“Is the market about to crash?”

If only I got paid a dollar every time I overheard somebody ask that…

But I surely see where this is coming from, especially given the current environment – we’ve gotten relatively high up, there’s no questioning!

I’m not even talking about all individual climbers… just look at the SPY—the index the whole world is glued on.

SPY is currently up more or less exactly 100% from the COVID low of $218.26… in a mere 16 months! Talk about a great time to be alive…

And believe it or not, by the looks of it, we might be headed higher still…

A Crash, That Keeps Pushing Back

Look, there’ve been plenty of legitimate concerns about the state of the market over the past year.

First, we counter-intuitively climbed higher through the COVID-19 pandemic – all the while economies domestically and around the world struggled to keep afloat.

Then, our election… The more pro-free market Trump got replaced by a more pro-regulation Biden with some arguing and rioting in the process. Not the most bullish sequence of events on its surface, yet higher we went still!

Now the deficit, the inflation, the slow-ish job market recovery, the Delta strain concerns…

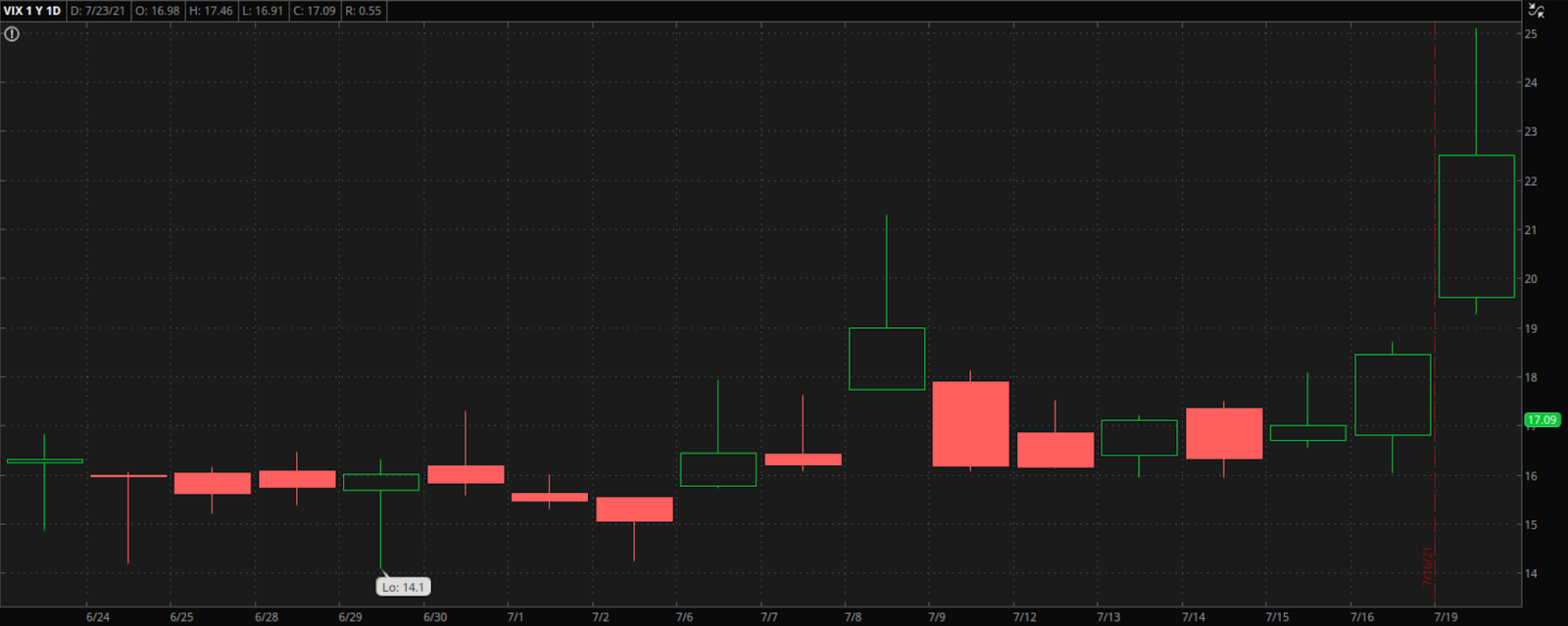

Add into the mix the “not ideal” recent price action across the board… For one, here’s the SPY from last week-early this week:

Getting a rough rejection at all time highs and then losing 16 points in 2 sessions on giant volume sure makes some people sweat.

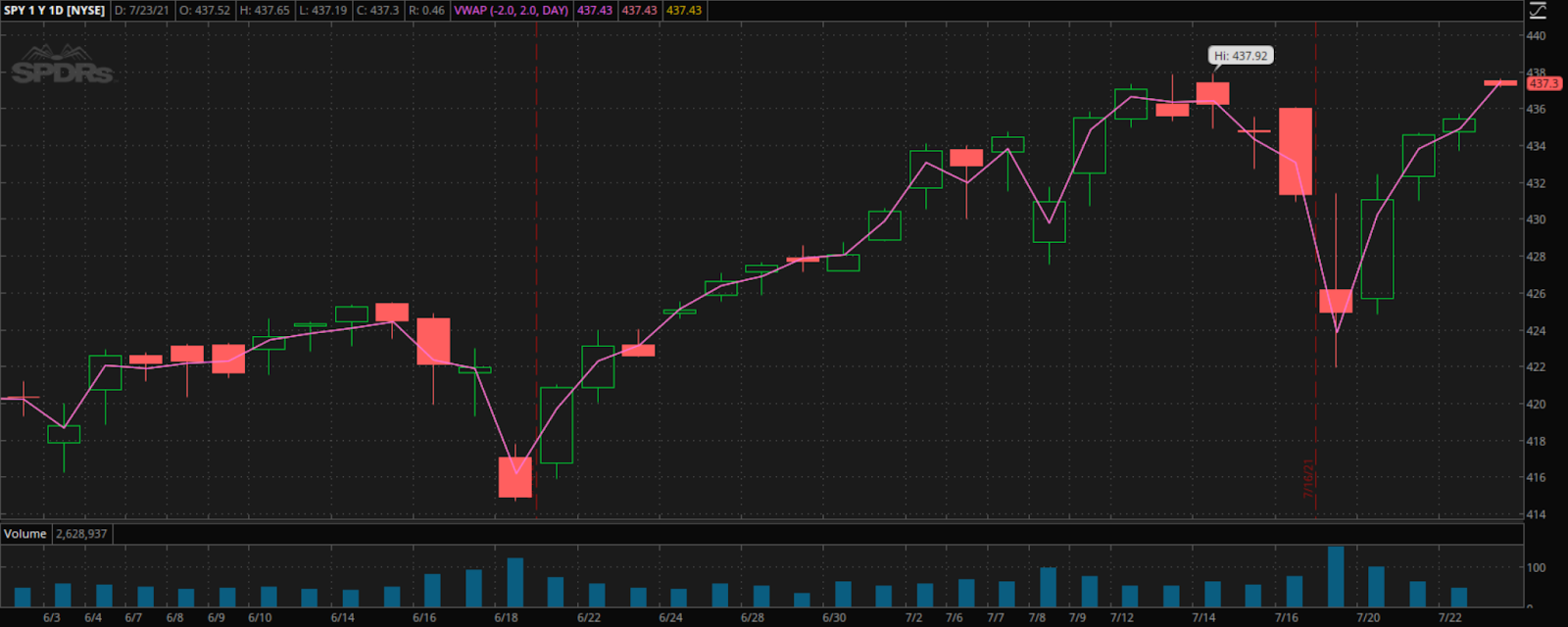

The VIX, or the Fear Index (you can read more about VIX here) in chief demonstrates that well, as it’s moved from $16 to $25 in a matter of those same 2 days:

Then, there’s Bitcoin too. And I’m not implying that Bitcoin is in any way related to the market, but we can surely agree that it’s a useful gauge of traders’ excitement.

Well, Bitcoin has failed to excite this time around:

It finally slid below the $30k level that it’s been holding onto for so long, seemingly ready to finally fall into oblivion and take all the hype with it

That’s a pretty gloomy looking picture. isn’t it?

Except that, well, this is not at all how it turned out!

Another Dip, Another Buy

Fast forward some 4 days… and all three bearish looking charts from above turned bullish in a blink of an eye:

Here’s SPY, back at the highs like nothing ever happened:

Here’s the Fear Index, not looking very fearsome anymore:

And finally, here’s Bitcoin, back above the $30k, possibly setting up for a bounce higher:

Throw into the bunch a couple of wild runners we’ve had over the past few days – IGC, WISA, SCKT, etc – and the seemingly overheated, desperate and scared market starts to look more like business as usual.

Which makes me wonder…

Is The Next Leg Up Coming?

Let me be clear here – I’m not discounting any of the bearish arguments, in fact, I think many of them have great merit.

But as a trader, I have to rely on what I see happen, not on what I believe should happen.

And what I’m seeing and trying to point out to you is that price action suggests we may easily get more upside.

The SPY had just vigorously defended its long term uptrend:

If the $430 area continues holding and trying to advance higher, I really see no reasons to be short.

At the same, an all time high, especially one that gets rejected and defended multiple times is often a tipping point – meaning the next move may be violent in either direction.

That’s why if the $435-$437 area starts getting rejected again – I might position myself for a pullback.

1 Comments

Thanx pro this is preciuos info.