I wrote a detailed post yesterday that explored the energy sector’s strength and potential sympathy plays as a result.

If you recall, I discussed the chart pattern in the XLE and how the range contraction might signal that a breakout is likely to happen soon.

Well, lone and behold, yesterday that breakout occurred.

As I predicted and mentioned in yesterday’s post, the strength in the sector might have a spillover effect on specific stocks poised to benefit from the overall strength in the industry.

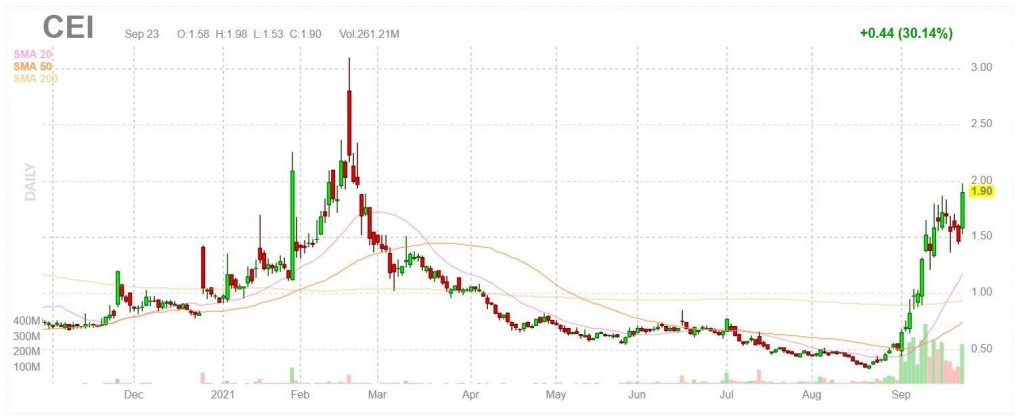

The popular penny stock grabbing all of the headlines at the moment, CEI, broke out of its consolidation yesterday and closed near the high.

Yesterday I added a few names to my energy watchlist as I prepared for a potential theme play after noticing the strength in the sector and CEI.

I briefly mentioned one stock, in particular, in my previous post.

However, the breakout and action in the name yesterday now warrants a closer look at the stock.

Northern Dynasty Minerals (NAK)

The company, according to Yahoo, engages in the exploration of mineral properties in the United States.

Although the company is not directly in the same sector as CEI, it shares a similar technical setup. It has been widely touted as a sympathy play by retail traders online popular social media platforms like Twitter and StockTwits.

The stock first gained attention and popularity online as CEI approached $1.

Market Cap: 310.44M

Float: 474.99M

ATR: 0.05

Average Volume: 7.12M

Short Interest: 3.99%

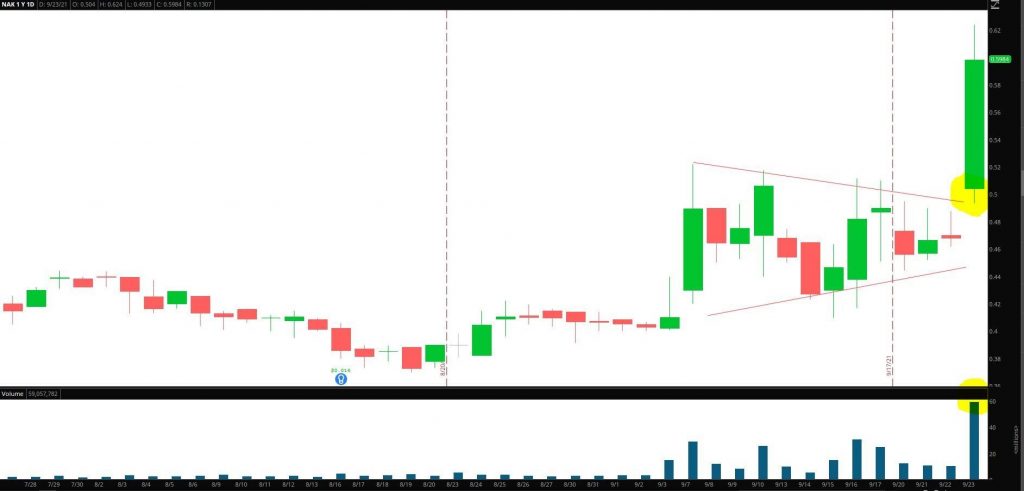

For the last two weeks, shares of NAK have consolidated in a bullish pennant, with support at $0.45 and resistance at $0.50.

Yesterday, however, the strength seen in the broader market and industry, along with a significant breakout in CEI, resulted in the stock breaking out of the pennant and trading abnormal volume.

The stock traded over 59M shares yesterday, which is substantially higher than its average volume of just 7.12M. The bulls will now have increased confidence in the breakout as it was met with a substantial increase in volume.

As the stock has a large float of 310.44M shares, the bulls will want to see the volume increase sustained.

The stock also traded almost twice its average true range, signaling a range expansion and increased volatility.

What’s Next for the Stock?

It has become apparent that the stock is moving primarily in sympathy to CEI. So as time advances, the potential for continuation to the upside might depend on CEI’s ability to remain on the front side of the move.

Key levels of support and resistance:

The breakout level of $0.50 will now act as critical support going forward.

Yesterday the stock broke out higher, on increased volume, over $0.55, which should now turn into support if the stock pulls back.

Resistance from yesterday afternoon was experienced around the $0.60 level.

As the stock advances, the bulls will want to see the resistance from yesterday afternoon establish itself as support.

If the stock pulls back, the bulls will not want to see the stock below $0.55. If the stock fails to hold above $0.55 and fades below $0.50, it might signal the end of the bullish move.

Alternatively, if the stock can continue to base higher and advance, the next resistance level would be $0.80.

1 Comments

I love your short articles. I think you are the best of all the group of people on ragging bull.