Rho is the rate at which the price of an option changes relative to a change in interest rates. In other words, rho measures the sensitivity of an option’s price or a portfolio to a change in interest rates.

For example, if an option has a rho of 1.0, then for every 1% increase in interest rates, the value of the option will increase by one point.

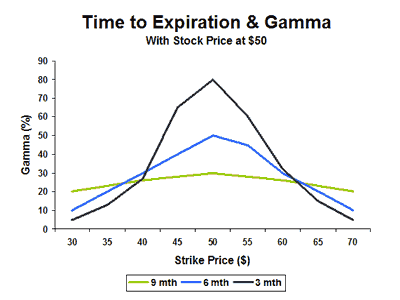

When looking at rho, at-the-money options with longer-term expirations are most sensitive to a change in interest rates.

Call options typically increase in value with an increase in interest rates. For example, assuming that a call option is priced at $5 and has a rho of $0.50, then if the risk-free rate increases by 1%, the value of the call option will increase from $5 to $5.50.

Out of the five common greeks, traders typically refer most frequently to four important risk metrics: delta, gamma, theta, and vega. Rho is typically ignored and is considered to be the least important in terms of risk for options traders.

For day traders, rho is typically not an options greek that they will ever need to worry about.

Alternatively, if an investor was to purchase a LEAPS contract, or Long-term Equity AnticiPation Securities, which are options with expiration dates that go out as far as three years, they are at far greater risk to changes in the risk-free rate. Therefore, these options have larger values of rho compared to shorter-term options.

What is the Risk-Free Rate?

When discussing interest rates, it’s assumed that a risk-free rate is being referenced. The risk-free rate is the theoretical rate of return on an investment that has zero risk. While there is not actual risk-free investment, a good proxy would be investing in government bonds, such as Treasury bonds and Treasury bills.

This is considered as close as you can get to a risk-free investment because you can assume the government will not default, and you will be paid back on your bond or bill.

Risk-free investments are also known as the minimum return investment because, as an investor, you would expect a higher return anytime you have money at risk. No one will risk their money if they could make more money in a risk-free product.

Wrapping Up

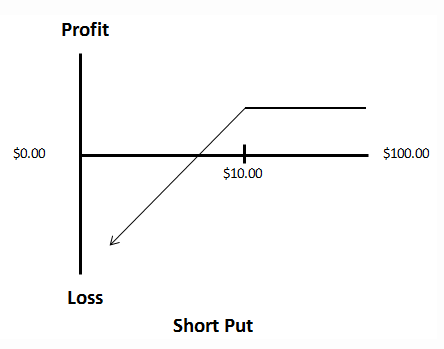

Generally, interest rates do not affect an option’s premium as much as the time value, the underlying stock price, and volatility. However, in a highly volatile interest rate environment, rates matter. An increase in interest rates — as measured by the less-followed greek “Rho” will typically increase call prices and decrease put prices.