There was blood in the streets yesterday, both figuratively and literally. My thoughts are with everyone affected. Panic gripped world markets in the morning as Russia invaded Ukraine and sent stocks tumbling. Baron Rothschild once said that “the time to buy is when there’s blood in the streets”, and that proved to be the case yesterday.

I’ve been bullish on the stock market coming into this week. I hadn’t seen the markets this pessimistic in a long time leading me to believe that a short-term bottom was near. In fact, I was so confident that a majority of tech stocks were so oversold I made QQQ my Bullseye trade of the week.

I was a couple of days too early on the call, as Putin’s invasion sent the market tumbling. But once the dust settled, it was clear yesterday was a great opportunity to buy, and the bottom could finally be in, at least in the short-term.

What do stocks like Paypal (PYPL), Facebook (FB), and Roblox (RBLX) have to do with what’s going on in Ukraine? The answer is- absolutely nothing. There are so many stocks on the market down 50-60%+ that there was not much lower to go in my mind, at least in the short-term. This was my line of reasoning coming into this weak. The attacks on Ukraine could have finally been the exhaustion bottom that the market needed before it beginning of a significant bounce.

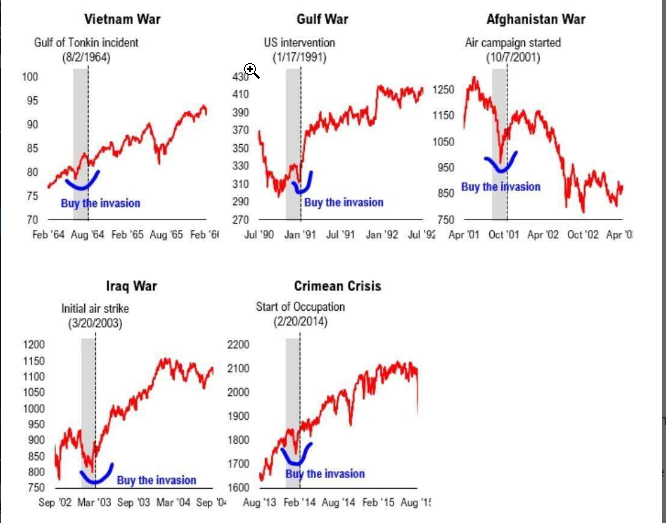

Let’s take a quick look at history to see how previous wars have played out.

As we can see from the case study above of 5 previous invasions, they were all followed by significant bounces once the initial war panic subsided.

Technicals

The $420 to $428 area is a major area of prior support for the SPY. It is what is known as a traditional neckline of a classic head and shoulders pattern. If we break and hold below $420, there could be much more pain ahead for the entire market.

However, yesterday we opened below this level at $411.02, made a low of $410.65, and then closed the day at $428.31, right at the top end of our previous support area. Today we are gapping down to $424.51 in pre-market as I write this. I expect the market to reclaim the $428 area next week for a move to at least $440, if not $450 before we see some resistance. A real nice squeeze above that could see a test of $470 in the short term.

There are a lot of heavily discounted stocks around. They include companies such as ROKU (ROKU), ZOOM (ZM), TELADOC (TDOC). Even if these stocks do eventually head lower, typically, you should see some type of bounce. And I believe this one could be significant simply due to the fact that these stocks have been going straight down for months!

All this uncertainty around Europe, and let’s not forget China is in a bear market, could make the U.S a safe haven. I expect a lot of institutional dollars to begin being put to work in the U.S economy due to the heavily discounted stocks around looking far more attractive than they did just a few months ago.

This invasion may have been the panic washout the market needed before it begins its recovery.

1 Comments

Your historical analysis is excellent.