COVID-19 hit the economy hard!

And if there’s one place where they can tell you all about it – it’s the travel sector.

It’s hard to imagine that business across an entire global industry can come to a screeching halt virtually overnight.

Yet, that’s exactly what happened here: cruise ships, airlines, hotels, booking agencies, you name it, have all seen the demand plummet by as much as 95% in the first few months of the pandemic.

Now, in all fairness, those times of complete despair are long gone – as of the past half a year, we’ve definitely been in the recovery mode and as bumpy as this road may be, there’s surely light at the end of the tunnel.

The market has noticed – most of the sub sectors of the travel industry are hitting the highs in the expectation of booming demand ahead.

Most, but not all!

There’s one big sector that lagged behind, but I’m happy to report this may all be about to change.

Let me tell you what, how and why…

The Big 3 US Airlines

Being a passenger airline is not a fun thing even when the demand is booming.

The business is overleveraged, the competition is fierce, the margins are razor-thin.

But that’s all fun and games compared to being a passenger airline in the middle of a pandemic.

You’re still on the hook for all the payments and expenses: aircraft leases, airport parking fees, employee salaries… except that now your sources of revenue are almost non-existent.

It’s been a struggle for US airlines, many of them have significantly shrunk fleets, and we’ve all heard about the tens of billions of dollars of the combined bail out money they’ve gotten.

Still, in terms of damage done, the Big 3 US airlines – United Airlines, Delta Airlines, and American Airlines – stand out.

And the reason is simple – they have (or had, pre-pandemic) a HUGE international presence.

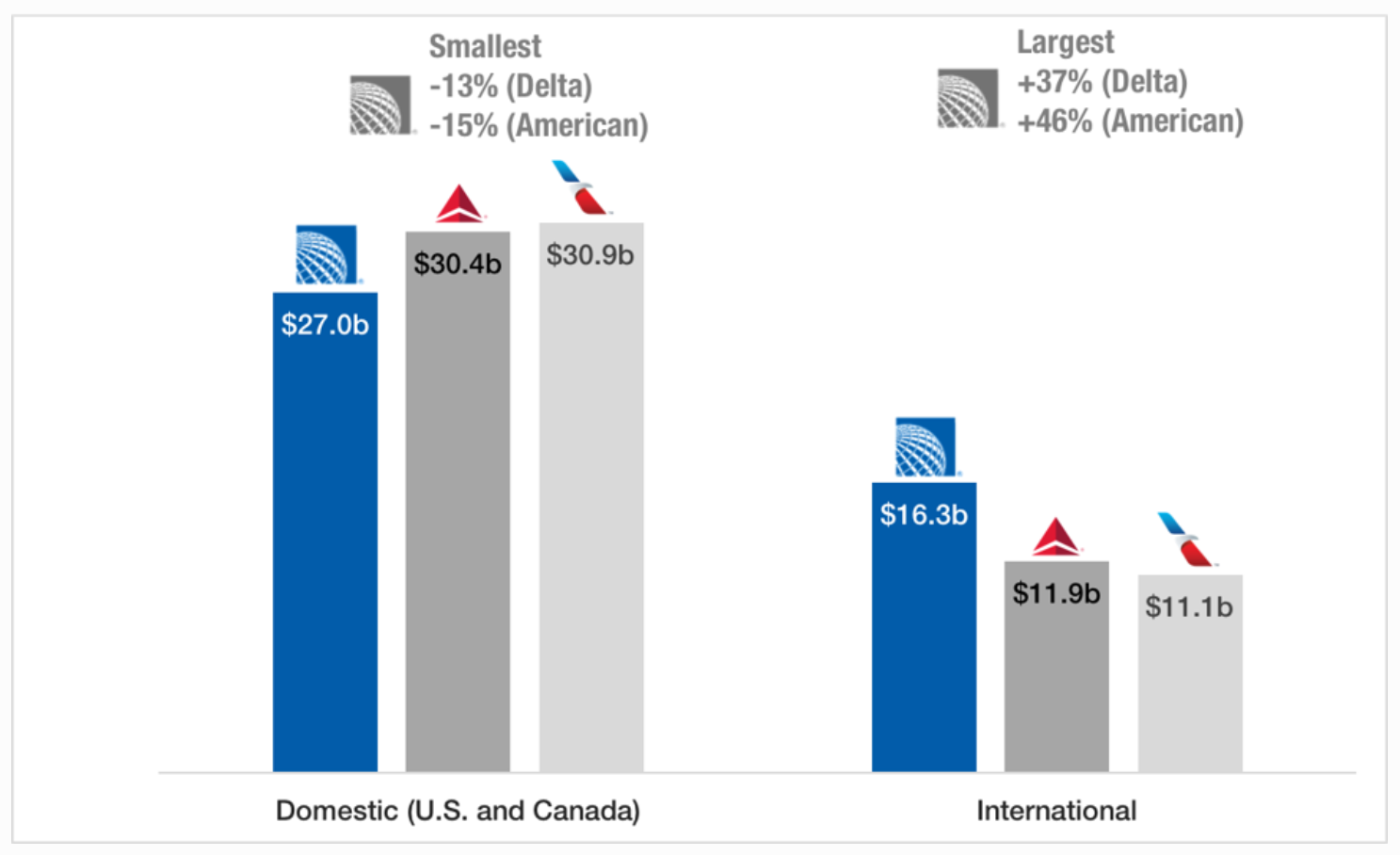

Here’s some good graphics I found in a Forbes article, showing the domestic vs international revenues splits for the Big 3 US carriers:

Before the pandemic, the 3 of them have generated around $40B in international revenue, or nearly a third of all the revenue they brought in!

Now, keep in mind, through most of COVID, the US has had blanket travel restrictions for virtually all foreigners – and so have the foreigh countries for Americans.

With most lucrative international markets such as China (and most of Asia, for that matter) and EU completely cut off – these 3 airlines have surely found themselves in a bit of hot waters, even when compared to the struggling domestic ones like Southwest and Jetblue.

Well, the good news is, they better buckle up, prepare for take off and enjoy the flight.

US to Lift Travel Restrictions for Vaccinated Travellers

Earlier today, Reuters reported that according to a White House official, the Biden Administration will lift travel restrictions for fully vaccinated foreign travelers on Nov 8th of this year, or, in about 3 weeks from now.

There have been plenty of rumors about this recently, but now it seems we might finally get the official announcement.

And that’s a big deal, if you care to hear my take!

And it’s not just me that’s getting optimistic!

Just yesterday, United Airlines announced 8 new long-haul international routes for the 2022 season.

A few days before that, Delta announced a 5-route expansion out of Boston.

You see where I’m going with this – the airlines can’t wait to put those planes back to good use, and fill in the expensive international premium seats.

Well, this decision by the Biden Administration has just gotten us one huge step closer to that.

What To Expect

The charts of United, Delta and American are quite similar, but, more importantly, they all share the unflattering distinctive features:

- All 3 remain far off the pre-pandemic highs.

- All 3 have been shaping up for a move higher.

- All 3 have failed at it multiple times.

I think this announcement has the potential to finally turn the page for the Big 3 US airlines, allow them to find stronger support and get moving higher.

Each push they’ve had so far turned up a failure. Let’s see if an industry-wide catalyst can get the job done.

Here are some key levels I’ll closely watching in the coming days and weeks:

United Airlines – UAL:

As we’ve seen above, United has by far the greatest exposure to international traffic – therefore, I think it’s UAL that may see the biggest reaction.

UAL also has one of the better charts among the three.

United also happens to have nearly all of its workforce vaccinated, meaning it won’t be materially affected by any labor shortage-related disruptions.

$48 area that it’s currently trading at has been a big level for the stock, and I think right now may be the perfect time for it to hold the support and start a move higher.

If we get a solid consolidation above, I will consider a long against $48 for a move into $59.

Delta Airlines – DAL:

The $42 area has been a big level throughout. The stock may finally be ready to bounce off of it and see meaningful upside.

I’d love to see it establish above $42 – once that happens, I may consider an entry with a target at $48.

American Airlines – AAL:

American Airlines is the last on the list for a good reason – it’s the choppiest of all.

Still, if the sector gets going, AAL can get going as well.

I’m interested above $20 and even more interested above $21. Under the right circumstances, I think we can see $24-$25 fairly soon.

Comments are closed.

1 Comments

Thanks, Jason! KD