Ever since I called the bottom of the market on the “DEATH CROSS”, it’s been a risk-on market. When the speculative action heats up, Bitcoin usually does really well. That’s why a few days ago, I was Bullish on THIS Bitcoin stock.

I’m no crypto expert, but our resident crypto expert Jake McCarthy knows almost everything there is to know! In fact, Jake has been teaching this old dog a few new tricks with his knowledge after buying his first bitcoin almost 9 years ago.

He lives and breathes the crypto coin market, and shares his knowledge every day live in CoinCommand! His favorite stock in the sector for a while now has been Marathon Digital (MARA).

I’ve been following MARA closely over the past year, and a few days ago, it formed a great technical setup. I still focus on what I’ve been doing for over 20 years, and that’s trading stocks with great technical setups.

MARA

Marathon Digital Holdings, Inc. (MARA) operates as a digital asset technology company that mines cryptocurrencies with a focus on the blockchain ecosystem and the generation of digital assets in the United States.

MARA has contracts with Bitmain to purchase bitcoin miners and with Compute North to host its miners at multiple locations, the majority of which are wind and solar farms operated by one of the largest renewable energy power providers in North America.

Looking at the stock chart, you can see that after a nasty downtrend, MARA has been consolidating since January. After selling off more than 70% off the highs, MARA has found support around the $20 level on 6 occasions. I believe that the short-term bottom is in and expect MARA to hold these levels, if not continue higher.

Here’s how I’m trading it:

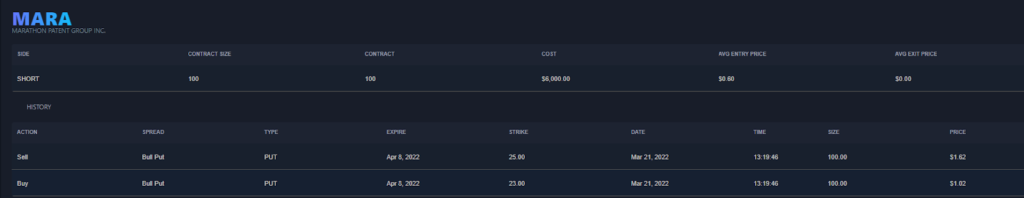

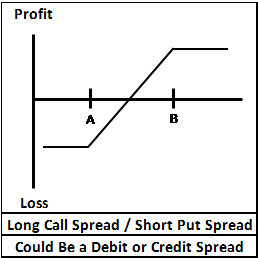

On March 21st, I sold the $25 strike puts expiring April 8 at $1.62 and bought the $23 strike puts expiring April 8, for $1.02. This is known as a short put spread. So long as MARA stays above $25 on April 8 I will pocket the difference of $0.60. My max risk on the trade is $1.40, if MARA falls below $23. Buying the $23 puts reduces my potential return but also reduces the downside on the trade. This is the benefit of using spreads. Furthermore, I don’t need MARA to go up in order for the trade to work, MARA can simply trade sideways, and I will benefit from time decay (THETA).

By using options, I can define and change the risk characteristics of my trade ideas.