Markets are down again this morning on geopolitical worries. The SPY responded positively after pricing in the invasion of Ukraine on Thursday and rebounded significantly to finish the week strong.

However, over the weekend, tensions in Europe have Intensified, and this has led to stocks trading lower again in Pre-Market. Despite these geopolitical worries and a bear market in growth stocks, some stocks have stayed bullish and continue to make 52week highs.

The Professor has Identified 2 stocks with bullish trends that look set to continue. The stocks with two bullish patterns are Chevron Corp (CVX) and Alcoa Corp (AA). The bull market in commodities continues to roar and benefit from inflation and geopolitical worries. The Professor was spot on with his previous commodity pick in RIO, which you can read more about here. Can He do it Again?

The Professor, Mike Parks, is Raging Bull’s Senior Training Specialist.

Mike is a veteran trader and educator and is adding a level of insight to Total Alpha that can only come from decades of experience in trading and market education.

Mike has incredibly knowledgeable on all things markets and his talent for teaching new traders how to use market signals to choose the right options strategies is unmatched.

Chevron Corporation (CVX), through its subsidiaries, engages in integrated energy and chemicals operations worldwide. It is involved in the exploration, development, production, and transportation of crude oil and natural gas; processing, liquefaction, transportation. It also engages in refining crude oil into petroleum products; marketing crude oil, refined products, and lubricants; manufacturing and marketing of renewable fuels; transporting crude oil and refined products by pipeline, marine vessel, motor equipment, and rail car.

With the oil price spiking and approaching $100, the fundamentals for oil companies haven’t been this good in a long time.

Technicals

This trade is setting up with three great patterns, a push on the upper resistance level and positive momentum on the TTM Squeeze. With On Balance Volume showing positive numbers, I’m expecting the bulls to remain in control here.

With these three bullish signals, I’m expecting to see a breakout to the upside as the bulls step in to take control here.

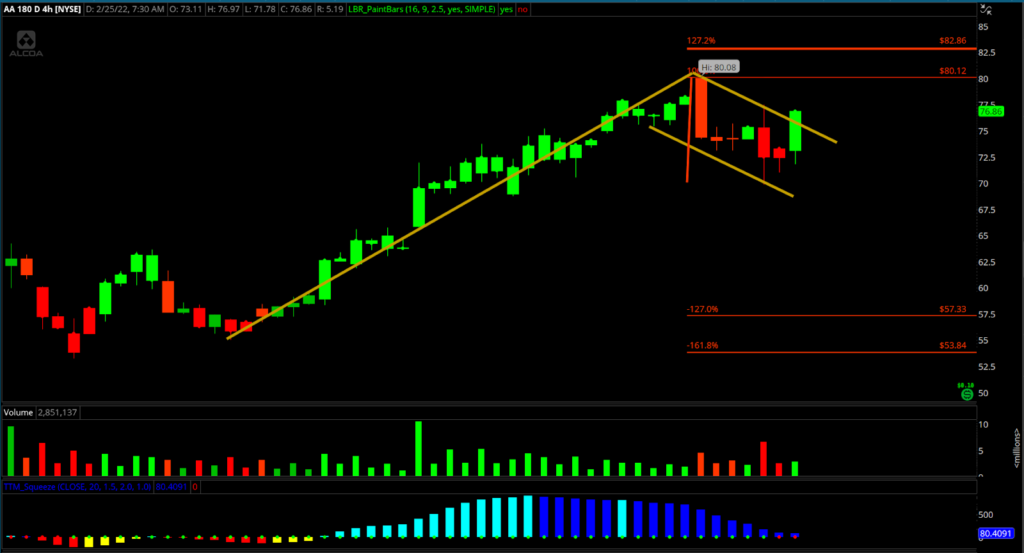

Alcoa Corporation (AA), together with its subsidiaries, produces and sells bauxite, alumina, and aluminum products in the United States, Spain, Australia, Brazil, Canada, and internationally. It engages in bauxite mining operations; and processes bauxite into alumina and sells it to customers who process it into industrial chemical products, as well as aluminum smelting, casting, and rolling businesses.

Aluminum plays a significant role in the light-weighting of electric and hybrid vehicles, and Hydro develops cutting-edge solutions. Hydro components made from Aluminium for EVs include battery packs and enclosure frame solutions for all-electric vehicles. Given the increased and growing EV production all over the world, the demand for Aluminium is increasing and bodes well for producers.

Technicals

There are two things to watch out for in this trade, the bull flag breakout to the upside along with the TTM Squeeze.

Right now with a break to the upside, I want to watch for momentum to kick back up and press higher with the TTM Squeeze “firing positive” indicating that the bulls are in control.

And this trade went out to my members Friday!

Bottom Line

Despite weakness in tech and growth stocks as well as geopolitical uncertainty, there are still sectors of the market that continue to perform very well, and are still in bull markets and making new highs.

The resource sector is one such sector, and the Professor has identified 2 great bullish trade setups in CVX and AA. The classic trade adage “The trend is your friend” definitely applies here, and there is no reason that these two stocks cannot continue higher!