With the SPY and Nasdaq making all-time highs last week, some mania has returned into the small-cap sector after a few months of relative quietness in this space.

On June 21st, we pointed out a flag pattern in Alfi, Inc ticker ALF. This low float recent IPO looked poised for a breakout, and sure enough, after Jason Bond brought it to your attention last week, it broke out for over a 70% move on Tuesday.

Here is the chart from last Monday…

ALF was flagging consolidating at the highs

This is how the stock played out for the rest of the week…

Gapped up and held above highs for an explosive breakout

Now, when you see a play like this run over 500% in 2 weeks, it is prudent to identify the characteristics of the trade and stock involved and research other potential targets that traders might go after.

Generally, when a theme starts working…traders will look for similar opportunities. And today I’m going to show you how it all works.

Identifying the Characteristics of the Trade

So, in this case, we had a recent IPO that had formed a base and cup and handle pattern with a low float of only 4.39 million shares outstanding.

Having seen this stock break out, the best traders would begin to research another recent low float IPO with the same characteristics—this can be done by looking at the IPO calendar on the Nasdaq website.

To help narrow down the search we would be interested in only low float stocks priced under $5 as was ALF. ALF IPO’d in May on the 4th of the month so any stocks close to this date would be ideal. One such stock was DBGI which IPO’d on May 14.

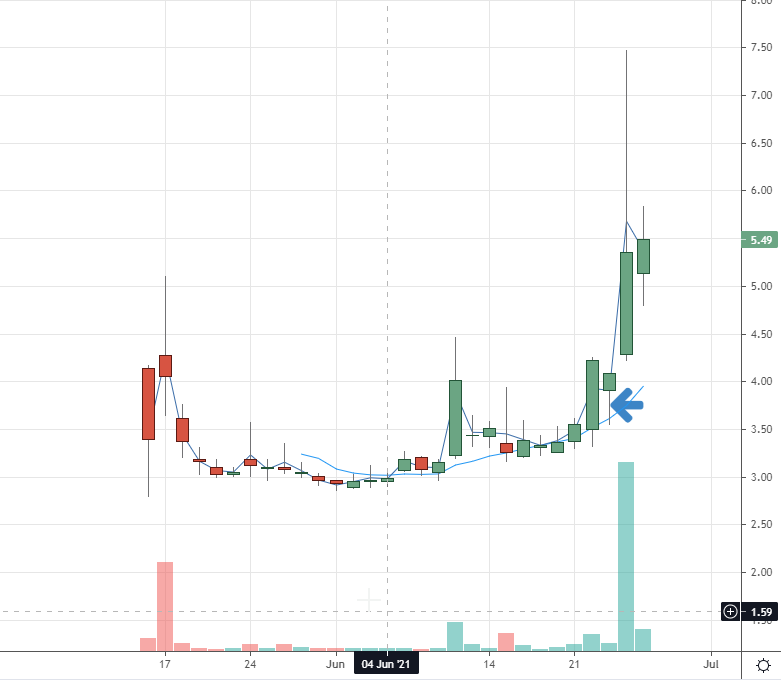

It had a float of less than 5millon shares and was also priced at under $5. Now have a look at this chart and compare it to ALF.

It’s almost identical! What an opportunity from the market!

DBGI forms a base post IPO setting up a cup and handle pattern on increasing volume

Chart Setup

There is a long base near the lows post IPO and a classic cup and handle pattern. Given the IPO was priced at $4.15, any moves below $4 into 3.50 would be an ideal entry, with risk below $3 for a move to $5 at the previous high and beyond.

After ALF had made a move of over 100% on Tuesday before midday, DBGI hit scanners at 1pm and made a move from $3.60 to close the day at $4.20.

The stock gave us another chance to load the boat with a consolidation day and pullback to $3.60 before closing the day at $4.09.

Catalyst

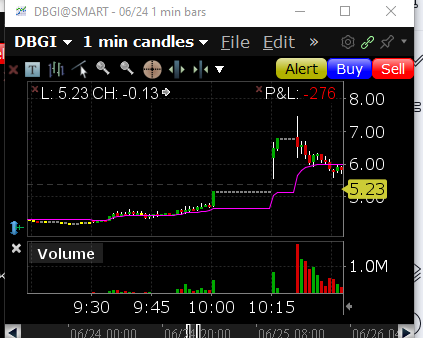

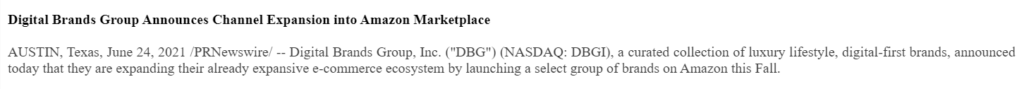

The next day DBGI gapped up and grinded in the morning to $4.50 before a timely PR at 10am hit with the headline “Digital Brands Group Announces Channel Expansion into Amazon Marketplace”.

With the factors described above- low float, cheap stock, identical chart to ALF this catalyst was enough to make the stock explode! It halted immediately at $5.20 on the PR and came out of the halt above $6 giving a nice opportunity to exit some if not most of the position.

A second halt and then a kill candle shooting star on the 1 minute timeframe was a reason to get completely out of the position between $6-$7.

Preparing for the Next One

Now whether you were able to capitalize on this trade or not, what’s important is what you do next.

Patterns repeat over and over in the stock market as day and swing traders tend to continue to do what works until it doesn’t, which is the opposite of Einstein’s definition of insanity.

History repeats in life and in the stock market and this was a great example. With the market at all time highs, be on the lookout for similar patterns moving forward. Some low float recent IPOs under $5 with potential are listed below:

FLGC

Flora growth (FLGC) plants and sells cannabis and hemp-derived products to consumers in Columbia and potentially for export.

TRKA

Troika Media Group, a brand entity and communications agency that provides integrated branding and advertising solutions for global brands, primarily in entertainment and sports.

IFBD

Infobird Co., a software-as-a-service provider of innovative AI-powered, or artificial intelligence enabled, customer engagement solutions in China.

Bottom Line

As traders, it is important to identify patterns that are working the market. Oftentimes, when a theme works, traders will stick with it until it stops.

6 Comments

Please can you help me money please help me sir

How do I join your club

How do I join

Thank you

Thank you very much.

Thanx a lot