Hello Trader,

Cathie Wood was the darling of Wall St last year after being the most bullish TSLA analyst in the world. Her prognosis in terms of price targets, and growth were spot on, and early investors in her flagship fund Ark Innovation ETF (ARKK) benefitted significantly as ARKK was up over 400% from the Covid Lows. However, the tide turned in March last year, and since then her fund is down almost 70%.

It’s tough out there for investors right now, this is a traders’ market! The QQQ’s have been getting pounded before we saw a reversal yesterday.

As the broader markets sell-off, there are not many places to hide for investors. This is especially true for tech investors such as Cathie Wood, whose ARKK fund has made significant bets on the future, investing in high revenue growth and low or mostly negative income companies. The market has not been kind to holders of these stocks for almost a year now, as they continue to get the Kibosh.

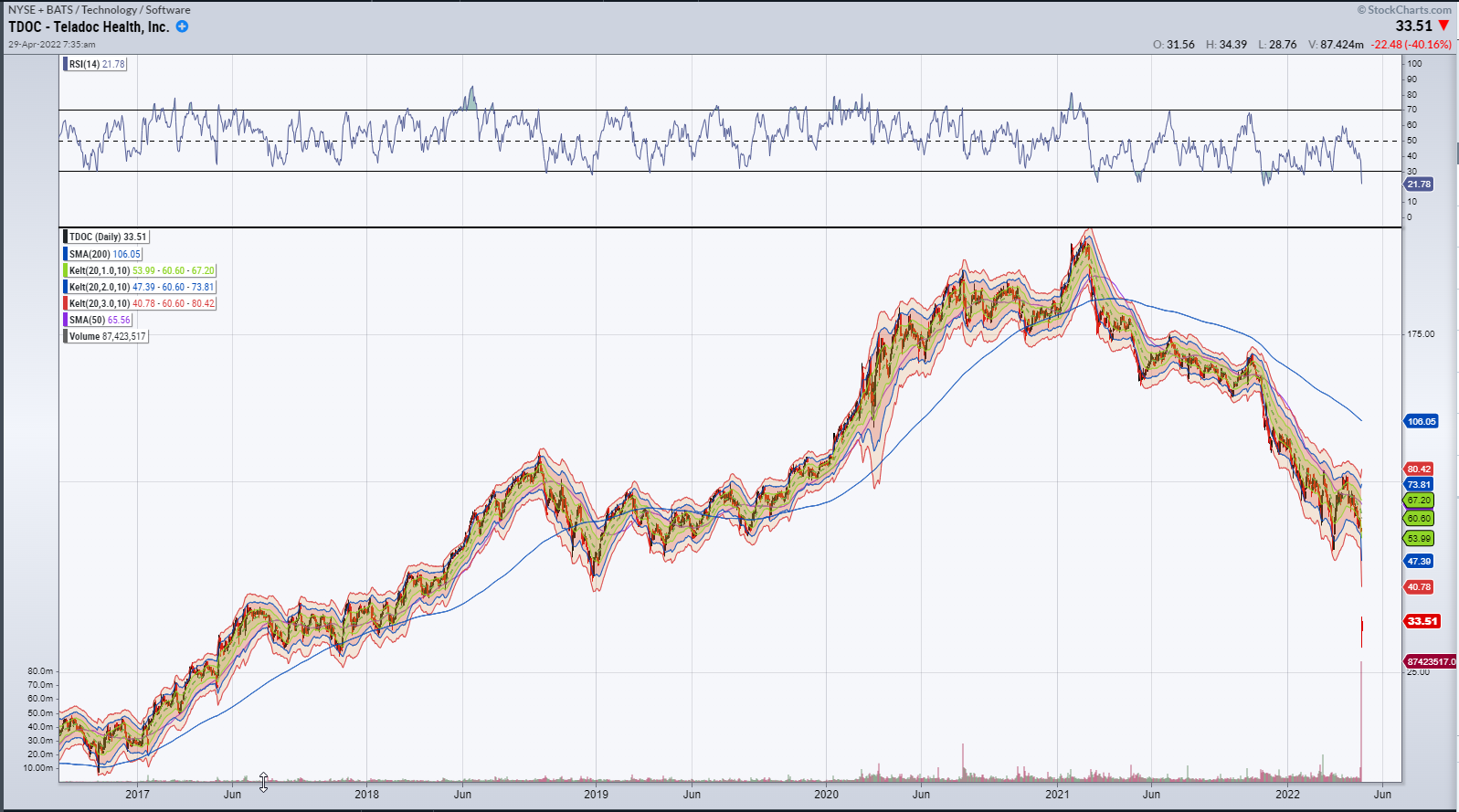

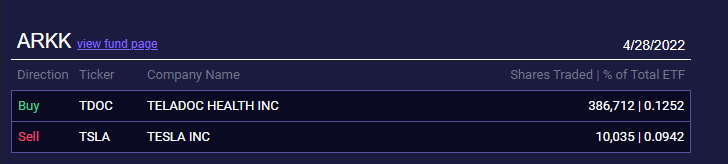

When I talk about “riding down losing trades and never stopping out”, ARKK fits the bill. Even worse, she keeps adding to these stupid trades on the way down. Cathie added like 90k shares of TDOC the week of earnings before the 30% drop again after hours.

On Thursday, she added 380k shares more!

TDOC is now more than 80% off its highs made in Feb ‘21. This is one of the worst managed funds I have ever seen. Cathie just keeps adding to losing trades “betting on the future!”

A lot of the great growth investors over the last few years are getting taken to the woodshed. Their strategy involves buying high-risk growth stocks and holding them forever.

The great Jessie Livermore once said, “The money lost by speculation alone is small compared with the gigantic sums lost by so-called investors who have let their investments ride.” This is why risk management is key to successful trading to avoid debilitating drawdowns in Bear markets.

Jessie Livermore would not approve of Cathie Wood’s trading strategy, and neither do I. That is why I use advanced options strategies to always have defined risk on every trade I make. Real traders use stops! Don’t become a bag holder!

Ark Innovation ETF (ARKK) is Cathie Wood’s flagship fund. She was behind TSLA’s $3000 (pre-split) target when it was trading below $300 (pre-split), and most on the Street were still skeptical. Her 10x call came to fruition, and she was hailed as the next big thing.

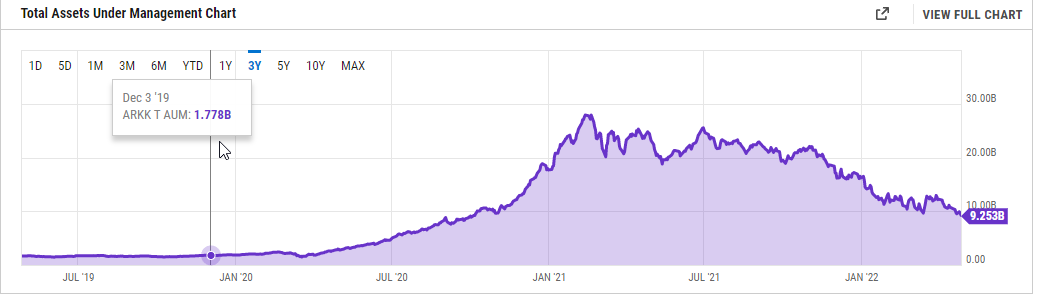

Due to great returns on the portfolio and massive inflows from new investors backing Cathie ARKK, assets under management (AUM) rose from $2billion in 2020 to over $27 billion in Feb ‘21.

Today, her total assets under management are less than $10billion.

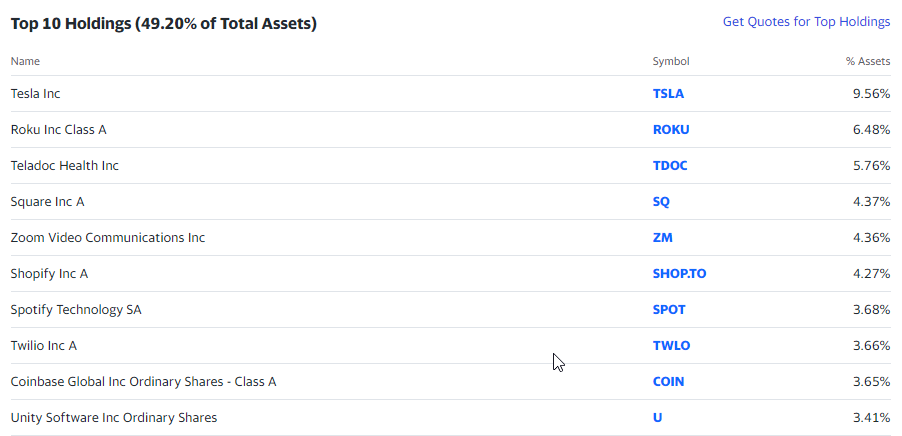

Throughout 2020 and 2021, her fund received massive inflows and was up over 400%. However, since February 2021, the ARKK fund is down over 60%, and many of her high growth, money-losing companies, are also down 60% or more. Besides TSLA, ARKK’s main holdings include ROKU, TDOC, SQ, ZM, SHOP, SPOT, TWLO, and COIN.

Cathie just keeps adding to losers. Either some of her stocks find a bottom and her bet on the future turns around, or she will be forced out of her positions at the worst possible prices as investors run for the hills. Either way, Cathie has taken an enormous risk, and her investors are in a world of pain right now, and it could get much worse.

The best traders I know are the best risk managers, a trait that Cathie Wood appears to lack. Doubling down when trades go the wrong way is usually a really bad idea, but it appears this is Cathie’s strategy. This is especially bad when you go all in high growth money-losing dog-meat stocks hoping for a better future.

In a bear market, these types of investors get wiped out. If the bear market continues, we may never hear of Cathie Wood again. Many of these types of “Geniuses” were swept away into obscurity during the .com bust. If you want to survive in this game for a long time, risk management is paramount.