It’s not very often that you’ll see me shorting a penny stock.

And there’s a good reason for that…the power/ danger of the short squeeze.

But it does happen from time to time.

In Tuesday’s post I mentioned how I’ve been noticing less follow through in penny stocks lately.

For that reason, selling into strength has been key for me…

But it also opened the door to what I did on Wednesday, something I rarely do…I shorted a penny stock on a reversal.

OneSmart International Educational Group (ONE)

OneSmart International Education Group (ONE) provides tutoring services for the students of kindergarten, primary, middle, and high schools in the People’s Republic of China.

Needless to say, things couldn’t be looking worse for this sector.

You’ve probably seen the news…China takes a hard stance on afterschool tutoring companies.

When it rains it pours…and it’s pouring on ONE right now.

The stock was near $7 a year ago…but down to just .50 a week ago following the fallout from China’s new stance on afterschool education.

But it didn’t end there…adding salt to the wounds, the New York Stock Exchange (NYSE) notified the company that it was below compliance criteria in connection with the performance of trading price of their American depositary shares.

Simply put…ONE is at risk of being delisted from the NYSE due to having a stock price less than $1.00 over a consecutive 30 trading-day period.

To keep from being delisted, they have to bring the share price and average share price back above $1.00 by six months following receipt of the notification.

The company can also regain compliance at any time during the six-month cure period if on the last trading day of any calendar month during the cure period the company has a closing share price of at least $1.00 and an average closing share price of at least $1.00 over the 30 trading-day period ending on the last trading day of that month.

By no means would this be considered good news.

But look at what happened to the stock after it was announced.

The stock went up 150% that morning.

No one ever said stocks have to do what is expected. For one, it’s a small stock with 161M shares outstanding but only 32M shares in the float, according to finviz.

This tells me it’s a closely held stock and therefore “insiders” may have more control over the movement.

And what they need right now is a share price over $1.

Regardless of what happens long term, the stock shot up over 100% on what I would consider bad news.

Pair that with how I’ve been noticing penny stocks aren’t following through on their moves like they were a few months ago…and this led to my plan to do something I rarely do with penny stocks.

Reverse the move by selling the stock short.

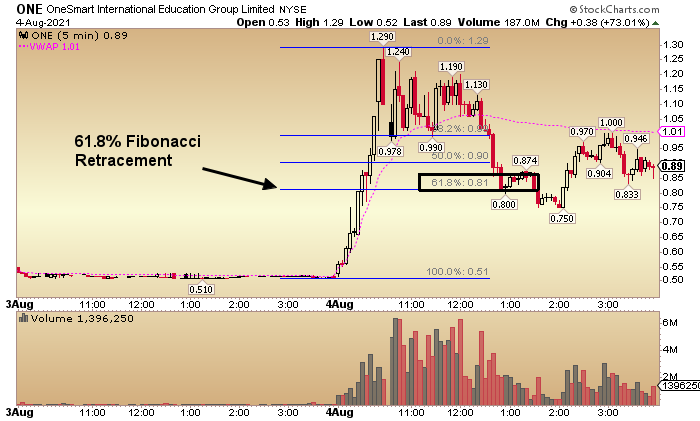

In the 5-minute intraday chart below, you can see it peaked at $1.29 just before it was halted, up from just over .50 the day before.

Maybe this move was pushed by tight control on the supply or speculation that the company would do something to get the price back above $1 to keep from being delisted.

I can’t say for sure. All I can do is trade what I am seeing, so I went short ONE and watched as it made lower highs down to the VWAP (pink dotted line).

It was a little dicey for a bit as it was holding a range at VWAP, but once it finally broke through…ONE made a quick move to my target range of .80.

Why the .80 range target?

For one, I’m a short-term trader so I’m simply looking for a reasonable move within my timeframe.

And to find that “reasonable level” I was looking at the Fibonacci levels.

Take a look at the chart below…

I added the Fibonacci retracement levels to the chart. Looking at the 61.8% level (golden ratio) gives me a good idea where the stock could retrace before finding some support, which happens to be the .80 range.

And second…I had no plans to hold this stock short overnight.

I don’t short pennies very often but when I do, I generally don’t hold them overnight.

Even the slightest chance the stock catches good news or “insider” pressure to get the stock above $1 is enough to keep me on edge.

The play here from a risk to reward standpoint was an intraday reversal based on the factors mentioned earlier…

- The stock was up over 100% on bad news (in my opinion that is)

- Pennies haven’t been showing the same follow through lately (pop and drop potential)

- Fibonacci retracement level target for a short-term reversal on the initial pop (technical target)

It played out in my favor, but it could have simply continued up and I would have been stopped out above the high of the day. That’s trading. I have a plan and try to stick to it.

Another interesting note here is that I wrote a post about how I deal with the Pattern Day Trader (PDT) Rule…one of the ways is by limiting the number of intraday day trades I take.

This was one of my 3 intraday day trades allowed per 5 day trading period.

The point is I planned for that. I wasn’t flying by the seat of my pants and forgetting whether I have any “day trades” left.

I knew I wouldn’t want to hold this stock short overnight, and my plan was specifically based on the potential for an intraday reversal.

What’s next for ONE is anyone’s guess…since the intraday reversal trade, the stock is trading in a range between the ever so important $1 and .65.

At this point it’s a waiting game…watching for a breakout.