I love structuring my trades using options. I use a number of advanced options strategies to control my risk. One of the simpler strategies I use is to sell puts naked on lower-priced stocks. I do this on small-cap stocks that I don’t think will go much lower. You see, the beauty with selling puts is, the stock doesn’t even need to go up for me to have a great trade. So long as the stock stays sideways, the trade will work due to time decay or Theta. I recently made a great trade in SPHERE 3D CORP (ANY) by selling puts that expired worthless, leaving me with all the premium!

Time Decay or Theta is a very important concept when it comes to trading options, and this knowledge can give traders an extra quiver in their trading arsenal.

Theta

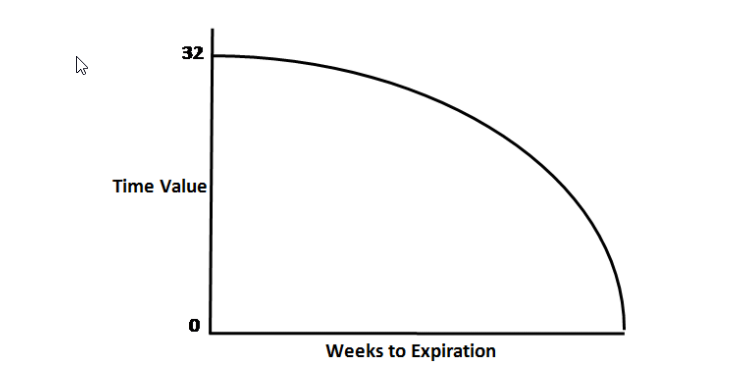

An option‘s price is made up of intrinsic value and time (extrinsic) value. The closer an option gets to its expiration date, the faster that extrinsic value erodes. That rate of decay is the option’s Theta. It represents the amount of time value that will be lost the next day.

The closer the option gets to expiration, the bigger Theta gets. And, this increase happens at an exponential rate. Here’s an example of how Theta might erode an option’s time value.

And, here’s what that would look like when plotted on a graph.

Now, whenever you buy an option (call or put), your position has a negative Theta. On the other hand, when you sell premium (call or put) you have a positive Theta. For an option buyer, Theta works against you, and for the option seller, Theta works in your favor.

Three critical aspects I analyze before making a trade are price, volume, and time. Most beginners only focus on price, which is one-dimensional. Adding the concept of time adds a third dimension to how a trader can view markets. This added dimension is even more important when trading options.

The Smart Money

The market makers selling options are considered the “smart money.” They make a living selling options to retail speculators. Although selling options might seem risky at first, being an options seller has an added benefit. And that is Theta. You see, as Theta decays the options seller receives this premium, it is like collecting rent. Every day that the stock stays below that particular strike, the price of the options will decay due to Theta, and the options seller will be in a stronger position. The option seller benefits from the passage of time, not only price.

By selling options, I can benefit not just from the movement in price but also the passage of time, just like the market makers.

One of my favorite trading strategies is selling puts on lower-priced stocks. It takes advantage of the market’s tendency to move up for longer than it moves down and allows me to be right on a trade even if the price of a stock doesn’t move higher when I think it is likely to do so.

On higher-priced stocks, I usually sell spreads to control my risk. So I would sell one put option close to the money and buy a put option further out of the money. This protects me from unexpected drops in the price of a stock and from outsized losses. However, on lower-priced stocks that I like, I sell puts naked. My risk is defined in that the lowest the stock can go to is 0, and these events are rare. I do extensive research to make sure this is unlikely to happen, but I am a big boy and understand sometimes I will have to take a big hit if something unexpected happens. I am willing to take this extra risk so that I am able to get the added returns by selling puts naked over selling spreads.

The Fundamentals

In June, Sphere 3D Corp. (NASDAQ: ANY) entered into an Agreement and Plan of Merger with Gryphon Digital Mining, Inc. (“Gryphon”), a privately-held company focused on the mining of bitcoin using renewable energy. Upon completion of the merger, the Company will change its name to Gryphon Digital Mining, Inc. Given the recent strength in bitcoin and cryptocurrencies as well as the focus on renewable energy, I liked the company’s fundamentals in the short term. It was also a popular social media stock that I felt people would support so long as bitcoin held steady. Moreover, I really liked the chart.

The Technicals

Daily Chart of ANY, I entered the trade on September 20th highlighted by arrow

I’d been stalking ANY for a while. In early September, the stock ran to over $10 but could not hold above. It had started to consolidate with resistance at $7.50 and support at the $5.50-$5.70 area. I liked the stock, and the story, so I was waiting patiently for a pullback into support before taking a position. Patience and great entries are key, so when ANY touched $5.50 and bounced off the 30-day moving average (MA) I entered the trade.

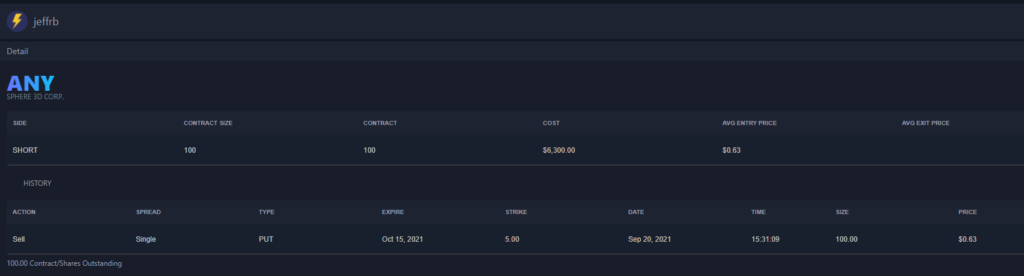

The Trade

I sold 100 of the $5 puts expiring October 15th for 63cents on September 20th. So long as ANY traded above $5 over the following few weeks, I would pocket $6,300 on October 15th, and this would be mostly due to Theta. I thought that this was a very high probability trade in that $5.50 was a great support level, and I thought it was unlikely that ANY would go much below $5 in this time period. Those options expired at 0 so I pocketed all of the $6,300 premium I had received, as ANY closed at $8 on Friday.

Bottom Line

One of the simpler strategies I use is to sell puts naked on lower-priced stocks. I do this on small-cap stocks that I don’t think will go much lower. By selling options, I can benefit not just from the movement in price but also the passage of time, just like the smart-money market makers. On lower-priced stocks, I am willing to take the extra risk so that I am able to get added returns by selling puts naked over selling spreads. The lowest a stock can go to is 0, which is unlikely and one I am willing to take over the long term. A great example of this strategy was my trade in ANY which worked to a T!

3 Comments

loved your detailed explanation of positive theta

Excellent. I need to pay more attention to Alpha.

Really helpful! Thanks, Jeff! KD