Using Options to Hedge Short Positions

Using options to hedge isn’t an exclusive opportunity for long traders, with protective calls and covered puts protective strategies for short sellers.

Remember, when you short shares of a stock, you borrow them from your broker at the current market price. The goal is for the share price to fall, allowing you to buy the borrowed shares back at a lower price — which is where your profit is derived.

But since a short seller has no real “skin in the game” in terms of an equity or cash stake, these bearish positions have to be met with collateral, in the form of deposits into a margin account that are sufficient to cover the risk exposure. Margin accounts will vary, so check with your broker.

And while risk on a short sale is theoretically unlimited (considering there’s no upper limit to how high a stock can rally), there are ways shorts can protect their bearish bets using options.

Protective Call

A protective call is a call position which is purchased against a short stock position. The goal is not to make money, but to save it on an unexpected move higher in the underlying stock. And similar to a protective put on a long stock position, the more out of the money a strike is, the cheaper it will be to buy the insurance policy — though it will provide less coverage than an at-the-money or in-the-money call.

Let’s say you went short on 100 shares of ABC stock when it was trading at $30, but the shares have since retreated to potential support at $25. While your longer-term outlook on ABC remains bearish, you think the shares could be in store for a short-term bounce off $25, so you buy one 28-strike call at $0.20, or $20, since each option contract accounts for 100 shares.

Since you’re a short seller above all else, you ultimately want these calls to expire worthless, and the stock to continue to fall. However, should the shares bounce off technical support, the long call will begin to act as a hedge once ABC moves above breakeven at $28.20, which is the strike plus the premium paid.

At this point, you can either exercise your option to buy stock ABC at $28 per share, return the shares to the broker, and close out of your position with a profit, or continue to hold your call through expiration in hopes the shares resume their longer-term downtrend.

Covered Put

Most traders know about the covered call, where you sell a call option against a stock that you own, collecting a premium. This limits your upside from wherever you set the strike, but cushions you on the way down. It’s one of the more basic and conservative trades out there.

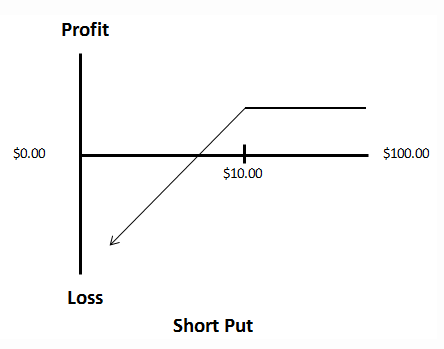

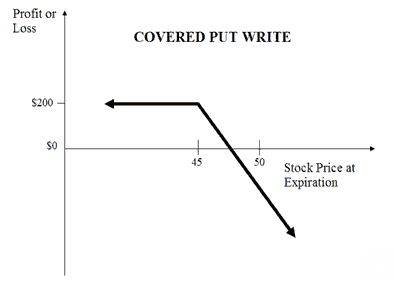

On the flip side is what’s known as the covered put. In this strategy, you sell a stock short and then sell a put against that position, which pays you a premium. Similar to the covered call, you give up any additional profits below the strike price beyond the credit you received upfront.

Here’s a quick example:

- You sell short 100 shares of XYZ at $45 per share, or $4,500

- You sell a 45-strike put for $2, or $200 (since each contract accounts for 100 shares)

You get to keep that $200 you received as your maximum potential reward should the stock settle right at the strike price at expiration. The breakeven price for the trade is $47, as the $2 collected covers your short position up that far.

However, if the stock keeps going down, and the option moves into the money — you’ve profited on the short stock trade, but forfeited any profit opportunity from the short put.

This trade works well in high-volatility markets when premiums are rich.

Wrapping Up

Using options to hedge is not just for buy-and-hold investors. Strategies exist for short sellers, too, with the protective call and the covered put options speculative players can initiate to guard short positions against any upside risk.