Of course, I have to start off by saying that I am so excited for this weekend’s Super Bowl.

I am a big Cowboys fan, but being a betting man I am taking the Bengals this weekend to win straight up.

Now, when it comes to the market unless you were living under a rock at the time, you know that large growth stocks were bludgeoned in January.

Because of the sheer size of these companies, as well as their LARGE weighting within popular market indices, this weakness was the primary driver of the drop in SPY and QQQ.

With volatility comes great trading opportunities and paying attention to your surroundings is absolutely critical to knowing what kind of options strategy to employ in order to profit.

Today, I am going to show you how I used Google’s (GOOGL) “surroundings” to utilize an options strategy that ended up being a winning trade during the dark days of late January.

I closed my Iron Condor on GOOGL this week

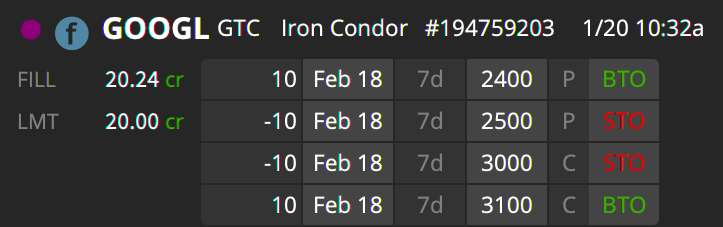

I originally placed the following Iron Condor trade back on 01/20/22 to take advantage of what I believed would be a large range trade heading into and following the 02/01/22 earnings announcement.

When I placed that trade I collected a credit of $20.24 and I closed that trade this week for a debit of $4.00.

In other words, because I sold to open (STO) the trade I collected the $20.24, then as time passed by and both volatility diminished and time decay took effect, I waited until the value of that spread dwindled to $4.00 before buying to close (BTC) the trade.

I can imagine that this might seem a little hard to grasp for those of you that are new to trading multi-leg options, so that’s why I put together this comprehensive review about everything you need to understand the mechanics of this trade.

Why would a trader use an Iron Condor?

Traders would use this strategy if they feel the price of a stock is poised to remain within a certain price range over a certain period of time.

This trade is also used when a trader wants defined risk, with relatively strong odds of success.

Although these trades have a good success rate, the tradeoff is that the profit potential is limited.

What does this trade look like?

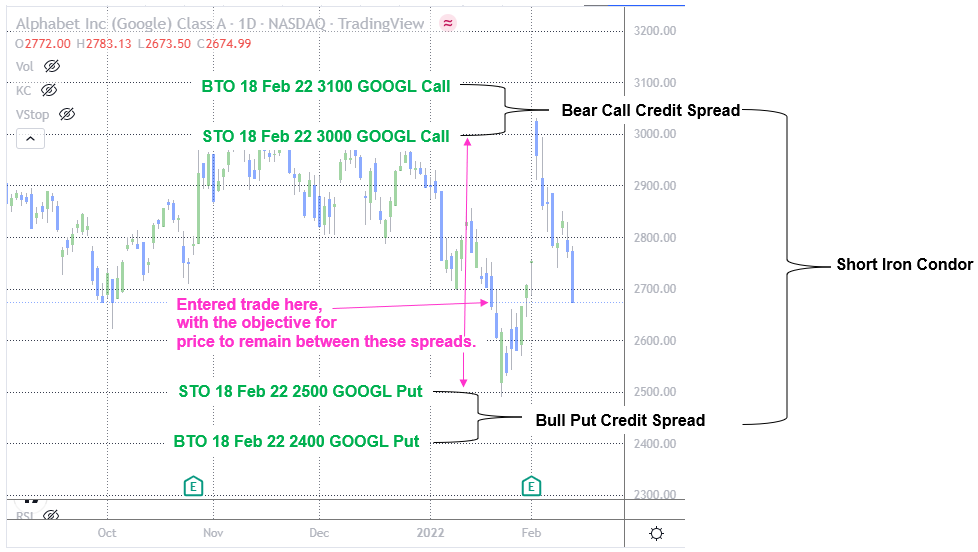

As part of my Total Alpha service, I use a lot of “credit vertical spreads” such as “bull put spreads” and “bear call spreads.”

I like to use these trades not just because of their high success rate and limited downside risk, but also because they are the easiest multi-leg options strategies to understand.

That’s because they involve simply selling a higher-priced put and buying a lower-priced put (bull put spread) or selling a higher-priced call and buying a lower-priced call (bear call spread), all with the same expiration date. You’ll see what I mean in Figure 2 below.

Well, to construct an iron condor you simply combine both of these trades in a manner that establishes a price range that the trader feels the underlying stock price will not exceed.

On the next chart, you can see that I’ve used my actual GOOGL trade parameters to demonstrate this.

Figure 2

What’s the maximum profit potential?

The most a trader can make on this trade is equal to the amount of credit (i.e., the spread) collected when the trade was constructed.

What’s the maximum loss potential?

The most a trader can lose on this trade is equal to the difference between the strike prices of the bull put spread (or bear call spread) minus the net credit that was collected when the trade was constructed.

When does this trade reach maximum profit potential?

The maximum profit on the trade is reached when, at expiration, the price of the underlying stock closes equal to or below the call that was sold and above the put was sold, allowing the spread to expire worthless, which means the trader has collected all of the credit collected when the spread was created.

When does this trade reach maximum loss potential?

Well, the answer to this question is a bit more complex because there are two possible outcomes in which the maximum loss is realized.

First, if shares of the underlying stock close below the lowest strike price at expiration, that causes the calls to expire worthlessly, but both puts are in the money. As a result, the bull put spread reaches its maximum value and maximum loss.

Second, if shares of the underlying stock close above the highest strike price at expiration, that causes the puts to expire worthlessly, but both calls are in the money. As a result, the bear call spread reaches its maximum value, causing the trader to suffer maximum loss.

Where is the breakeven price?

Again, the answer here is twofold:

First, the lower breakeven level is where the stock price equals the strike price of the short put minus the net credit received.

Second, the upper breakeven point is where the stock price equals the strike price of the short call plus the net credit received.

How does volatility effect an Iron Condor?

The ideal environment for entering this trade is when volatility is at elevated levels, and, perhaps more importantly, when the trader expects volatility to start falling shortly after entering the trade.

Why?

Because the elevated volatility prior to entering the trade will allow options premiums to become expensive, which will allow the trader to collect a higher credit when entering the trade by selling for a net credit.

From there, if volatility falls according to plan that will allow the options premium to fall rapidly, which is the goal since the trader wants the value of the spread he or she created to decay to zero.

How does time affect the trade?

If you sell an iron condor, you like to watch paint dry.

Trust me when I tell you in this business, that’s a good thing, as the passage of time is what helps give trades like this their high success rate.

This is because a short iron condor spread has a net positive “theta,” which means the trade benefits from time decay as long as the stock price is in the range.

To YOUR Success!

2 Comments

If I’m using cash app to buy and sell stocks is it the same as everyone else See’s stocks and do I buy a share and let it sit for 5 yrs will it make money.thank you

Good explanation — thanks for helping me understand this kind of options trading!