This week we got the market bounce I was looking for, and my Bullseye picks from the last two weeks hit their targets! Here’s the outcome:

![]()

![]()

Every Monday morning, I send out my best trade idea for the week before the market opens to Bullseye subscribers. After analyzing the market the week before, and running through charts over the weekend, this is my favorite and most primo setup for the week.

Don’t miss my next favorite setup coming Monday morning! Click Here!

I believe that if you can manage one single trade a week and do it well, you can filter out all of the noise happening with the market overall. There’s a lot of thought that goes into the Bullseye trade of the week. I’m looking to find good trade ideas that are outliers in the market.

Get Bullseye delivered to your e-mail Monday Morning! Don’t miss next week’s best setup! Click Here

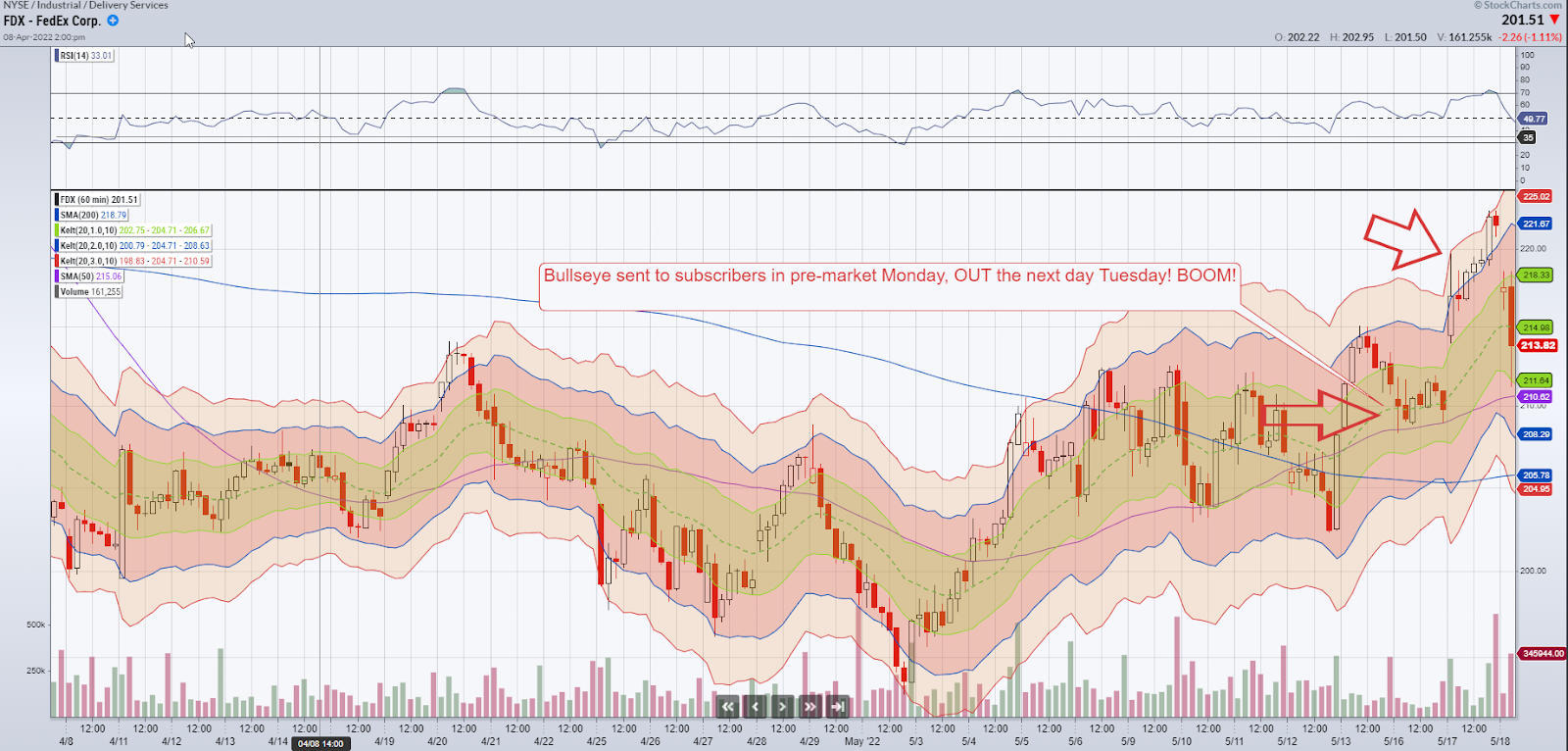

My Bullseye trade Idea for FEDEX (FDX) was sent out to subscribers on Monday morning, and I was out of the trade the next day:

![]()

Here’s What happened:

Here Was My Reasoning sent to Subscribers on Monday. Subscribe Here to get my Favorite trade idea of the week straight to your Inbox!

Bullseye Pick Of The Week – FDX

FDX – FedEx Corp

I am going to look at FDX this week.

I like FDX because it is a non-tech related stock that is still growing earnings (which aren’t until June 22).

From a technical viewpoint, FDX is in a TPS squeeze setup on multiple time frames indicating that there is a “calm” seen from many different types of traders.

This breakout could result in a domino effect for a move higher when everyone gets into this trade.

And additionally, there has been a lot of Relative Strength out of FDX.

This stock has been much more resilient than most of the market in the past couple of weeks leading me to believe the bulls are still in here for a move higher.

If I am wrong, I will stop out of this trade with a close under $202. If it works in my favor, I plan to sell if the stock reaches the $220 area.

My Trade Details:

- FDX May 27 2022 $215 Calls near $4

- Stop under $202

- Target $220

Subscribe Here to get my Favorite trade idea of the week straight to your Inbox!

I was out of the trade the next day. It’s important to Know When To Hold Them… And When To Cash In! It’s good I took profits too, as the market and FDX got the kibosh the following day!

Not only that but this week I was able to get out of my Bullseye trade from the week before, this one took a little bit more time to work!

Here was the trade idea:

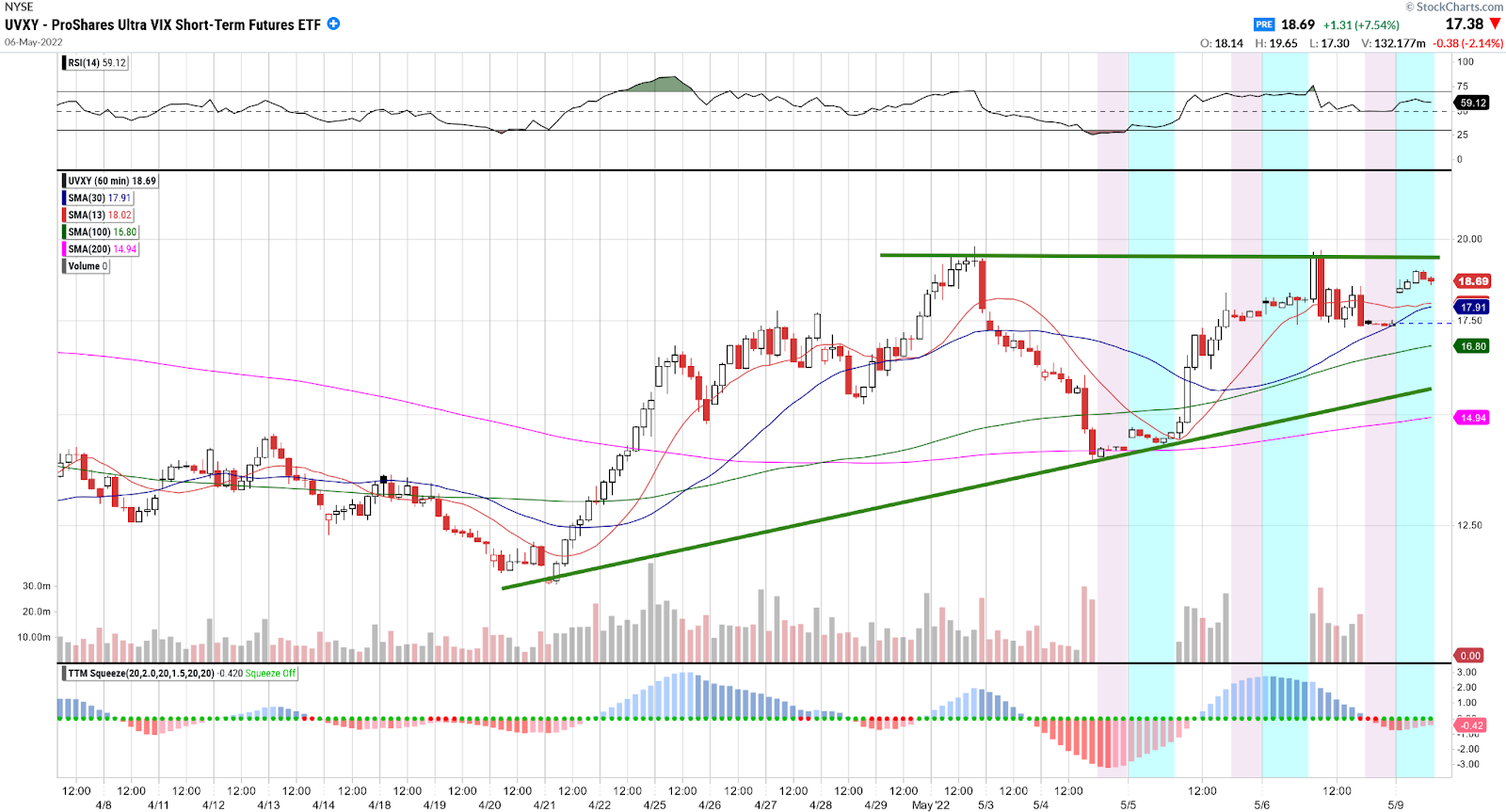

Bullseye Pick Of The Week – UVXY

I think this big drop will be short-lived though and that brings me to my trade idea of the week, which is to bet against UVXY (buy puts).

My Trade Details:

- UVXY May 27 2022 18 Put near $2.20

- Stop over $21 on close only

- Target 1 : $17

- Target 2 : $15

35 was a major resistance level in the VIX and it held.

UVXY broke down as expected and I got out of the trade. Here was the result.

![]()

If you’re struggling with your trading, become a part of BULLSEYE TRADES, and receive my favorite trade of the week straight to your inbox every Monday! CLICK HERE NOW TO SUBSCRIBE!

If you want access to a more comprehensive trading strategy and see what I am doing every single day, as well as live training sessions daily, subscribe to Total Alpa. This is my education community with access to my portfolio. Click Here to become a part of the team!