The past few weeks have been uneasy on any trader or portfolio manager – regardless of the experience, the strategy, or the account size.

A lot has happened and is still happening – the Evergrande scandal in China, the seemingly never-ending government budget & debt fights in the US, the spiking COVID-19 cases all over the world – there’s plenty of stuff to be concerned about.

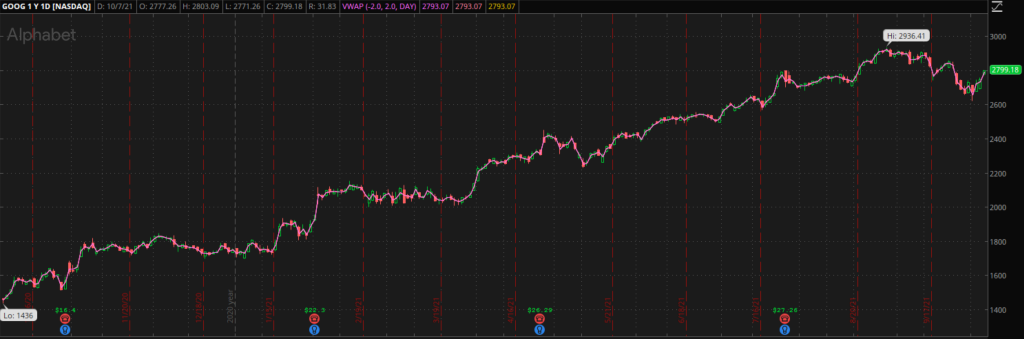

And if there’s one thing the market never appreciates – it is being concerned! Uncertainty loomed and it certainly showed in the price action:

It has not been a fun time for traders with major market exposure!

Now, we all know the motto of the past year and a half has been “Buy The Dip”, hence, the question was obvious – do we simply buy it this time around?

We can argue whether the strategy is a sound one, but one thing is for sure – dip-buying has been working great.

Let me showcase to you one way of doing so patiently, safely, and profitably!

Confirmation Is Key

I often talk about the importance of confirmation.

Confirmation is a pretty abstract concept – each trading setup may have its own little signals that a stock is ready to do what you want it to do.

As a general rule of thumb, I try to wait for confirmation with the absolute majority of my trades, but I believe it’s especially important when trying to find a bottom.

See, when things fall apart, you cannot simply buy out of a leap of faith – there’s just no telling how much lower a stock may go if stuff does hit the fan (and one day it will)!

What if a stock doesn’t bounce?

What if this is a real market crash?

Where are you wrong in a trade?

You have to be patient and careful when buying dips – if you’re not, there will come a day when you’ll regret not asking these questions.

Thus, in situations like this, I always want to see a stock find at least some kind of support – that way, even if I’m wrong I have a clean level to trade against and a tight stop to control my risk!

This is exactly what the market has given us, for the first time since the shakeup began:

Just look at how well the $429 level held over the past few days!

If you were looking to buy the dip, now you have proof that at least buyers are stepping up, plus you got a clean level you can enter against – confirmation at its finest.

Stock Selection

You can definitely trade the market itself, there’s absolutely nothing wrong with that!

Although I had a slightly different idea – the SPY is not very volatile compared to individual stocks, so I thought it makes sense to find a name that would move in sympathy, but with greater magnitude.

This way, I’d have more meat on the bone and would take greater advantage of the potential rebound.

To find such a stock, I like to turn to the good old relative performance – if a stock has been stronger than others while the market is weak, imagine what it will do when the market is strong!

I skimmed through the names closely related to the market – namely, the FAANG stocks (Facebook, Apple, Amazon, Netflix and Google) – and one stood out to me!

Between weak FB, AMZN, and AAPL and a strong (and therefore, not suitable for a dip trade) NFLX, Alphabet (GOOGL) had the most going for it:

- Unlike FB, It’s not been weaker than SPY in the short-term

- Unlike AMZN and AAPL, it’s done great on a longer-term chart with a steady uptrend.

- Unlike NFLX, it still dipped and printed a similar-to-SPY support area.

If I wanted to trade this market dip, GOOGL looked like my go-to stock.

I Go With Options

It is important to understand that GOOGL is a large-cap – it will not move 20-40% on a rebound.

I want to make sure I use my capital as efficiently as possible, therefore, I often turn to options when trading large-cap – they allow me to take greater advantage of small moves in the underlying assets.

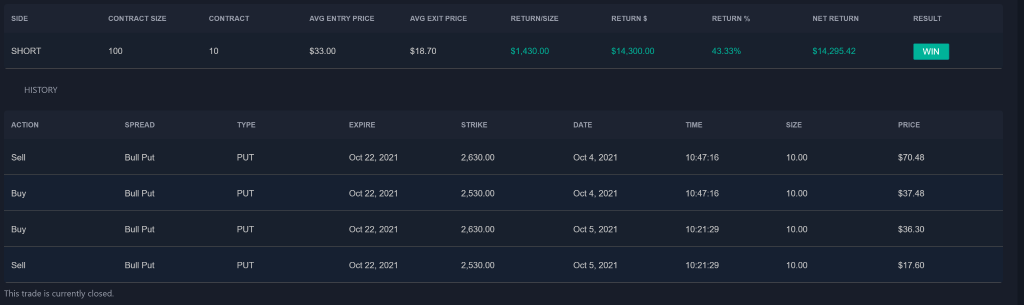

For a rebound trade, I picked a bull put spread.

I’ve spoken about this options strategy extensively in the past and won’t repeat myself this time, but in short, it allows me to profit in two ways:

- Collect the decreasing intrinsic value of an option contract I short.

- Collect the shrinking volatility premium of that same contract, as its stock rebounds.

All the while, maintaining safety, as my position is covered by out-of-money contracts I buy as a hedge.

With that, there was just one thing left to do – time my entry…

My GOOGL Trade

As I mentioned above, I saw the market find some support in the $429 area, which for GOOGL translated into support around $2670.

This Monday, on October 4th, I saw both GOOGL and the market dip lower.

In my view, this break below support meant one of 2 options:

- Option 1: it’s a shake-out, we will rebound back above support and bounce higher, meaning this will be the bottom

- Option 2: the support truly breaks and we just crash lower from here.

Following the down move, I saw GOOGL establish intraday support right under $2630:

It clearly didn’t want to crash! Hence, I went with Option 1 – this is a shakeout, it should rebound and a move higher will likely follow!

And if I’m wrong and it fails to rebound – I’ll just close out intraday, with minimal losses.

So I entered the bull put spread with Options expiring October 22nd:

- Sold $2630 Puts for $70.48 – these are the options I’m expecting to decrease in value and generate a return.

- Bought $2530 Puts for $37.48 – these are options I use to hedge.

As I planned, the stock rebounded – it closed above the support of $2670, keeping me in the trade overnight.

The next day, GOOGL opened higher and quite literally never looked back…

My spread worked out perfectly – even though GOOGL only moved about 3% higher from my entry, my options trade netted me a 43% return! All in under 24 hours!

It is also worth noting that patience truly paid off – as GOOGL proceeded higher following my entry, I was in the money through the duration of my trade.

And this is something I want you to take away: buying the dips can work in any market! Just make sure you have a confirmation, pick your stocks wisely and once you do – patiently wait for a good entry.

2 Comments

Thank you!

Excellent info