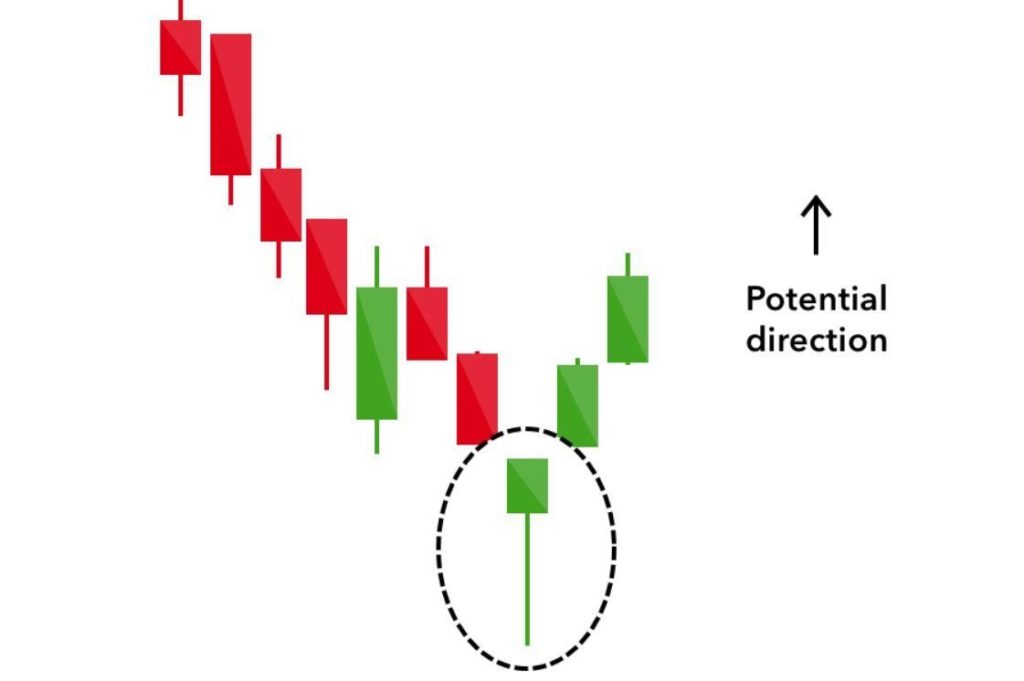

The Hammer

This image, from IG, depicts the Hammer pattern. I view the Hammer pattern as being the opposite of the Shooting star pattern. This pattern, which represents a stuff to the downside, or a false breakdown, shows a stock that is trending lower and makes a vast push to new lows but buying immediately overpowers the selling, and the stock reverses.

Alright, now that the makeup of the setup is clear, let’s take a look at some examples.

Yesterday in the pre-market, $707 was established as a firm-level of resistance in TSLA. Off the open, the stock had large volume come into the name and attempted to get above resistance. Within a minute, the stock failed to hold above resistance and moved sharply lower. This is a failed breakout, a.k.a the Stuff Setup.

Let’s take a look at another example of this setup on the short side. Here, AMD had established a bullish consolidation at the highs yesterday morning. Resistance was $111.50, and support was $111. After a brief drop in volume, volume increased as the stock attempted to breakout. Immediately after the stock broke above resistance, it was met with selling. Shortly after that, the stock broke below support and trended lower.

Yesterday, TSLA also provided a great example of the setup for a long opportunity. A morning low had been set after the stock trended lower and based for thirty minutes. Volume increased, and the stock broke below the consolidation and then immediately snapped back. This is an intraday false breakdown, a.k.a the stuff setup.

The Bottom Line

I always like to prepare with IF/THEN statements. Knowing how to identify a stuff move allows me to identify a failed breakout attempt and then capitalize on the move. Rather than finding myself in a position of hesitation, I have this setup on hand, allowing me to react quickly to unexpected movements in the market.