A few weeks ago, I discussed VWAP, an indicator I recently added to my trading arsenal. I explained how institutions use VWAP to fill clients’ orders and how we can use it to identify the trend and potential areas of support/resistance. You can read about that here.

Today I will discuss how I use ANCHORED VWAP to:

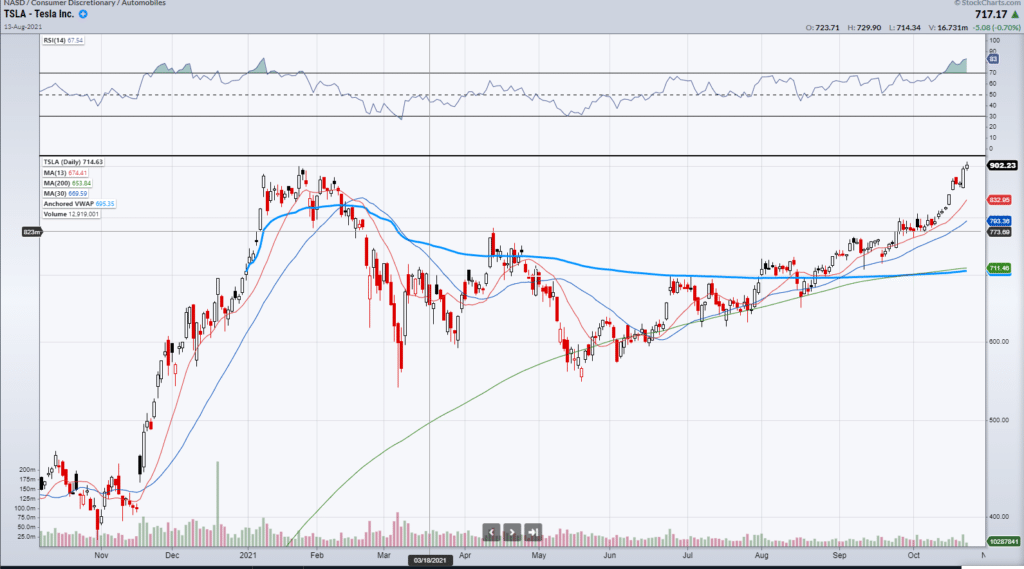

Identify where market participants can be positioned and use it to make more informed trading decisions. The trading action in TESLA INC (TLSA) from this year shows how anchored VWAP indicated who was in control of the stock throughout the course of the year.

The volume-weighted average price (VWAP) is a trading benchmark used by traders that gives the average price a security has traded at throughout the day, based on both volume and price.

ANCHORED VWAP

The Anchored VWAP indicator ties VWAP calculations to a specific price bar chosen by the trader. Like the traditional VWAP, it incorporates price and volume in a weighted average and can be used to identify areas of support and resistance on the chart.

Anchored VWAP allows you to specify the price bar where calculations begin, making it easy to see whether the bulls or bears have been in charge since a very specific point in time. The starting price bar that is chosen generally marks a shift in market psychology, such as a significant high or low, earnings, news, or other announcements. The Anchored VWAP line is charted using price and volume data from that significant event onward.

Let’s study Anchored VWAP and TSLA from this year:

Daily Chart of TSLA with thick Blue Line Indicated VWAP for the year

BULLS VS BEARS in TSLA

As we can see, for most of the year, VWAP for the year, that is, the anchored VWAP from January 1st, 2021 was resistance. Sellers took control right at or slightly above VWAP for the year in April and June and the anchored VWAP was trending down. Short sellers were in complete control, and it looked like finally, their claims of TSLA being significantly overvalued might be true. Dr. Michael Burry had a significant short position in TSLA from last year.

However, $550 was a major support level that was tested twice and could not be broken. From the low made in May, TSLA made higher lows and grinded tighter and tighter against VWAP for the year. Finally, in September, TSLA broke above the anchored VWAP for the year and continued trending.

From a psychology perspective, what does that mean? It means that all the short sellers that had been controlling for most of the year were finally wrong. The price of TSLA was above the VWAP for the year which now meant all the shorts selling for most of the year, keeping the price of TSLA down, were now underwater. This meant that it was now highly likely that they would be forced to cover and push the stock even higher.

Once the $740 level held above VWAP, all the moving averages I use were pointing up. There were many opportunities to get long TSLA to take advantage of the fact that shorts had lost control and that bulls were in charge. TSLA went on to make a significant move to $800, and then to $900 to make new all-time highs post-earnings.

Bottom Line

Anchored VWAP allows you to specify the price bar where calculations begin, making it easy to see whether the bulls or bears have been in charge since a very specific point in time. The starting price bar that is chosen generally marks a shift in market psychology, such as a significant high or low, earnings, news, or other announcements.

I use ANCHORED VWAP to identify where market participants can be positioned and use it to make more informed trading decisions. The trading action in TESLA INC (TLSA) from this year shows how anchored VWAP indicated who was in control of the stock throughout the course of the year.

1 Comments

Thanks, Jeff! KD