The overall market has been terrible. Tech stock investors such as Cathie Wood have been getting smashed; you can read more about that here! However, as I’ve learned over the years, there is always a bull market somewhere! And this week, my Bullseye trade Idea rocketed 100% in just one day!

Every Monday morning, I send out my best trade idea for the week before the market opens to Bullseye subscribers. After analyzing the market the week before, and running through charts over the weekend, this is my favorite and most primo setup for the week.

I believe that if you can manage one single trade a week and do it well, you can filter out all of the noise happening with the market overall. There’s a lot of thought that goes into the Bullseye trade of the week. I’m looking to find good trade ideas that are outliers in the market. This week that trade idea was AVAV.

AeroVironment, Inc. (AVAV)

AeroVironment, Inc. designs, develops, produces, delivers, and supports a portfolio of robotic systems and related services for government agencies and businesses. It operates in two segments, Unmanned Aircraft Systems (UAS) and Medium Unmanned Aircraft Systems (MUAS). The company supplies UAS, tactical missile systems, and related services primarily to organizations within the U.S. Department of Defense and to international allied governments.

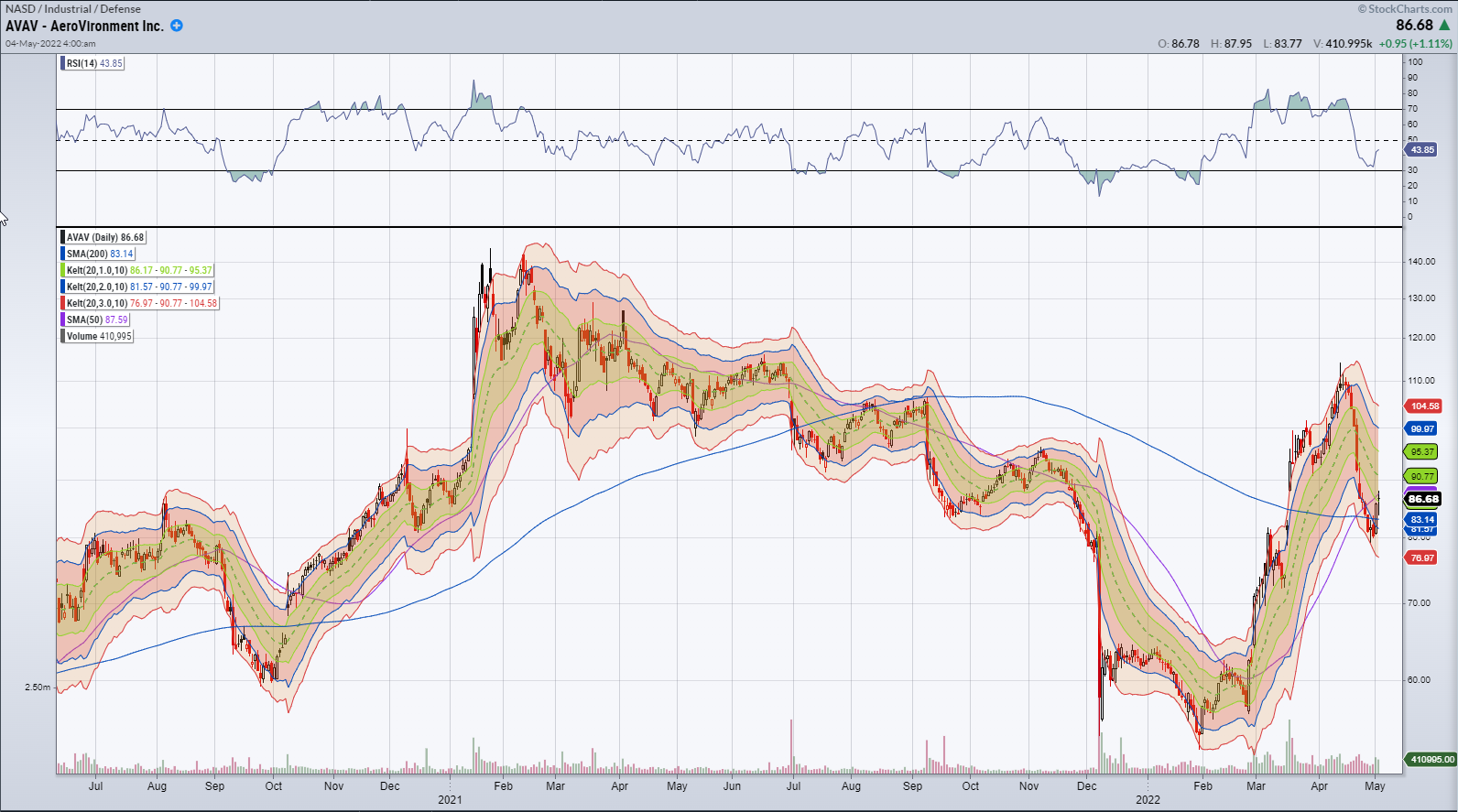

AVAV is one of the larger drone stocks out there! After Russia invaded Ukraine, the stock got a big bump on the news. There was a huge overreaction to the upside. Given that the U.S government would be supplying Ukraine with billions of dollars worth of weapons to defend itself, including drones, this was poised to benefit AVAV. After the huge up move, there was a reaction to the downside before the stock found a support level. This is a pattern that I look for time and time again.

AVAV was over 140 in Feb last year at the market top when many growth stocks were making new highs. Like most other stocks this year, it sold off heavily down into the 50’s. Then after the war in Ukraine began, AVAV almost doubled from $56 to over $114!

That’s a really decent move, especially in a market like this. Psychologically I like to think of it like this: There was a big run on lots of momentum as investors clamored to get into AVAV. Then as the stock became overextended to the upside, it became a good opportunity to sell. There were early people taking profits, stuck chasers taking losses, and shorts entering, beating down the stock!

Now you don’t normally see these stocks go straight down. There was a nice natural pullback towards the 200DM, before the selling eased, and there was a consolidation. My job is to get long strong stocks, and a great risk-reward area for me is this consolidation after the pullback.

The pattern I look for is this. A story stock, big move, and then a pullback! Then I’m looking for a consolidation to get the entry.

I also think that we’re close to a market bottom. If volatility is not your thing, sit on the sidelines because this market is a roller coaster. But I think a nice bounce is not far away. The fact that I thought the market could bounce this week gave me extra confidence on this long trade Idea.

Another clue for me that gave me even more confidence on this trade idea was on Thursday and Friday. When the market rallied on Thursday, AVAV didn’t move much. Then on Friday, when the market was in the toilet, AVAV again, didn’t move much, down only $1.40. To me that is a sign of relative strength. When almost every stock in the market is getting crushed, stocks that are holding are in fact, pretty strong.

On Friday, I was looking at every stock that held and didn’t go down with the market, and AVAV was one of them. Relative strength is a good sign we may have found a bottom. On terrible days I want to be looking at stocks that hold, because they really should have died. Friday sealed the deal for me on AVAV! I think of it like this, if AVAV didn’t crash Friday, what in the world would make it go down?

Here was my Trade Idea sent to Bullseye subscribers Monday morning.

My Trade Details:

-

Buy AVAV May 20, 2022 $85 Call near $2.20

-

Stop under $77

-

Target 1 : $88

-

Target 2 : $95

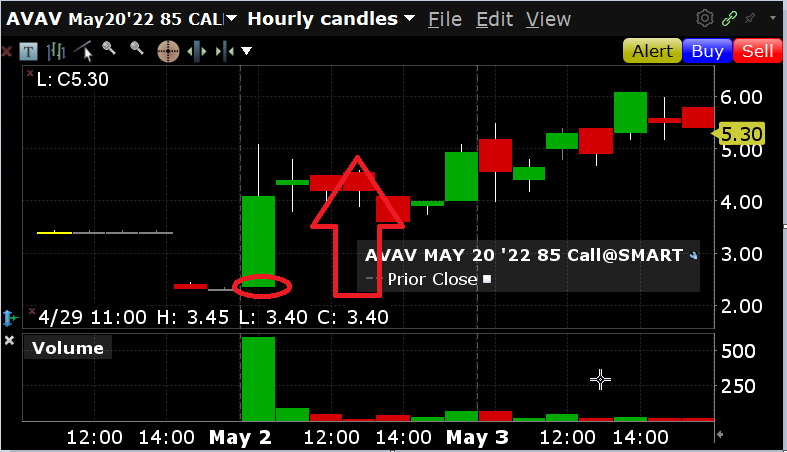

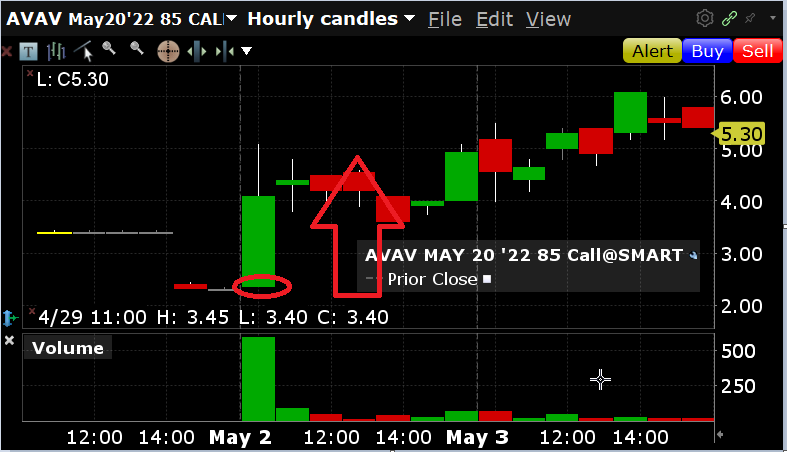

Here is What the Trade Did:

Unfortunately, I wasn’t able to get a fill on this trade Idea! The options got as low as 2.35, but my bid was at 2.20. The options then went to over $5 on Monday, up over 100% in the first 2 hours.

Despite missing the trade, the key is the lesson. The reasoning for the trade was spot on. I also think that this trade is not over, in fact, it could be just the beginning, and I will continue to watch AVAV for another possible entry. I still think it can go to $95 after reaching $87.95, just in front of target 1!

My 88 and 95 were targets based on the Bollinger ATR’s. The first target was hit and it’s still not too late. If the market catches a bounce, there could be some buying coming in or some short covering, I don’t think this trade is over at all!