Options act as insurance on stocks.

Bob has a big stock position in TSLA, but Elon Musk has been unpredictable lately, so ‘Bob the buyer’ buys put options out a month to protect against ‘unpredictable Elon’.

Meet ‘Bob the buyer’

And ‘Bob the buyer’ knows a thing or two about ‘buying’ insurance. His big stock position in TSLA isn’t his only big investment.

Bob owns a home too, so he went to State Farm and ‘Bob the buyer’ bought monthly home insurance for $100.

Now meet State Farm agent ‘Sally the seller’ and retail trader.

Sally is the State Farm agent who sold ‘Bob the buyer’ his home insurance.

Sally also likes to trade on her lunch and because she knows a thing or two about probability, unbeknownst to her, sold ‘Bob the buyer’ those puts options out a month.

Bob goes about his business and the month flies by.

TSLA stock price ends up going slightly higher that month, which is great for ‘Bob the buyers’ big stock position.

But those put options out a month, ‘Sally the seller’ collects the premium Bob paid. The insurance expired worthless.

And if Elon acts unpredictable again, Bob feels okay about buying put option insurance out another month.

During that month, neighborhood kids broke a window at Bob’s house.

But because Bob has a deductible, Bob’s insurance doesn’t cover the $300 cost.

Nothing else happens to Bob’s house that month, so again, ‘Sally the seller’ collects Bob’s full premium. The insurance expired worthless.

Bob wants his house to be safe, so he’s okay to pay the monthly premium again.

What ‘Sally the seller’ knows from being a State Farm agent is that most monthly insurance premiums expire worthless and that’s one way she at State Farm makes big money.

Sally also knows most options expire worthless, so she likes to play probability in the stock market too, acting as the seller of options, afterall, they are insurance contracts with expirations, just like home insurance.

Bottom line, ‘Sally the seller’ collects the full home insurance premium in multiple ways:

- If nothing happens to ‘Bob the buyers’ home

- If nothing bigger than the deductible happens to ‘Bob the buyers’ home

Same for the TSLA put option insurance Bob bought:

- ‘Sally the seller’ collects the premium if the stock goes slightly lower

- She collects if the stock goes sideways

- And she collects if the stock goes up

‘Bob the buyer’ can only use his home insurance if something devastating happens and the same is true for the put options he bought.

Who has the probability?

Bob the buyer or Sally the seller?

WALL ST BOOKIE knows it’s Sally.

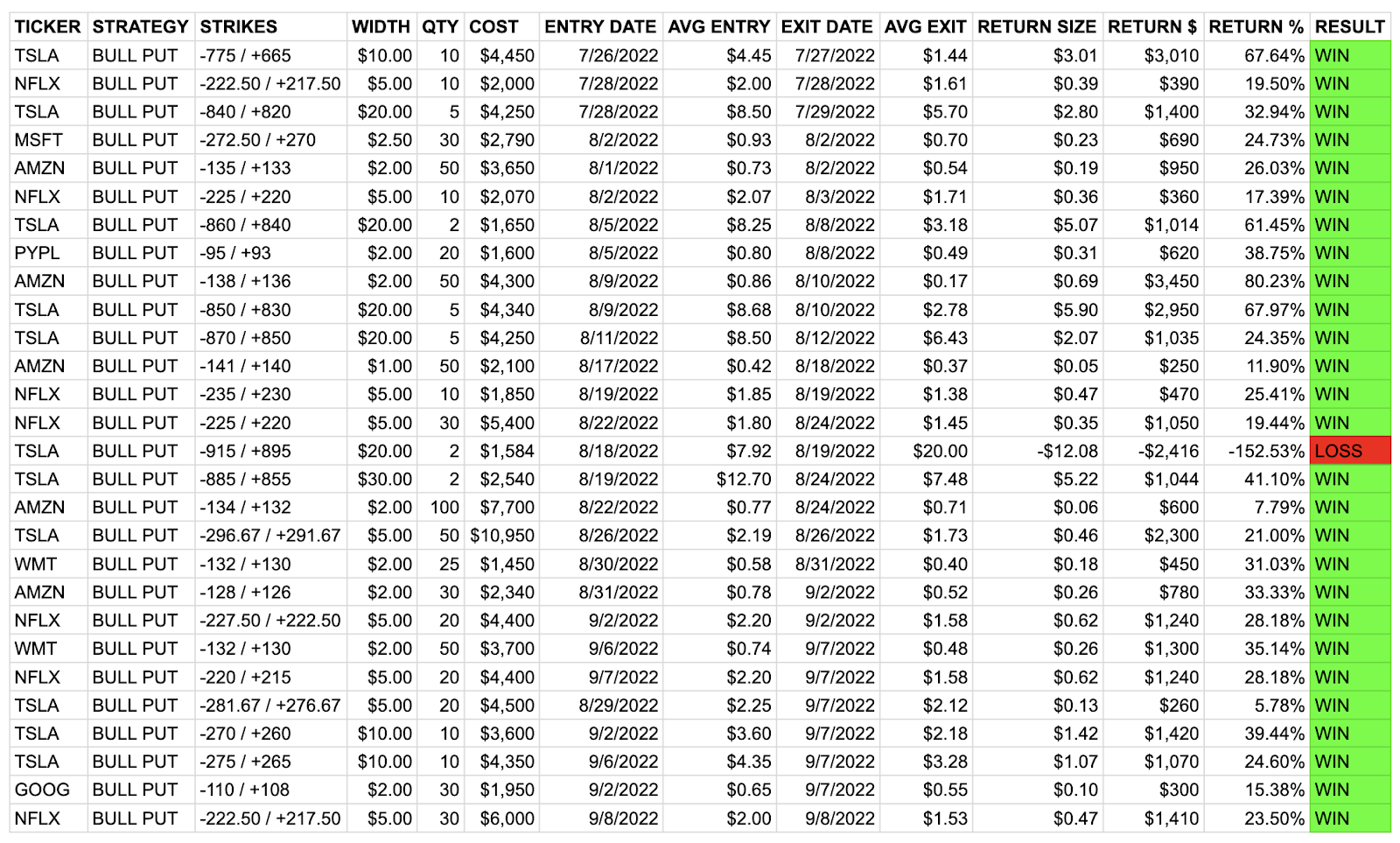

27 wins and 1 loss since service launched 6-weeks ago on July 27. All trades from watchlist and were alerted before I entered and exited positions.

Nothing promised or guaranteed in the future except my transparency and passion for teaching you to learn from both the wins and losses.

Learn more about Jason Bond’s high probability strategy here