Coming into Friday last week, the pullback across the board was the main talking point. However, on Friday, the bulls stepped in and changed the narrative.

All major industries caught a bid on Friday, with technology and healthcare leading the way.

After experiencing a brief selloff during the week, the technology ETF XLK bounced back towards all-time highs on Friday and closed the week up 0.48%

The SPDR S&P 500 ETF, SPY, closed the week down 0.57% after bouncing back on Friday and offsetting losses experienced earlier in the week.

The IBB found support at the 50d SMA on Friday, which is a crucial level of support. This could signal that a higher low has been formed. A higher low would be not only bullish for the ETF but also the entire biotech sector.

The strength seen across the market on Friday has created new potential opportunities. Stocks that looked to be breaking down are now poised for a breakout.

The above map, from Finviz, paints the picture of Friday. A wave of green swept the market, and many stocks found support at critical levels.

Let’s go over a few of the charts that I am keeping an eye on.

DXCM

Float: 96.24m

Market Cap: 48.91B

ATR: 14.28

Short Interest: 4.40%

DexCom (NASD: DXCM) has been having an exceptional year so far, with shares up 40.37% year to date and 51.71% on the quarter.

The stock has an average target price of $517.55 set by analysts, below where the stock closed on Friday.

This isn’t entirely surprising, given that shares of DXCM were trading below $350 back in May 2021. Numerous positive catalysts have driven the surge in share price.

Most recently, the company reported a Q2 earnings beat, which proved to be the catalyst for the stock to break out over $460 and base over $500.

Even though this stock has traveled a distance already, from low $300s to low $500s in a short time, the current setup is attractive for bulls.

If the stock can continue to base over $500 and then gain momentum as it clears the resistance of the consolidation, it could have a further leg to the upside.

FULC

Float: 17.56m

Market Cap: 891.78m

ATR: 2.60

Short Interest: 3.96%

Fulcrum Therapeutics (NASD: FULC) is another stock experiencing bullish momentum this year. FULC is up 119.21% year to date, 166.56% on the quarter, and 204.15% on the month.

FULC has an average target price of 28.29 set by analysts, which is almost 10% above where the stock closed on Friday.

Earlier in the month, on August 10th, the company unveiled positive results for its sickle cell disease treatment. This news release was the catalyst for a breakout and sustained move higher.

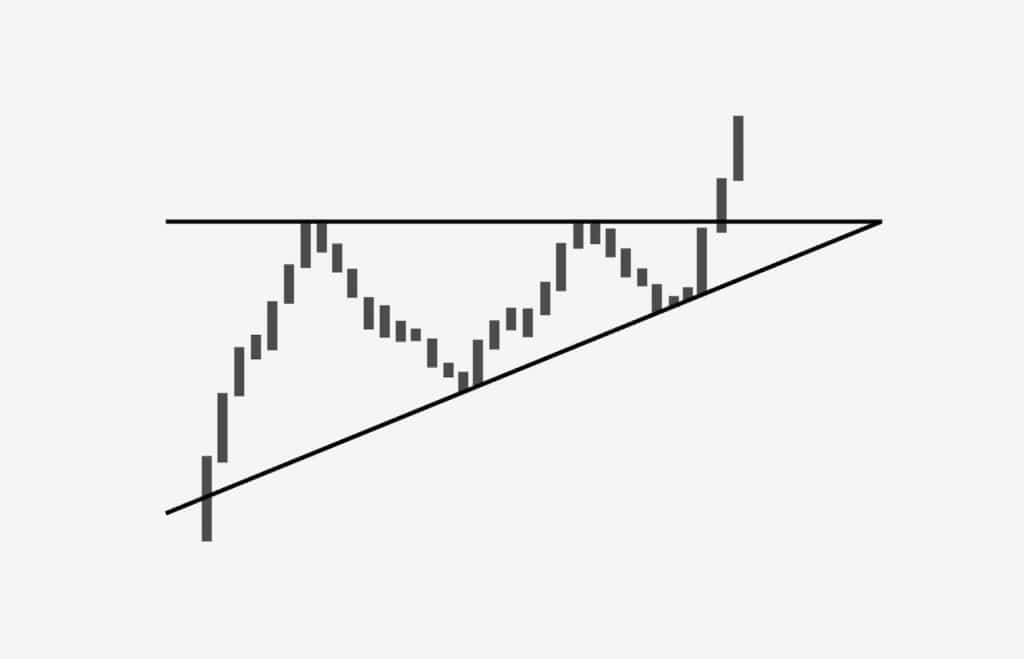

The catalyst for a second leg higher might be a technical one. The stock has spent two weeks consolidating in a range. As time has passed, the stock has held higher in the range, which is a sign of strength. In the future, I will be looking for the stock to hold above resistance of the range, which is $27, and for the volume to increase.

CLDX

Float: 30.10m

Market Cap: 2.12b

ATR: 2.65

Short Interest: 12.43%

Celldex Therapeutics (NASD: CLDX) is yet another healthcare name having a great year. The stock is up 171.40% year to date.

CLDX has an average target price of $62.25 set by analysts. This average price is considerably higher than where the stock closed on Friday, at $47.55.

Most recently, at the beginning of July, shares of CLDX soared to new highs as the company released positive test results for its hives treatment.

Since the release of positive data, the stock has spent time consolidating in a range. Resistance of the range is $48.

This stock looks poised for a breakout. Bulls will specifically want to see the stock break above resistance, on increased volume, and hold above this level. If that were to happen, a move over $50 would not surprise me in the short term.

Comments are closed.

1 Comments

This is great! Thank you! KD