Ever heard the old trading adage buy the rumor and sell the news? When played correctly, it can be a perfect trading setup.

For example, Amazon Prime day is one of the year’s biggest events in retail and e-commerce. It’s also a significant date on the calendar for traders.

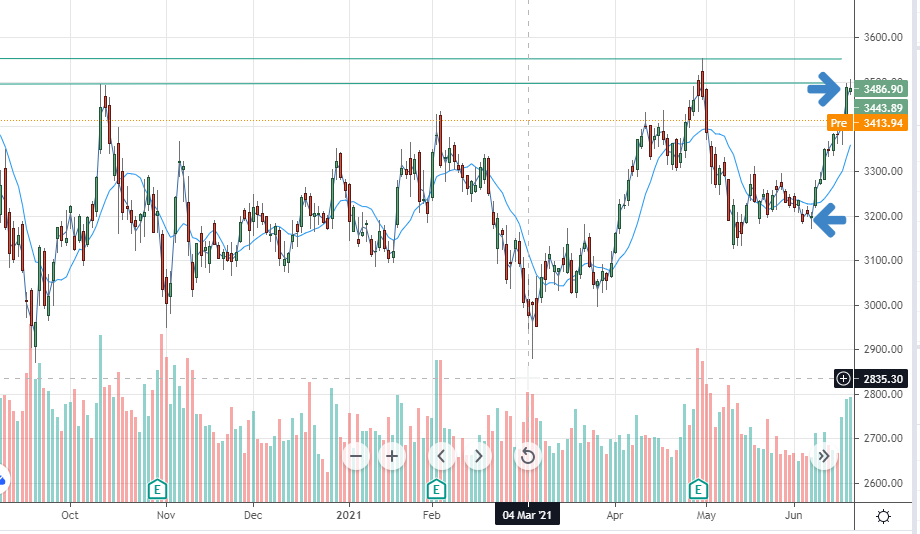

Here’s the chart of AMAZON.COM INC (AMZN) going into the event beginning June 21 from last week:

AMZN moves $300 to $3500 in less than 2 weeks into prior resistance at 3500, finding sellers

We can see that AMZN was up over $300 in 2 weeks coming into Prime Day. This major move higher in such a short period made me want to take advantage of a possible sell the news event.

Setting up the trade

Now I wanted to make a bet on a move lower in AMZN. There are a variety of ways I could go about doing so. I could short the stock naked, but given that AMZN is a high-dollar stock, this would take up a lot of buying power.

Also, my risk would be infinite and undefined, any surprise news overnight could leave me with a much bigger loss than intended. I always want to control how much I am risking so the best way for me to set up this trade was through options.

I decided to sell a call spread expiring at the end of the week, a very short-term bet. It works like this. I sell an option with a strike price which I don’t think AMZN will trade above, in this case that price was $3500, a significant prior resistance level.

All AMZN needs to do is stay below $3500 and I will pocket the premium I sold the option for. However, if I am wrong and AMZN goes higher, I will be on the hook for every dollar above the premium I received. I also bought the $3550 calls for less premium than I sold the $3500’s to control my risk. If AMZN stays below $3500 I will pocket the difference, which is exactly what happened.

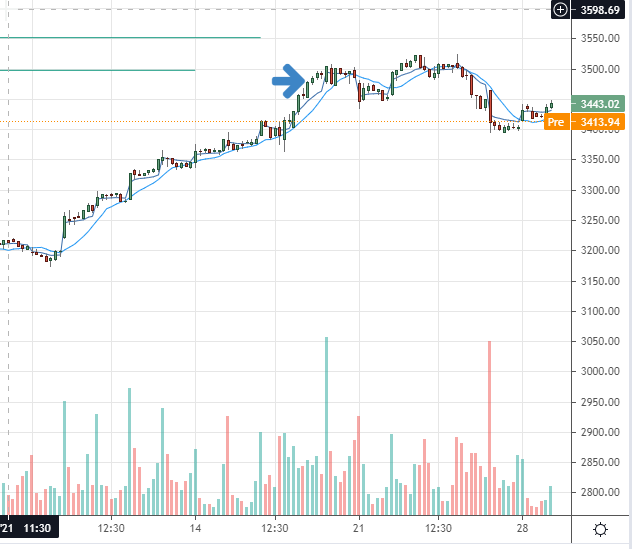

Here’s how the trade played out:

AMZN tests 3500 a few times before failing and closing the week lower at 3401.46

AMZN gapped down on the beginning of Prime Day at 3450 and made a low of 3430, we were in the money and looking good but the market will usually not make things easy for us.

Prime day goes for 48 hours and the following day we had a test of 3500 breaking slightly above to 3520. Going from green to red on a trade is never easy but we made a plan and are going to stick with it as our risk is pre-defined.

Finally, after a consolidation day on Wednesday the stock broke on Thursday and continued lower on Friday to close the week at 3401.46. All calls above 3500 expired worthless and we got paid on our call spread.

Bottom Line

Sell the news plays are rare events that happen a handful of times per year. I prepare for these opportunities in advance and use options to control my risk. By selling call spreads, I can bet on a stock going down (or at least not going up) in a controlled manner.

5 Comments

Thanks

Nice Move.

Will follow your advice sir

I will keep watching what you tech Jeff thank you gregorio

Being a member of Total Alpha I will keep flowing